28 October 2019

Weekly Market Review (28 Oct 2019) - What happened & What's next?

Market update

- Global equities ended the week in the positive territory on the back of positive momentum on trade talks and earning surprises. In the US, 40% of S&P 500 companies have reported 3Q results, out of which 80% have reported positive EPS surprises. However, 4Q guidance is somewhat weak, while 2020 earnings are seeing downgrades. On the trade side, optimism around US-China trade talks continued as reports suggested that US-China may be close to finalizing some sections of a trade deal, later confirmed by the China’s Ministry of Commerce. In the UK, the Parliament voted on a Withdrawal Agreement Bill and rejected the PM's fast track Brexit process. Risks of a hard Brexit appear low given that the EU agreed to a Brexit extension, however they have not yet committed to a date. In Asia, results so far have been mixed, with slightly more beats than misses. On domestic side, foreign investors ended its 14-week selling streak on JCI and booked inflow of USD23mn last week. JCI strengthened to 6,252.3 (+1.0%WoW) by the end of the week. Agriculture was the best performer by gaining +2.5%WoW due to higher CPO price. Meanwhile, Mining sector was the biggest laggard, declining -1.6%WoW. News flows to be watched this week: US 3Q GDP, FOMC rate decision, China PMI.

- IDR strengthened to IDR14,038 (+0.8%WoW), stronger than other emerging markets. On the other hand, DXY strengthened to 97.6 (+0.6%WoW).

- 7 days RR cut from 5.25% to 5% and continued foreign inflow made Indo bond yield decrease by 5 – 11bps with 5 year series decrease the most.

- Foreign investor reported net inflow of IDR 10.3tn over the week.

- Increasing expectation of a trade deal made 10yr UST yield increase from 1.76% to 1.8%.

Global news

- Markit US manufacturing PMI recorded 51.5 vs consensus expectation of 50.9, while services PMI recorded at 51.0 in-line with consensus expectation.

- US initial jobless claims reached 212,000 (vs consensus of 215,000) for the week of 19 Oct.

- News reported that China willing to buy USD20 billion of US farm products in year one of a partial trade deal.

Domestic News

- BI cut 7-day reverse report rate by 25bps to 5%.

- President Jokowi announced the complete list of new cabinet on Wednesday. Breakdown of ministers: 53% non-political professionals, 12% PDI-P, 9% Golkar, 9% NasDem, 9% PKB, 6% Gerindra, 3% PPP.

- Government to cut corporate tax rate for export-oriented industry and industry which produced the substitute of import products from currently 25% to 20% by 2023 (in stages).

- Government officially issued the luxury tax (PPnBM) regulation for the electric vehicle (PHEV, BEV, and Fuel Cell EV) in which the PPnBM tax will be 0%.

- Government 2019 budget deficit is projected to widen from initially 1.84% of GDP to 1.93%. Ministry of Finance is anticipating this by preparing a number of financing instruments.

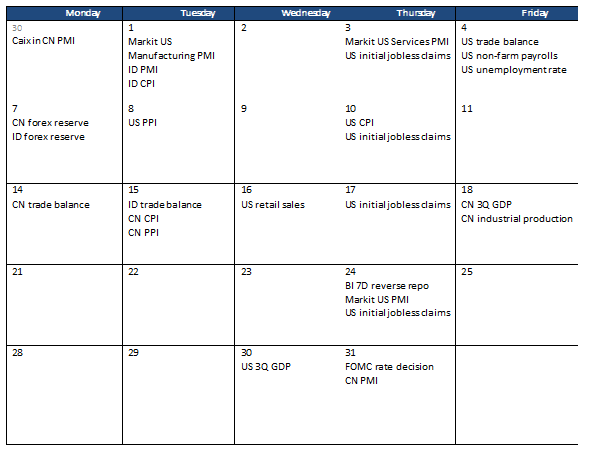

Calendar

October 2019

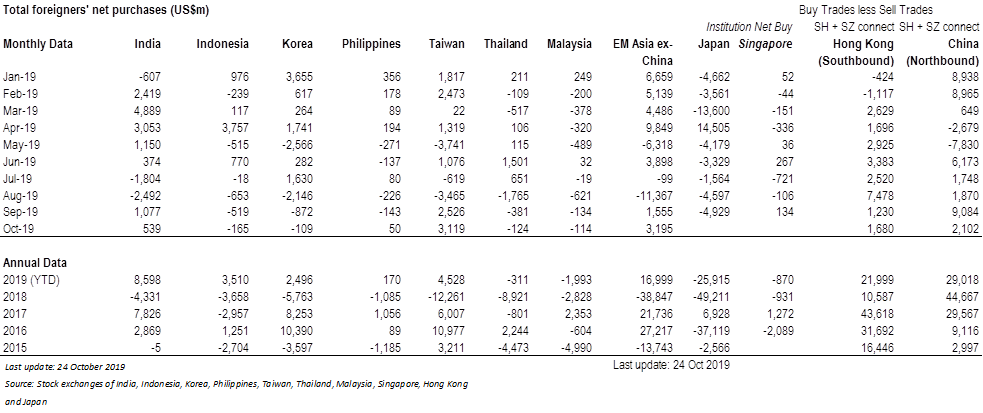

Foreign net purchases of Indonesia equities