18 November 2019

Weekly Market Review (18 Nov 2019) - What happened & What's next?

Market update

- Global indices closed the week with mixed performance. The decline was mainly due to lack of meaningful progress on US-China trade deal, protests in HK and weak economic data dampening investor confidence. While US market closed all-time high with DJI at 28,004.89 (+1.2% WoW) and S&P500 at 3,120.46 (+0.9% WoW), Asian equities took a breather (MXASJ -2.1%) after five straight weeks of gains. Economic data in China was weaker than expected. China loans and aggregate financing data for October slumped, missing market expectations. October activity data (IP, FAI, retail sales) were also down significantly from September. To prevent further growth slowdown, PBOC injected RMB200bn of liquidity into the banking system last Friday. On the domestic side, JCI weakened to 6,128.3 (-0.8%WoW) by the end of the week. Basic industry was the best performer +0.5% WoW led by petrochemical sector. Whereas Mining sector was the worst performing sector -3.0% WoW. News flows to watch within this week: BI 7-day reverse repo rate decision, US initial jobless claim.

- IDR weakened to IDR 14,077 (-0.4% WoW), in-line with emerging market. On the other hand, DXY declined to 98.0 (-0.4%WoW).

- Continued US- China trade tension development made Indo bond yield increase by 4 – 9bps, with 10 year series increase the most.

- Foreign investor decrease position by IDR 0.75 Tn over the week.

- Slower US industrial output fell in October, down 0.8%, below consensus of 0.5%,that made 10yr UST yield decrease from 1.86%to 1.75%.

Global news

- China warned of ‘substantial’ trade war tariff increases by US President Donald Trump if deal is not reached. He reiterates that scheduled 15 per cent tariffs will be imposed on December 15 if a deal is not reached. Interim agreement expected to include a US pledge to scrap tariffs scheduled for December 15 on about US$156 billion worth of Chinese imports.

- Germany narrowly avoids a technical recession with 0.1% growth in the third quarter. Germany’s GDP (gross domestic product) rate exceeded the -0.1% contraction expected by analysts. On an annual basis, the economy grew by 0.5% from July to September.

Domestic News

- Indonesia recorded USD161mn trade surplus. Exports better than estimates of -8.15% YoY. Imports dropped even deeper -16.39% YoY to US$14.8bn vs estimates of -15.4%. As a result, trade balance came out better than consensus estimate of US$300mn trade deficit.

- Indonesia aims to complete omnibus laws in early next year. Govt plans to submit the laws in Dec. and is expecting to get a parliamentary approval early next year.

- Gov’t tax collection recorded at Rp1,032.8tn in 10M19, +1.6% YoY from Rp1,016.52tn in 10M18. Gov’t needs to catch the remaining Rp544.82tn of tax collection in the last 2 months (November and December).

- Non-tax revenue (PNBP) reached Rp332.9tn (+3.6% YoY) as of end of October 2019, 88% of gov’t FY19 target of Rp378.3tn. Non-tax revenue from oil and gas has reached Rp159.8tn, 88% of FY target. Gov’t is optimistic to meet the target as Crude Price is still above US$60 per barrel.

- Coordinating Economic Ministry said implementation of B30 program on 1 January 2020 may save the government’s forex reserves by US$4.8bn for the entire year.

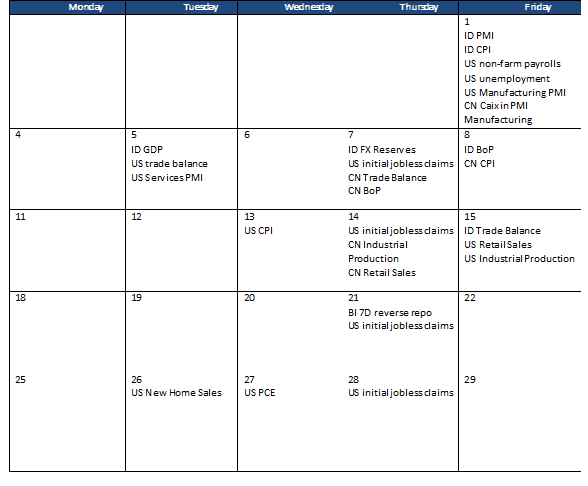

Calendar

November 2019

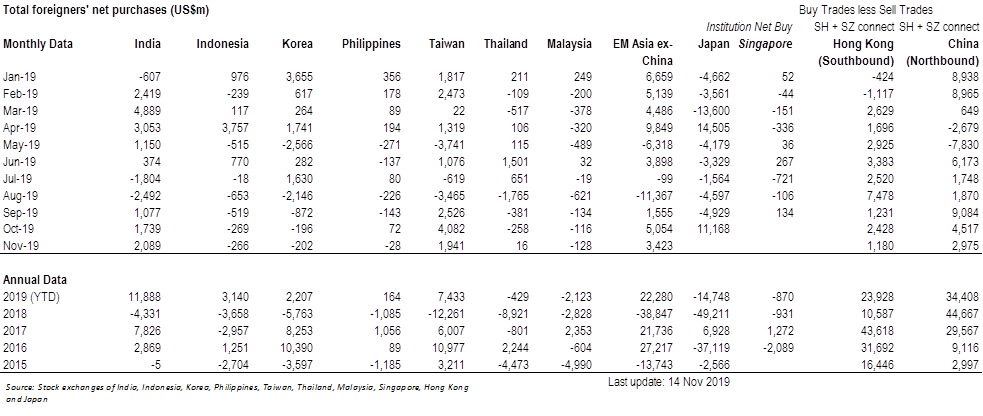

Foreign net purchases of Indonesia equities