19 March 2019

Weekly Market Review (8 March 2019) - What happened & What's next?

Market update

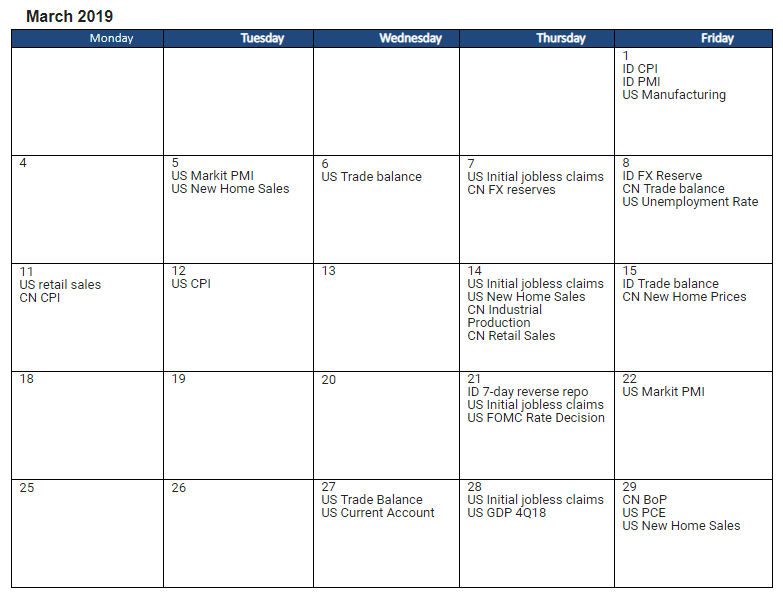

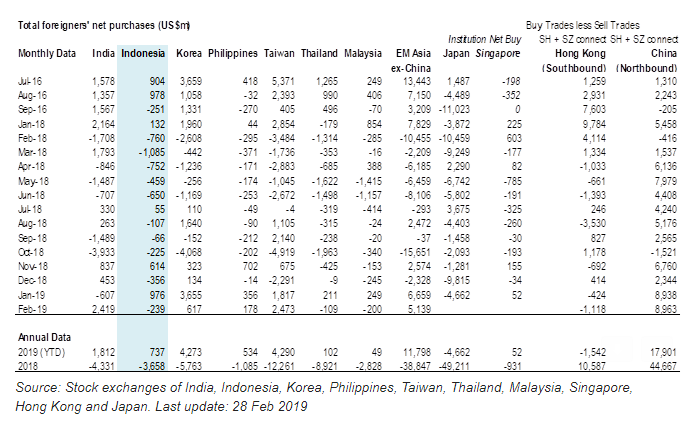

- Global markets closed the week higher with S&P 500 posted +2.9% WoW and DJI +1.6% WoW (DJI posted lower gain due to higher weighting on Boeing stock). China’s Premier Premier Li Keqiang highlighted stimulus to smoothen the downward economy pressure. On the other hand, investors will be focusing on the latest comments about interest rate and the pace of economic growth from Federal Reserve on 20 March. The latest news highlighted that Federal Reserve signaled that their growing reluctance to raise interest rate at all. On domestic side, foreign outflow continued with net inflow of USD29mn on the back of surprise trade surplus of USD330mn. JCI closed the week with a gain of +1.2% WoW to 6,461.18. Basic industry became the most outperformed sectors by gaining +2.8% WoW driven by CPIN (+13.5% WoW). Meanwhile, Agriculture sector was the biggest laggard with -0.3% WoW due to lower CPO price -1.2% WoW. Newsflows to be watched this week FOMC meeting, BI 7-day reverse repo decision, Brexit discussion, US market PMI, US initial jobless claims.

- IDR strengthened to IDR14,260 (+0.4%WoW), slightly lower than average emerging markets (+0.8% WoW). On the other hand, DXY weakened to 96.6 (-0.7% WoW).

- Positive sentiment came from February trade data, that reported surplus of USD330mn. This made bond market yield decreased by 17-20 bps. 10 years series decreased the most.

- Foreign investor decreased position by IDR 2.35tn, mostly seen on 10 years series.

- Indonesia has been affirmed at ’BBB’ by Fitch with Stable outlook. Fitch stated that Indonesia’s ratings balance a favorable GDP growth outlook and a small government debt burden.

Global news

- Li Keqiang highlighted in his annual press conference : 1) Li highlighted that the economy is facing new downward pressure but China will stick to targeted economic support and resist the temptation to engage in large-scale stimulus; 2) Li reiterates the government’s new emphasis on preventing large-scale job losses; 3) confirmed tax cuts to take effect on 1 April and social security reductions on 1 May; 4) hopeful over trade talks with US and aims for a win-win situation; 5) highlighted that China doesn’t ask companies to spy on other nations.

- Several countries grounded Boeing 737 Max 8 due to recent crash by Ethiopian airline that showed similarities with the previous Boeing 737 Max 8 crash by Lion Air just few months back.

- British MPs have voted for a delay in the Brexit process for three months or more, after struggling to agree on what terms the UK should leave the European Union on 29 March. Legally, Britain will exit from the bloc on March 29 unless EU leaders unanimously grant Britain an extension — an issue that is likely to dominate an EU summit in Brussels this week.

Domestic News

- Indonesia recorded trade surplus of USD330mn in February 2019. Overall exports dropped 10% m-m to US$12.53bn, driven by 12 percent decline in O&G exports. On the other hand, imports also dropped -18.6 percent m-m to US$12.2bn, largely attributable to 20 percent decline in non O&G items and 6 percent drop in O&G. Non O&G import dropped by US$2.7bn with 40 percent of the drop was sourced from China, which might be due to shorter working days caused by Lunar New Year.

- Feb-19 2W wholesales volume grew to 531.8k units, up 21 percent YoY or -6.6 percent MoM. This brought the 2M19 2W wholesales volume to 1.1mn units (+19% YoY).

- Sri Mulyani, Finance Minister has prepared several strategies to boost tax revenue. The plans include expanding the tax base and improving the tax payment system.

- Government will soon release the new regulation for luxury sales tax (PPnBM) on cars, along with the legal basis for super deductible tax incentives scheme.