26 August 2019

Weekly Market Review (26 Aug 2019) - What happened & What's next?

Market update

- Dow Jones Index and S&P 500 declined -1.0% and -1.4%WoW, respectively, mainly dropped on the last day of trading as China's move to add 5-10% tariffs on $75bn of US exports in two tranches on Sep 1 and Dec 15, and end the suspended tariff hike on cars and car parts (from the first $50bn list) on Dec 15. In response, Trump intensified trade war by announcing from Oct 1 tariffs on $250bn in Chinese imports would rise from 25% to 30% and the other $300bn from 10% to 15% that will take effect on Sept 1. Trump's narrative towards taking on China also escalated over the weekend, further eroding any chance of a trade deal. The latest tariff hikes will mean about $97bn of the $150bn Chinese imports from the US will be subject to higher tariffs on Dec 15, including cars, soybeans and crude oil. On the other hand, Central bankers from around the world are gathering in Jackson Hole discussing challenges in an increasingly tense global economic backdrop, concluding the conference with dovish tone. On the domestic side, JCI was down to 6,255.6 (-0.5%) by the end of the week with foreign outflow of USD109m despite BI made an unexpected cut on 7-day reverse repo rate to 5.5%. Mining industry was the worst performer with -1.3%WoW due to soft commodity prices. Meanwhile, Infrastructure sector was the best performer (+0.8%WoW) last week. News flows to be watched this week: US initial jobless claim; EU CPI, Unemployment rate.

- IDR strengthened to IDR14,215 (-0.2%WoW), in-line with average emerging markets. On the other hand, DXY rose to 97.6 (-0.5%WoW).

- After BI cut the 7 days RR 25 bps to 5.5% and maintain accommodative monetary policy to support growth ,bond market yield decreased 9-14 bps. 10 years series decreased the most.

- Foreign investor reported net inflow of IDR 3.24tn over the week.

- Fears on escalated trade wars continue after Trump announced a hike in tariffs from 25% to 30% on USD 250bn worth of Chinese goods. This made US 10 years yield decreased from 1.55% to 1.52% over the week.

Global news

- At the Jackson Hole, Fed Chairman Jerome Powell said the U.S. economy is in a favorable place but faces significant risks as growth abroad slows amid trade uncertainty, keeping another rate cut on the table when officials meet next month.

- US Markit manufacturing PMI came in lower than expected at 49.9 vs. consensus of 50.5.

- US Markit services PMI came in lower than expected at 50.9 vs. consensus of 52.8.

- US Initial Jobless Claims declined by 11,000 to 209,000 for the week ended Aug 19. Market had expected claims at 216,000.

- US July new home sales recorded at 635k vs consensus of 647k.

Domestic News

- BI unexpectedly lowered 7-day reverse repo rate by 25bps to 5.5% vs. consensus estimate of no rate cut.

- Indonesia cuts income tax for bonds interest in KIK DINFRA, KIK DIRE, KIK EBA to 5% (registered until 2020) and 10% (registered in 2021 and beyond). Previously it was set 15-20% income tax for regular bonds.

- Indonesia’s proposed 2020 budget pencils in a fiscal deficit of 1.8% of GDP, down a touch from 1.9% of GDP in the 2019 outlook. The proposed budget pencils in 12.7% of GDP revenue assumption, premised on a 0.5% of GDP rise in tax revenues to 10.7% of GDP even as non-tax revenues, which derive largely from commodities, compresses 0.3%pts of GDP. Expenditures are expected to compress 0.1%pts of GDP, coming mainly from lower subsidies and regional transfers, down 0.2%pts and 0.1%pts of GDP respectively.

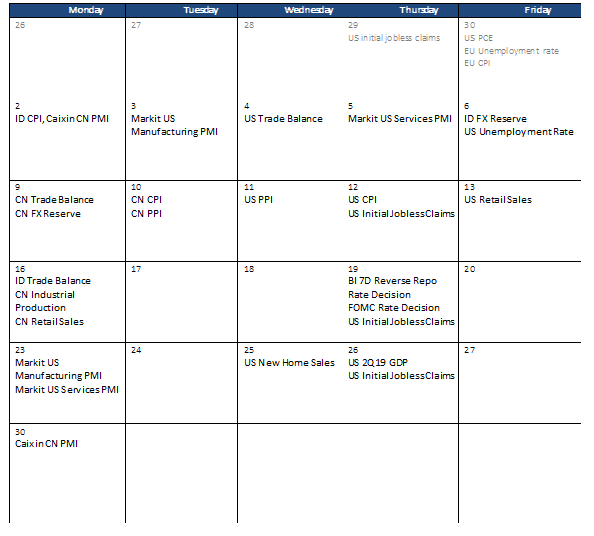

Calendar

September 2019

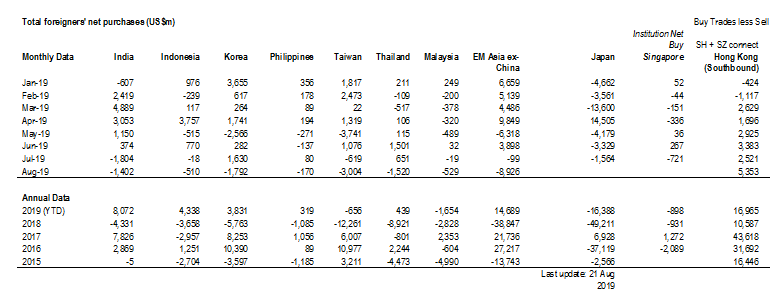

Foreign net purchases of Indonesia equities

Last update:21 August 2019

Source: Stock exchanges of India, Indonesia, Korea, Philippines, Taiwan, Thailand, Malaysia, Singapore, Hong Kong and Japan