22 July 2019

Weekly Market Review (22 July 2019) - What happened & What's next?

Market update

- US markets ended the week with the steepest weekly decline since the end of May-19, Dow Jones and S&P declined by -0.65% and -1.2% WoW respectively. The slipped occurred after Fed indicated that rate cut in the upcoming meeting will be lower than expected (25 bps from market expectation of 50 bps). In addition, news on the seizement of British oil tanker by Iran in the Strait of Hormuz also heightened geopolitical tension. On domestic side, JCI closed higher last Friday, up by +1.3% WoW. Basic industry was the best performer sector, increased by +4.8% WoW. On the other hand, miscellaneous industry was the worst performer with -3.6% WoW loss. News flows to be watched within this week include US initial jobless claims, EU rate decision and US GDP 2Q19 result.

- IDR continued to strengthen and reached IDR13,938 (+0.5%WoW) last week. It was one of the best performer currencies in emerging market. DXY index also strengthened by +0.4% WoW.

- Continued dovish tone from global central bank lead to inflow from foreign investor to Indonesian bond market. The capital flow and lower domestic reference rate made bond market yield decrease 9-11 bps. 20 years benchmark series decreased the most.

- Foreign investor reported net inflow of Rp 11.3tn over the week, mostly on 10 and 20 years series.

- Expectation on Fed rate cut at the end of this month made 10 year US Treasury yield decreased from 2.12% to 2.05%.

Global news

- China’s economic growth slumped to its lowest level in 27 years, only reached 6.2% in 2Q19. The growth has slowed down from 6.4% in the previous quarter as trade war with US prolonged.

- China’s retail sales rose by 9.8% YoY in Jun-19, from 8.6% YoY in the previous month.

- Bank of Korea lowered its benchmark interest rate by 25 bps, joining a growing number of global central banks. Their first rate cut since 2016 reflects some urgency among BOK policy makers who face growing pressure as the nation’s export slump drags.

- US retail sales increased more than expected in Jun-19 by 0.4% MoM in Jun-19, edging up 0.1% from the previous month. Retail sales increased as consumer spend more on motor vehicle and variety of other goods.

- US initial weekly jobless claims climbed by 8,000 to 216,000. Although application for unemployment benefits rose slightly, the rate of layoffs clung to exceedingly low levels. This shows US labor market is still going strong.

Domestic News

- Central Bank cut the 7 day reverse repo rate from 6.00% to 5.75% as expected last week. They mentioned that the decision was taken to push economic growth momentum, taking into account the stable domestic inflation and manageable BoP condition.

- Finance Minister guides that 2019 fiscal deficit may increase to 1.93% of GDP. A shortfall in tax revenue is expected to reach IDR 143tn which would be mitigated partially by a decrease in government expenditure by IDR 120tn. However, Ministry of Finance has not considered revising APBN 2019.

- BPJS Kesehatan deficit is expected to reach IDR 28tn in 2019, resulted from the 2018 rollover of IDR 9.1tn combined with 2019 expected deficit of IDR 19tn.

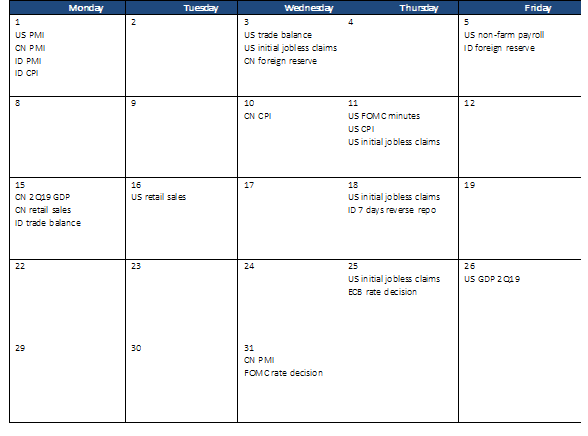

Calendar

July 2019