09 September 2019

Weekly Market Review (9 Sep 2019) - What happened & What's next?

Market update

- Dow Jones and S&P Index were up by +1.5% WoW and +1.8% WoW respectively, as US and China agreed to restart trade talk in October 2019. Both sides agreed to take actions to create favorable conditions, but gave no details. Beijing has cited three main sticking points in the trade negotiations. They are the removal of tariffs imposed in the trade war, reduction of the scale of U.S. goods purchases that China will make to help reduce the trade imbalance between the two, and the need for a “balanced” text for any trade deal. On the domestic side, JCI was down -0.3% WoW on the back of USD126mn foreign outflow. Mining was the most outperformed sector (+4.9% WoW) mainly driven by coal companies. On the other hand, telco sector was the main drag (-3.3% WoW) as competition among the operators started to tighten. News flows to be watched this week: ECB meeting; China CPI, PPI; US CPI, PPI, retail sales.

- IDR strengthened to IDR14,101 (+0.7%WoW), performed relatively better than average emerging markets. DXY declined to 98.4 -0.5% WoW.

- Positive sentiment came from Indonesia foreign reserves, which reported rising by USD 0.5 billion to 126.4 billion. Bond market yield slightly decreased by 1-2 bps. 20 years series decreased the most.

- Foreign investor reported net inflow of IDR 1.6tn over the week.

- Lower than consensus jobs data (130.000 added vs consensus of 150.000) and steady unemployment rate at 3.7% made US 10 years yield increased from 1.5% to 1.55%. Market still wait and see for FOMC meeting next week.

Global news

- China August forex reserve recorded at $3.107tn in-line with consensus estimate of $3.100tn.

- China trade balance stood at $34.8bn, below consensus estimates of $44.3bn.

- US trade balance stood at -$54bn, in-line with consensus estimates of $53.4bn.

- US non-farm payrolls added 130,000, below consensus estimates of 150,000.

- US and China agreed to restart trade talk in October 2019.

Domestic News

- Indonesia forex reserve added USD 0.5 billion to 126.4 billion in August 2019.

- Government plans to revise personal income tax in 2021. The revision includes widening the tax brackets, 5% income tax for people who earns Rp100-150mn per year and 30% for those earning >Rp1bn. The current tax brackets are: 5% for those earning

Rp500mn. - Gov’t confirms corporate tax cut from 25% to 20% in 2021, which may reduce revenues by around Rp54tn according to Finance Ministry. The gov’t hopes that the tax cut may be able to stimulate the economy and drive domestic investments. Newly listed companies with a free float greater than 40% would get a 3% income tax reduction for the first 5 years. The current 20% income tax for listed companies would be further reduced to 17%.

- Tax office will charge tax to digital company operated in Indonesia through in the new tax regulation. There are 2 points discussed: 1) VAT charge of 10% for the import of intangible goods and services. With the new regulation the VAT will charge not only to customers but also foreign tax subject 2) regulate the income tax from the electronic transaction that is done in Indonesia from foreign company that doesn’t have physical presence in Indonesia.

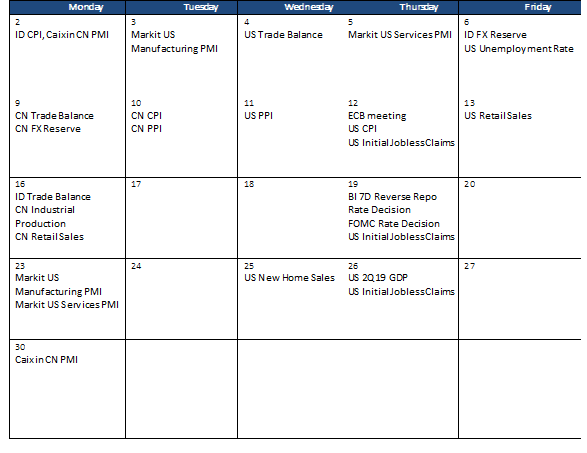

Calendar

September 2019

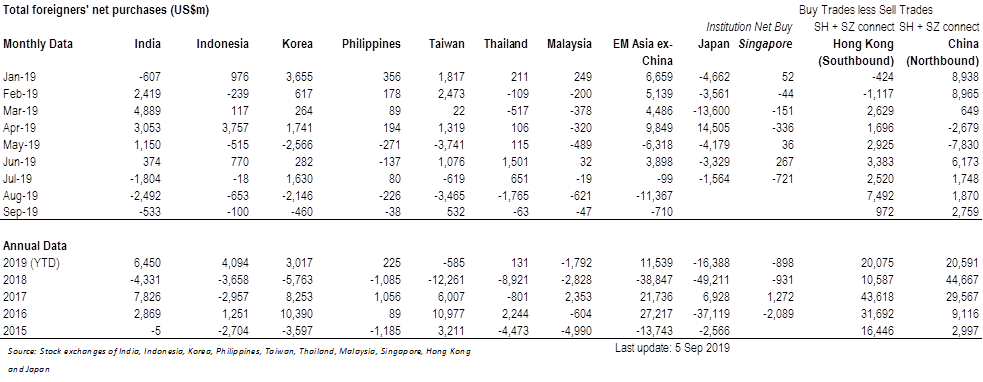

Foreign net purchases of Indonesia equities