04 November 2019

Weekly Market Review (04 Nov 2019) - What happened & What's next?

Market update

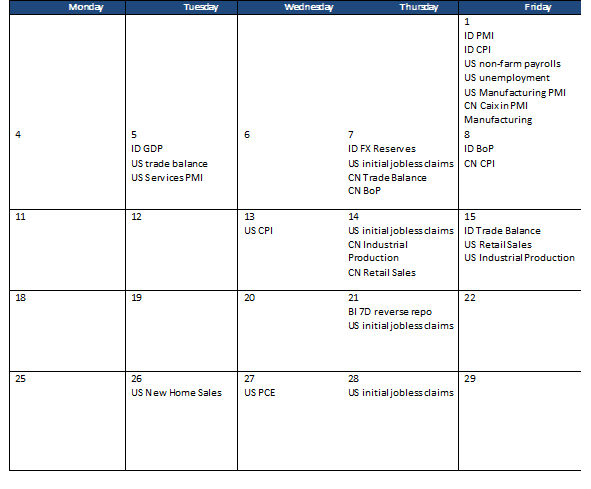

- US Equities posted another week of strong gains (SPX +1.5%, MXASJ +1.8%) as global Central Bank’s driven easier financial conditions, better than expected earnings and continued easing in geo-political risks related to a hard-Brexit and US-China trade tensions lifted equities higher. First, the Fed delivered a widely expected 25bp rate cut while signaling a pause and indicating that the bar for future rate cuts as well as hikes is high. Then in Japan, the BOJ kept its policy unchanged but kept easing expectations alive. While both the CBs appear to be on hold, it seems that the ‘CB put’ remains in place, which could continue to aid the risk sentiment – unless US-China trade talks were to collapse. On domestic side, JCI weakened to IDR6,207.2 (-0.7%WoW) by the end of the week dragged down by net foreign outflow of USD123.4m. Agri was the best performer by gaining +0.8%WoW, thanks to higher CPO price (+3.1%WoW). Meanwhile, Infra sector was the biggest laggard, by falling -4.7%WoW. News flows to Indonesia GDP, FX Reserves and BoP; US trade balance, Initial Jobless Claims and Services PMI; China Trade Balance, BoP and CPI.

- IDR was relatively flat at IDR14,039 (0%WoW), worse than average emerging markets (+0.5%WoW). On the other hand, DXY was also flat at 97.2 (-0.1%WoW).

- Increasing appetite on EM bonds after Fed rate cut by 25 bps. Domestic and foreign investor continue to add position on Indo GB and trading volume increased from IDR20trn to IDR24.7trn last week. Indo bond yield decrease by 5 – 11bps with 5year series decrease the most.

- Foreign investor reported net inflow of IDR4.77trn over the week.

- After the Fed cut interest rate for the third time in 2019 and Q3 US GDP slowed to 1.9%, 10yr UST yield decrease from 1.8% to 1.73%.

Global news

- US initial jobless claims rose 5,000 to a seasonally adjusted 218,000 (vs consensus of 215,000) for the week ended Oct. 26.

- U.S. GDP grew at an annualized rate of 1.9% in 3Q19, down slightly from the 2% pace in 2Q19. It was better than consensus expectation of 1.6%.

- US Businesses’ payrolls increased by 128,000 after a downwardly revised 93,000 gain in September. That exceeded the economists’ estimates that had called for a 110,000 gain. The unemployment rate ticked up to 3.6%, still near a half-century low.

- Fed cut rates for the third time this year and signaled an intention to take a pause in the easing cycle while keeping the door open for a cut in December.

- China Manufacturing PMI fell to 49.3, worse than the 49.8 market expectation. The non-manufacturing gauge was 52.8, lower than forecast.

Domestic News

- Indonesia PMI fell to 47.7 in Oct’19, lower compared to Sep’19 that reached 49.1, and the lowest point since the last 4 years.

- Indonesia CPI slightly increased by +0.02% MoM in Oct’19, lower than consensus estimates, thus causing the annual inflation to ease to 3.13% YoY (vs. Sep19 at 3.39%). The deviation was due to the deflation on raw food price (contributing -0.08 ppt to monthly inflation).

Calendar

November 2019

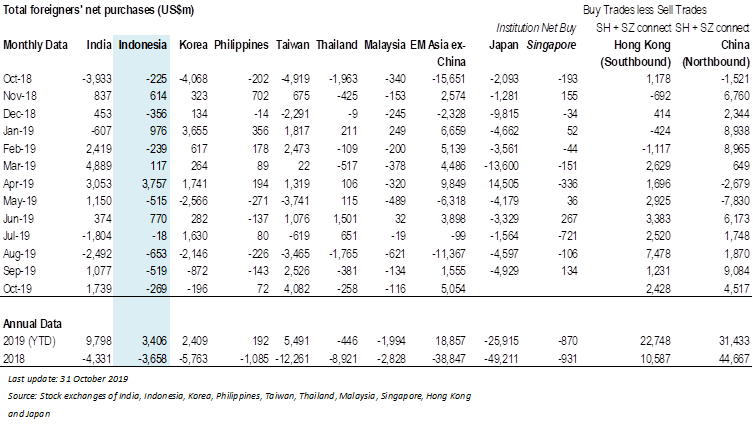

Foreign net purchases of Indonesia equities