07 October 2019

Weekly Market Review (07 Oct 2019) - What happened & What's next?

Market update

- Global Equities dropped throughout the week, dragged by weaker economic data from the US and from Europe, especially weighed by 1) the ISM manufacturing and non-manufacturing numbers, 2) by even weaker final Eurozone PMIs vs the flash releases and 3) after Germany’s five leading research institutes slashed their forecasts for economic growth (2020 cut from 1.8% to 1.1% and 2019 cut from 0.8% to 0.5%, in line with Bloomberg consensus). However, market pared some of its losses at the end of the week, helped by A) a robust US labor report, B) hopes of a better outcome in next week’s US-China trade negotiations and C) as Rate-cut odds for the Oct FOMC meeting rose to ~80-90% (vs 40% last week). On domestic side, foreign investors continued to sell JCI for 12 consecutive weeks with a total outflow of USD14.45m last week. Moreover, JCI dropped to IDR6,061 (-2.2%WoW) by the end of the week. Auto industry was the worst performer with -3.2%WoW due to weaker auto data. Meanwhile, Trading sector was relatively performing better (0%WoW) than other sectors last week. News flows to be Indonesia Forex reserve; US Initial Jobless Claims, CPI, PPI and Trade meeting between US and China.

- IDR strengthened to IDR14,138 (-0.2%WoW), worse than average emerging markets (-0.5%WoW). On the other hand, DXY was relatively flat at 98.8 (-0.1%WoW).

- Below than expected US economic data released had increased the expectation for another rate cut from the Fed this year. Over the week, bond market yield decreased by 2-8 bps. 10 years’ series decreased the most.

- Foreign investor reported net inflow of IDR3.14trn over the week.

- Weaker than expected ISM Non-manufacturing and jobs data released. September ISM Non-Manufacturing Index reported falling to 52.6, and September nonfarm payroll released at 136 k vs 145 k consensus. Over the week, 10 year US treasury yield decreased from 1.7% to 1.52%.

Global news

- US initial jobless claims increased 4,000to a seasonally adjusted 219,000 (vs consensus of 215,000) for the week ended Sept. 28.

- ISM manufacturing index falls to lowest level since 2009. The composite index from the ISM manufacturing survey defied expectations for a small increase and instead fell 1.3 points to 47.8, its lowest reading since the end of the last recession in June 2009.

- ISM nonmanufacturing survey’s headline composite fell from 56.4 in August to 52.6 in September. This September reading disappointed expectations and was the lowest reported in about three years.

- US Sep’19 change in nonfarm payrolls was 136k vs consensus of 145k. Hiring remains positive enough to push down jobless rate.

- US Sep’19 unemployment rate was 3.5% vs consensus of 3.7%, prior 3.7%, suggesting that a slower pace of hiring will still be sufficient to tighten labor conditions.

- US Sep’19 average hourly earnings was flat +0.0%MoM vs consensus of +.2%MoM, prior +.4%MoM

- US Aug’19 trade deficit widened to -USD54.9bn vs consensus of -USD54.5bn, prior -USD54.0bn

- The Caixin factory PMI continued to beat expectations in Sep’19, rising to 51.4 in September (prev 50.4) and offered a rare positive signal in the global PMI releases.

Domestic News

- Sep19 CPI deflated by -0.27% MoM, generating an annual inflation of 3.39% YoY, decelerating from 3.49% in the previous month. The result was below consensus’ at and 3.54%, respectively, as food prices decreased deeper than anticipated. Thus, the core inflation slightly increased to 3.32% YoY in Sep19 from 3.30% in the prior month.

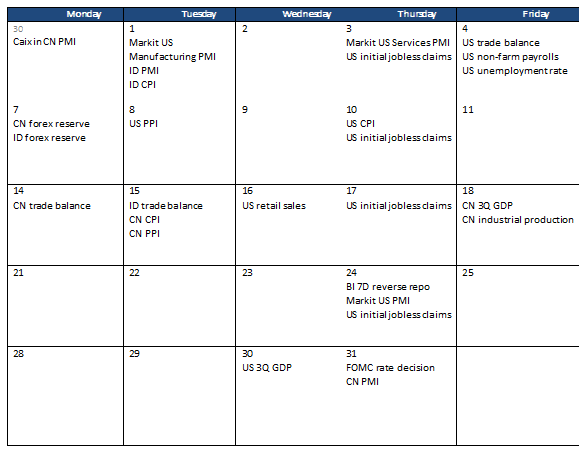

Calendar

October 2019

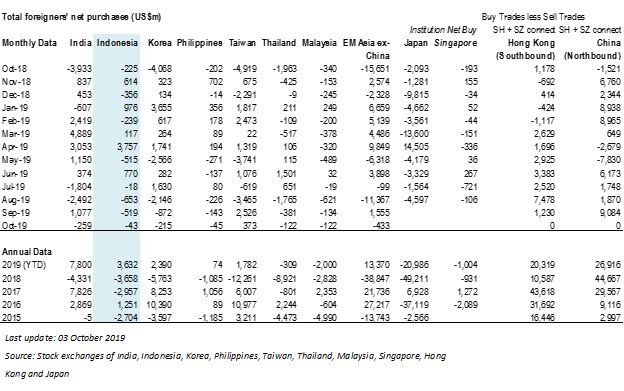

Foreign net purchases of Indonesia equities