12 August 2019

Weekly Market Review (9 Aug 2019) - What happened & What's next?

Market update

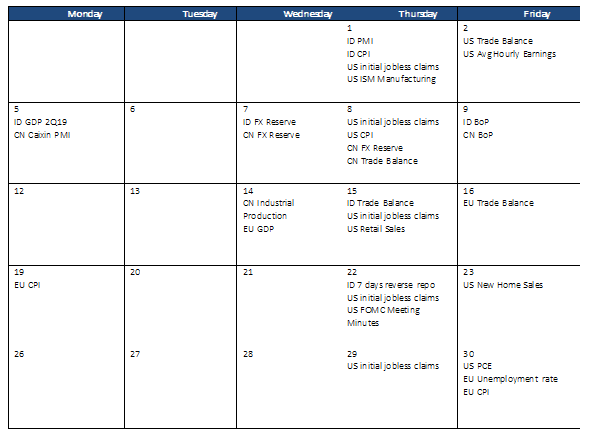

- Global equities continued to trade lower last week S&P500 -0.5%WoW, Dow Jones -0.8% WoW, Nikkei -1.5% WoW and Shanghai -3.2% WoW still due to concern about trade war. Indexes experienced sharp losses early last week but managed to claw back most of the losses on the last day. Trump stated on Friday that things are going “very well with China” but said he is not ready to make a deal. He also said he could cancel a coming September meeting of Sino-American trade negotiators. Trump administration also indicated that they are not ready to let US companies resume doing business with Huawei Technologies Co. In addition, China allowed Yuan to fall through the key 7 level in response to latest tariff increased. On domestic side, JCI also declined by -0.9%WoW. Agriculture was the most outperformed sector, up by +2.6% WoW as soybean price rallied . Meanwhile, Miscellaneous sector was the main laggard with -3.1% WoW decline. News flows to be watched within this week include ID trade balance, CN industrial production, US initial jobless claims, US retail sales, EU GDP and EU trade balance.

- IDR strengthened to IDR 14,194 (+0%.1 WoW), in-line with the emerging markets. On the other hand, DXY declined -0.6% WoW to 97.5

- Slower growth had triggered several central banks to ease monetary policy. Expectation of BI loosening monetary policy on the next meeting made bond market yield decreased by 18-30 bps across the curve. 10 years series decreased the most.

- Foreign investor reported net outflow of IDR 13.7tn over the week, mostly on 5 years series.

- Fear on escalating trade tension after China decided to stop buying American crops and after the US officially declared China a currency manipulator made US 10 years yield decreased from 1.86% to 1.74% over the week.

Global news

- US PPI advanced 0.2% MoM in July, in line with expectations and flat at 1.7% YoY. The number reflects a slowing down in manufacturing activity amid weaker global demand.

- US initial jobless claims dropped by 8,000 to a seasonally adjusted 209,000 last week. Labor market remains quite strong even though the economy has softened.

- China’s foreign exchange reserves fell by USD 15.54bn in Jul-19 to USD 3.10tn amid rising trade tensions. However, the decline was smaller than expectation.

- China’s Caixin PMI services dropped to 51.8 in Jul-19 came in below expectation and lower than the previous month at 52.

- China’s trade surplus was USD 45.06bn in Jul-19, down from USD 50.98bn in the previous month. Yet, the number is better than consensus’ estimates. Exports managed to grow 3.3% YoY in Jul19 while import shrank by 5.6% YoY.

Domestic News

- Indonesia balance of payment booked a larger deficit of USD 1.98bn in 2Q19. As a result, deficit equals to 3.04% of GDP in 2Q19, increased from 2.60% in the corresponding period. The financial account surplus came out lower than anticipated due to smaller portfolio surplus and growing other investment deficit.

- Jul-19 fx reserve increased by USD 2.1bn to USD 125.8bn due to Government’s withdrawal on FX debt.

- 2Q19 GDP growth reached 5.05% YoY, eased slightly from the previous quarter. Private consumption increased by 5.17% YoY, higher than 5.01% in 1Q19 driven by robust government social spending. While investment growth was stagnant at 5.0% YoY with agriculture sector posted stronger growth as a result of harvest season.

Calendar

August 2019

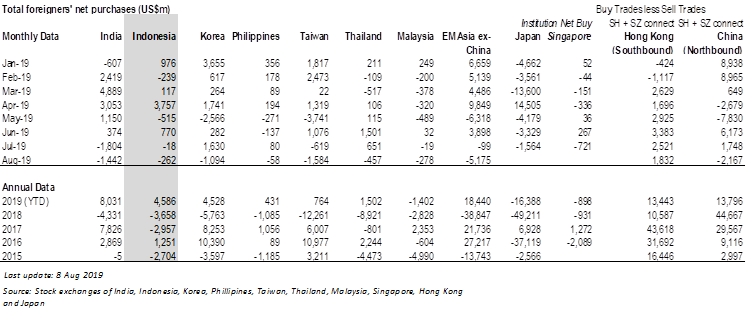

Foreign net purchases of Indonesia equities