23 September 2019

Weekly Market Review (23Sep 2019) - What happened & What's next?

Market update

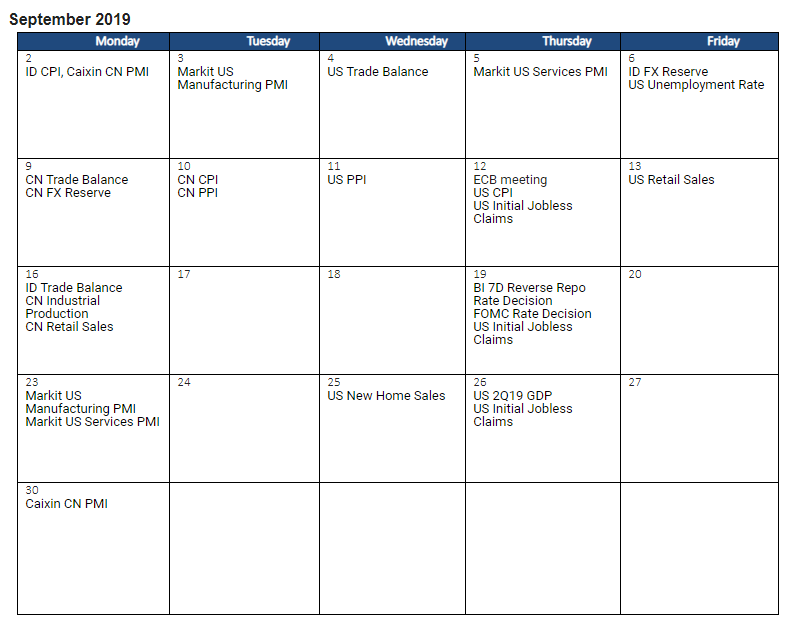

- Majority of global indexes were closed lower last Friday with Dow Jones and S&P declined by -1.0% WoW and -0.5% WoW respectively. Earlier last week, hawkish Fed rate cut gave positive sentiment to equity indexes. Yet, stocks turned lower in Friday after a report that a Chinese delegation cancelled plans to visit farms in Montana as a part of its negotiations with the US delegation. Similarly, JCI index also booked a loss of -1.6% WoW. Consumer sector was the main drag, fell by -6% WoW due to cigarette stocks (still in fear of excise hike). On the other hand, the most outperformed sector was Infrastructure, up by +2.6% WoW. News flows to be watched this week: US PMI, US new home sales, US 2Q19 GDP and US initial jobless claims.

- IDR depreciated to IDR 14,055 (-0.6%WoW), in line with average emerging markets. On the other hand, DXY strengthened by+0.3% WoW to 98.5.

- Profit taking from local investor after BI rate cut made bond market yield increased by 5-8 bps. 20 years series increased the most.

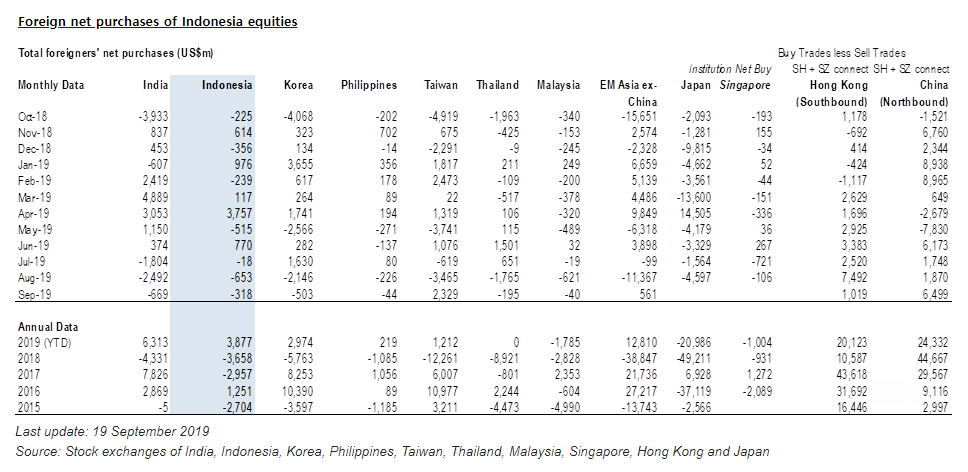

- Foreign investor reported net inflow of IDR 1.4 Trillion over the week.

- After Fed cuts rate by 25 bps last week and concern on increasing trade tension between US-China, made 10 year US Treasury yield decreased from 1.79% to 1.74% .

Global news

- China retail sales grew by +7.5% YoY in Aug-19, lower than expectation of +7.9% YoY. On monthly basis, retail sales experienced -0.1% MoM decline.

- China’s industrial production grew at +4.4% YoY last month, down from +4.8% YoY in Jul-19. Growth in Aug-19 is the lowest in the last 17 year.

- US initial jobless claims slightly increased by 2,000 to 208,000 in the seven days ended 14 Sep-19 from 13,000 in the prior week. Claims remain low, consistent with a still solid trend in employment growth.

- The Fed cut its benchmark interest rate by 25 bps to a range between 1.75% -2% last Wednesday. Seven Fed officials said they believed there would be one more rate cut this year.

Domestic News

- Trade balance recorded USD 85.1mn surplus in Aug-19, lower than consensus’ expectation of USD 161mn. The surplus was due to deeper import contraction, especially in the O&G side. Both volume and energy price has declined significantly.

- Bank Indonesia lowered rate by 25 bps to 5.25% last Thursday for the third consecutive month.