19 August 2019

Weekly Market Review (19 Aug 2019) - What happened & What's next?

Market update

- SPX declining -1%WoW due to market concerns on potential upcoming US recession on the back of the US 10Y/2Y yield curve briefly inverting, weak German economic data and China’s disappointing credit and activity data where Industrial Production and retail sales growth slowed down in July. On the other hand, news reports suggest that Huawei’s ‘temporary general license’ will be extended for another 90 days; US delaying tariffs on some Chinese imports to 15-Dec (from 1-Sep); and Germany is ready to run a fiscal deficit if recession arrives. On domestic side, despite a foreign outflow of USD185.6m, JCI was relatively flat at IDR6,286.7 (+0.1%) by the end of the week. Miscellaneous industry was the worst performer with -3.6%WoW due to soft auto sales data. Meanwhile, Property sector was the best performer (+3.9%WoW) last week. News flows to be New Homes Sales, and initial jobless claim; Indonesia’s 7 days reverse repo; EU CPI.

- IDR weakened to IDR14,240 (-0.3%WoW), better than average emerging markets (-1.6%WoW). On the other hand, DXY rose to 98.1 (+0.7%WoW).

- Risk-off sentiment continue rising as US yield curve officially inverted (2yr & 10yr) for the first time since May 2007. This made bond yield increased by 2-8 bps across the curve. 10 years series increased the most.

- Foreign investor reported net inflow of IDR 0.3trn over the week.

- Fears on global slowdown could tip US economy into a recession made US 10 years yield decreased from 1.74% to 1.55% over the week.

Global news

- US Initial Jobless Claims increased 9,000 to a seasonally adjusted 220,000 for the week ended Aug. 10. Market had expected claims at 214,000.

- US retail sales rose a healthy 0.7% last month, after a 0.3% gain in June. Online retailers, grocery stores, clothing retailers and electronics and appliance stores all reported strong gains.

- China Industrial output rose 4.8%YoY, retail sales expanded 7.6%YoY, and fixed-asset investment slowed to 5.7% in the first seven months. It was the weakest industrial output growth in a single recorded month since 2002, as a cyclical slowdown and trade tensions add to the case to roll out more stimulus.

- German economy shrank by -0.1% in 2Q19. German industrial output posted a quarterly decline of 1.9%, its steepest QoQ fall since the last technical recession observed amid the euro area debt crisis in 2012/13.

Domestic News

- Trade deficit was narrower than anticipated. It reached –USD63m, which is lower than consensus estimates at -USD 460mn. The deviation was due to the better-than-expected oil and gas export performance.

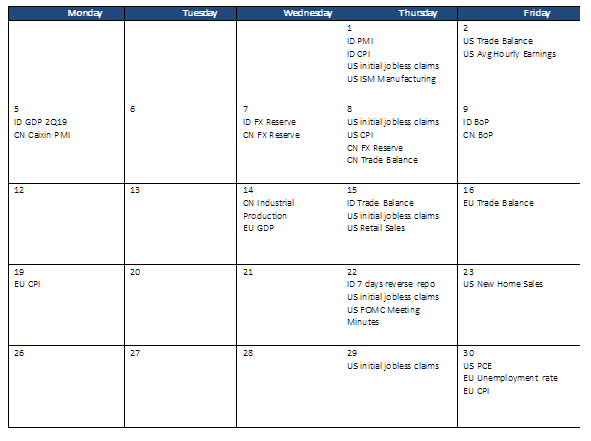

Calendar

August 2019

Foreign net purchases of Indonesia equities

Last update: 15 August 2019

Source: Stock exchanges of India, Indonesia, Korea, Philippines, Taiwan, Thailand, Malaysia, Singapore, Hong Kong and Japan