11 November 2019

Weekly Market Review (11 Nov 2019) - What happened & What's next?

Market update

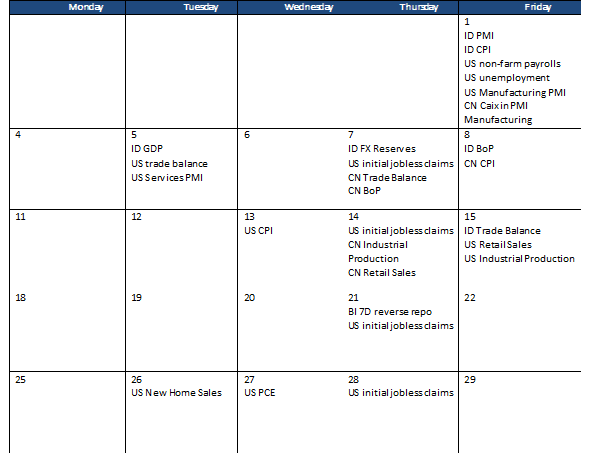

- Global indexes posted gains last week, buoyed by more positive news on trade deal as well as better than expected China’s data . China’s foreign ministry sent positive signals about trade talks last Tuesday, saying the two presidents are in contact and progress is being made on the negotiations. In addition, China’s import and export trade data was better than expected where both fell less than estimated (-6.4% YoY and -0.9% YoY). On the other hand, JCI weakened to IDR6,178 (-0.5%WoW) by the end of the week. Agriculture and Basic industry were the best performer sectors, each up by +2.1% WoW and +2.2% WoW respectively. Whereas consumer sector was the worst performing sector, down by -1.7% WoW. News flows to watch within this week: US CPI, US initial jobless claim, US retail sales, US industrial production, CN industrial production, CN retail sales and IN trade balance.

- IDR was weakened to IDR 14,014 (-0.2% WoW), in-line with emerging market. On the other hand, DXY increased to 98.4 (+1.1%WoW).

- Easing global volatility and increasing Indonesia’s foreign reserves by USD 2.4bn made domestic and foreign investors continue to add position on Indo GB. There is increasing appetite on 10 yr benchmark series last week. Indo bond yield decreased by 4-14bps with 10 year series decreased the most.

- Foreign investor reported net inflow of IDR 8.4tn over the week.

- Further progress on US-China “phase one” and signs that global economic growth has stabilized made foreign investor appetite on EM better. 10 yr UST yield increased from 1.73% to 1.94%.

Global news

- US trade deficit drops 4.7% to 5-month low, helped by oil surplus as well as a decline in imports from Germany and China.

- U.S. ISM non-manufacturing index climbs to 54.7% from 52.6% in Oct-19. The number has improved from a three year low in the prior month, aided by reduced trade tensions between US and China.

- US jobless claims fall to one month low of 211,000, signaling labor market that remains strong.

- China’s exports and imports in Oct-19 beat forecast. Export only fell by 0.9% YoY while import fell 6.4% YoY.

- China’s CPI rose 3.8% YoY, the fastest pace in almost 8 years in Oct-19, driven mostly by a surge in pork prices as African swine fever ravaged the country’s hog herds. On the other hand, PPI fell 1.6% YoY.

Domestic News

- Indonesia 3Q19 GDP growth slightly weakened to 5.02% YoY from 5.05% in the previous quarter. Domestic demand and investment showed a downward trend while improvement only seen on net export.

- Indonesia 3Q19 balance of payment (BoP) improved, reflected from the lower deficit of -USD 46mn from -USD 1.98 bn in the previous quarter. Current account deficit (CAD) narrowed to -2.66% of GDP (-USD 7.7bn) (vs. -2.93% of GDP in 2Q19). Meanwhile, the financial account surplus enlarged due to narrower deficit on other investment account and a healthy portfolio surplus.

Calendar

November 2019

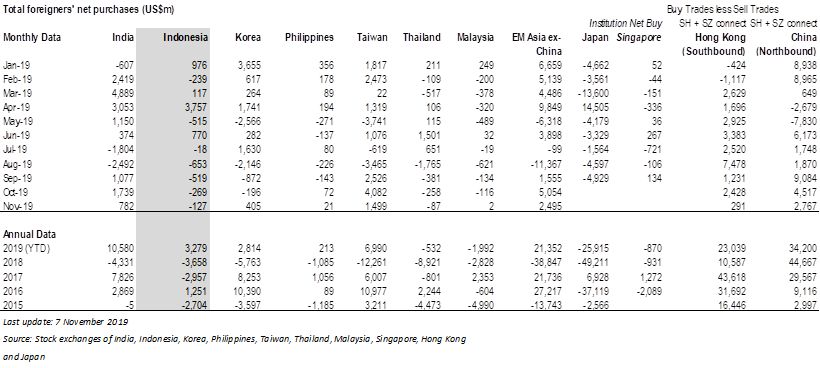

Foreign net purchases of Indonesia equities