16 September 2019

Weekly Market Review (16 Sep 2019) - What happened & What's next?

Market update

- Positive news continued to trickle in this past week, further boosting equities. First, trade tensions eased further on a slew of goodwill ‘gestures’ by both the US and China. China exempted 16 US products from tariffs while on Friday it announced it will exempt US soybeans, pork and other agricultural products from punitive tariffs. Meanwhile, President Trump delayed the tariff hike (from 25% to 30% on USD250bn of Chinese goods) slated to go online on 1 Oct by 2 more weeks. There were also lots of reports of a likely ‘interim' US-China trade deal that further boosted sentiment. However, the big event was ECB’s policy meet where it decided to ease policy on various fronts (deposit rate cut; forward guidance tweak; introduction of a two-tier reserve rate; adjustment in TLTRO-3 parameters; and, importantly, a EUR20bn/month QE starting Nov). On domestic side, despite a foreign outflow of USD47.23m, JCI was up by +0.4% to IDR6,334.8by the end of the week. Mining industry was the worst performer with -1.3%WoW due to soft commodity prices. Meanwhile, Property sector was the best performer (+2.4%WoW) last week due to lower central bank’s rate expectation. News flows to be Indonesia Trade balance, BI 7D Reverse Repo Rate Decision; US Initial Jobless Claims and FOMC Rate Decision; China Industrial Production and Retail Sales.

- IDR strengthened to IDR13,967 (+1%WoW), better than average emerging markets (+0.5%WoW). On the other hand, DXY was relatively flat at 98.3 (-0.1%WoW).

- Ahead of BI meeting, bond market yield decreased by 14-16 bps. 10 years series decreased the most.

- Foreign investor reported net inflow of IDR8.4trn over the week.

- Renewed hopes for a trade deal between US and China and a long awaited announcement for ECB stimulus made 10 year US Treasury yield increased from 1.55% to 1.8%.

Global news

- US initial jobless claims declined 15,000 to a seasonally adjusted 204,000 (vs consensus of 215,000) for the week ended Sept. 7, the lowest level since April. The drop in claims was the largest since May.

- US CPI slowed in August, rising by a slight 0.1%, reflecting a big drop in the cost of gasoline and other energy products. Core inflation, which excludes volatile food and energy costs, rose 0.3% last month and 2.4% over the past year.

- U.S. retail sales rose moderately in August, driven by a jump in auto buying and healthy online sales. US retail sales increased +0.4% in Aug’19, down from a healthy +0.8% in Jul’19. Excluding autos, sales were unchanged for the first time since February.

- China PPI dropped -0.8%YoY in Aug’19, the worst YoY contraction since Aug’16. On the other hand, China CPI rose +2.8%YoY in Aug’19, unchanged from July. That compared with a 2.6% increase predicted by analysts.

- In the UK, Johnson’s attempt to call for snap elections was rejected, raising the possibility of Brexit being delayed.

Domestic News

- The government made an announcement that it has decided to increase tobacco excise by ~23% in FY20

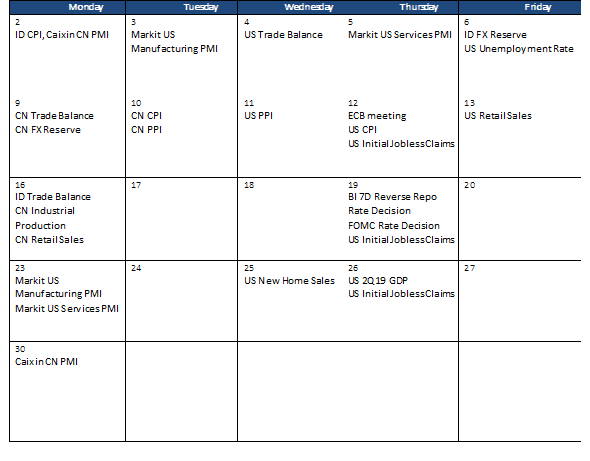

Calendar

September 2019

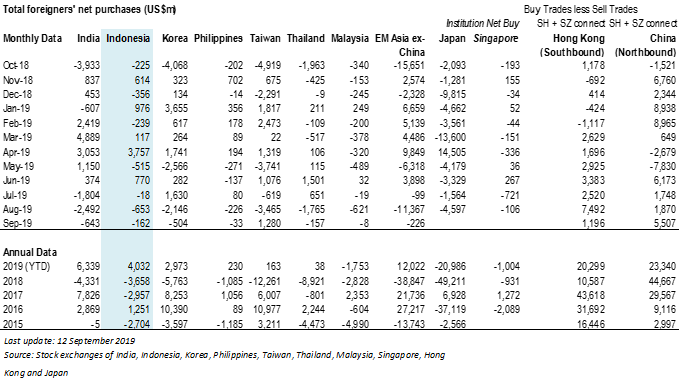

Foreign net purchases of Indonesia equities