14 October 2019

Weekly Market Review (14 Oct 2019) - What happened & What's next?

- Market update

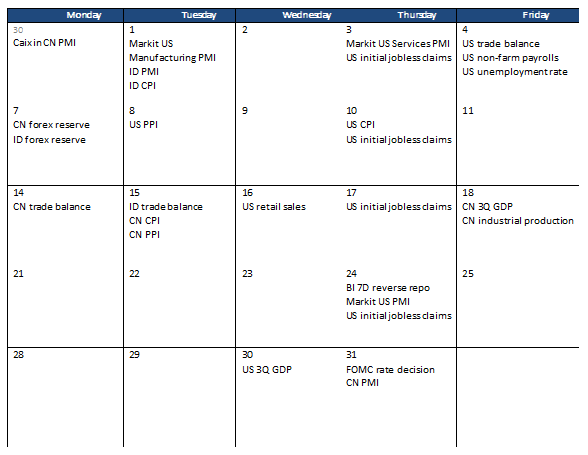

- Global Indexes ended higher last week due to improvement in trade deal. In the beginning of the week, markets ended in red as investors were spooked after the US government blacklisted several Chinese firms (these companies are accused of violating minority human rights). However, Trump met with China’s Vice Premier Liu He afterwards and agreed to delay the tariff imposition. China agreed to buy more US farm goods while the US will hold off on placing new tariffs on 15th October. JCI also booked a gain last week, up by +0.7% WoW. The most outperformed sectors were mining and property (+2.9% WoW and +1.8% WoW respectively). While the most underperformed sector was consumer, downed -0.1% WoW. News flows to be watched within this week: ID trade balance, US retail sales, US weekly jobless claims, CN trade balance, CN CPI, CN PPI, CN 3Q GDP and CN industrial production.

- IDR was flat last week, in-line with average emerging markets. On the other hand, DXY was weakened -0.5% WoW to 98.3.

- Lack of positive catalyst and concern on supply risk made bond market yield increased by 2-5 bps. 20 years series increased the most.

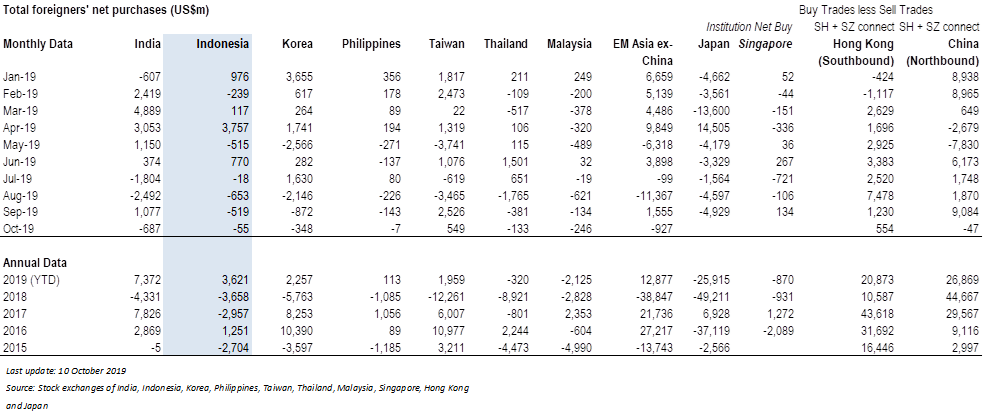

- Foreign investor reported net inflow of IDR 3.04tn over the week.

- Inline US inflation data and optimism on US-China trade deal made 10 year US treasury yield increased from 1.52% to 1.76%.

Global news

- US PPI sank 0.3% last month, booked the steepest decline since the beginning of this year. The drop reflects lower cost of gasoline. Similarly, US CPI was flat in Sep-19, marking the smallest change since Jan-19.

- US Aug-19 job openings came in at 7.051mn vs consensus 7.250mn , prior revision from 7.217mn to 7.174mn. It was the lowest since Mar-18 as employers seemed to have been pulling back on hiring.

- US jobless claims fall 10,000 to 210,000 in the week ended 11 Oct-19. The claims remains extremely low, suggesting no sign of rising layoffs.

- China’s forex reserve fell more than expected in Sep-19 despite of yuan rebounding from its biggest monthly drop in 25 years in the previous month. The country’s forex reserve fell USD 14.8bn to USD 3.09tn. The drop was much higher than consensus’ expectation of USD 6bn.

Domestic News

- World Bank expects 5% Indonesia GDP growth in 2019. Export is expected to contract by -1% while import seen declining -3.5%. Furthermore, private consumption is forecasted to remain robust at 5.2%. Investment, on the other hand, is expected to grow stagnantly at 5% pace.

- Government to revise PP no. 96/2015 regarding facility and easiness in the Special Economic Zones (SEZ). The revision will include 100% tax holiday for all business in SEZ but the period will depend on the investment value.

- Bank Indonesia stated foreign reserves in Sep-19 stood at USD 124.3bn, down by USD 2.1bn. The drop was due to foreign debt repayments and less foreign currency placements in BI.

Calendar

October 2019

Foreign net purchases of Indonesia equities