16 July 2019

Weekly Market Review (15 July 2019) - What happened & What's next?

Market update

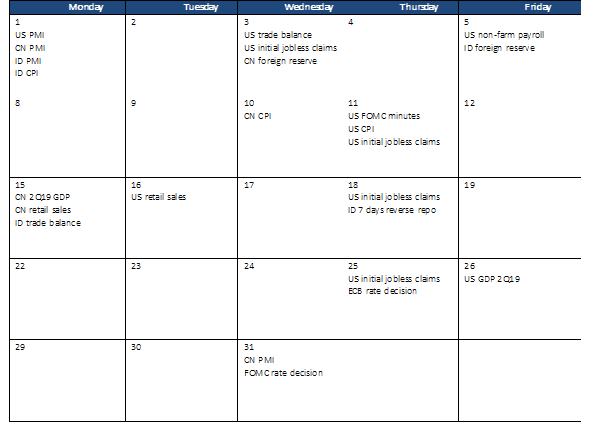

- US markets touched new highs last week on the back of Powell’s Testimony which signaled a rate cut in July. On the other hand, Asia started the week on a dismal note due to dampened expectations of Fed cuts post the strong US June NFP data and escalating trade dispute between Japan and Korea on key semi components exports, declining 1.2%WoW as they were dragged down by poor performance by India, Korea, HK and China equities. On domestic side, JCI closed flat at 6,373.3 by the end of the week despite net foreign inflow of $157mn. Miscellaneous industry was the best performer with +4.0%WoW. Meanwhile, Consumer sector was the worst performer (-3.1%WoW) last week. News flows to be watched within this week include CN GDP, retail sales; ID trade balance, 7-days reverse repo rate decision; US retail sales, initial jobless claims.

- IDR strengthened to IDR14,008 (+0.5%WoW), better than average emerging markets (+0.2%WoW). On the other hand, DXY weakened to 96.8 (-0.5%WoW).

- Foreign outflow on bonds and thin trading volume ahead of BI meeting made bond market yield increase by 1-6 bps over the week. 20 years benchmark series increased the most.

- Foreign investor reported net outflow of Rp 0.3 Tn over the week, mostly on 20 years series.

- Stronger than expected consumer price index that rose 0.1% in June made 10 year US Treasury yield increased from 2.04% to 2.12%.

Global news

- Powell’s testimony and June FOMC meeting minutes suggested a likely rate cut in July. He highlighted that based on incoming data and other developments, it appears that uncertainties around trade tensions and concerns about the strength of the global economy continue to weigh on the U.S. economic outlook. Powell sees uncertainty hurting growth and risking a near-term slump.

- US CPI inflation softened to +1.648%YoY in June, following +1.790%YoY in May, as food price inflation slowed and energy prices fell. Excluding food and energy prices, core CPI inflation rebounded +0.296%MoM in June (Consensus: +0.2%), after four consecutive monthly declines of around 0.1% on a rounded basis.

- China’s export growth in USD terms fell to -1.3% y-o-y in June from 1.1% in May, close to market expectations (Consensus: -1.4%), while import growth rose to -7.3% from -8.5%, albeit below market expectations (Consensus: -4.6%). As a result, the trade surplus widened to USD51.0bn in June from USD41.7bn in May (monthly average in 2018: USD29.2bn).

- China reported solid credit data with aggregate financing rising to RMB2.26tn (vs Cons: RMB1.9tn), suggesting weak macro but ample liquidity.

Domestic News

- Indonesia June trade balance recorded at $200mn surplus with exports down 9.0%YoY while imports increased 2.8%YoY (vs consensus est of $658mn surplus).

- President Joko Widodo pledges to cut corporate tax, overhaul labor laws and lift curbs on foreign ownership in more industries. Jokowi also said he'll retain 60% incumbent in new cabinet blueprint.

- Finance Minister Sri Mulyani Indrawati claimed to have prepared a draft law (RUU) specifically in the field of taxation to increase the flow of incoming investment. The legal umbrella, contained the aspirations conveyed by President Joko Widodo (Jokowi) which is ranging from the request for a reduction in income tax rates (PPh) to other tax incentives.

- Bank Indonesia sees 2Q GDP at 5.07-5.1% says governor Perry Warjiyo. Consumption likely to grow above 5.1% IN 2Q. Investment from ongoing development project will also help growth in April – June period. Demand for exports globally continues to fall with the impact on Indo expected to be seen in 2Q.

Calendar

July 2019

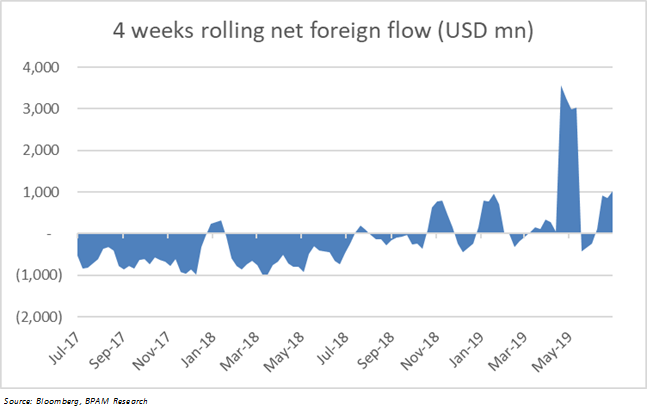

Foreign net purchases of Indonesia equities