25 November 2019

Weekly Market Review (25 Nov 2019) - What happened & What's next?

Market update

- Global indices closed lower last Friday as investors continued to digest mixed headlines on the progress of US-China trade negotiations. President Xi stated that they want to work for a Phase 1 agreement on the basis of mutual respect and equality. On US side, President Trump also made a positive comment that there was a good chance to make a deal. However, optimism around trade gave way after the Federal Communications Commission voted to label Chinese telecom giants Huawei and ZTE as a national security risk. In addition, US Senate and House passed bills to protect human rights and anti-China protesters in Hong Kong and also another bill to bar the export of certain munitions to Hong Kong police. On the domestic side, JCI index also booked a loss, down -0.5% WoW. Agricultures was the most outperformed sector, up by +1.8% WoW due to jump in CPO future price +5.0% WoW to MYR 2,748/ton. On the other hand, Basic Industry and Property were the main drag, down -2.7% WoW and -2.6% WoW respectively. News flows to watch within this week: US new home sales, US PCE and US initial jobless claims.

- IDR weakened to IDR 14,092 (-0.1% WoW), in-line with emerging market. On the other hand, DXY strengthened to 98.3 (+0.3%WoW).

- Lack of positive catalyst and thin market volume made Indo bond yield increase by 4-6bps with 10 year series increase the most.

- Foreign investor continue to decrease position by IDR 0.96tn over the week.

- Increasing political tension after US Senate passed a bill supporting Hong Kong protesters made 10 year UST yield decreased from 1.84% to 1.77%. The Fed officials generally saw little need for further rate cuts this year, unless economic condition change significantly according to Fed minutes that released Wednesday.

Global news

- US initial jobless claims clung to a five-month high in mid-November of 227,000. The number is higher than consensus’ expectation of 218,000.

- US manufacturing PMI (IHS Markit) in Nov-19 rose to 52.2 from 51.3 in the previous month. This is higher than expectation of 51.4 and is the fastest rate since April.

Domestic News

- BI has maintained policy rate unchanged at 5%, in-line with consensus expectation. To give extra liquidity, BI implements lower reserve requirement ratio starting on 2nd of January 2020.

- Deputy Finance Minister, Suahasil Nazara mentioned that Indonesia’s Government is prepared to widen the budget deficit to counter a potential deterioration in the global outlook. The Government already increased this year’s deficit target to 2.2% of GDP and ready to raise it in 2020 if necessary.

- 3Q19 trade balance recorded a surplus of USD 161mn beating consensus’ expectation of another deficit. Exports and imports recorded larger contractions of 6.1% YoY and 16.4% YoY respectively.

- Yasonna Laoly, the Minister of Legal and Human Rights stated that Government plans to submit omnibus laws in Dec-19 and is expecting to get a parliamentary approval next year.

- Based on the Finance Ministry press release, budget deficit widened to 1.8% of GDP in 10M19 from 1.58% in 9M19. The government revenue growth eased to 1.2% in 10M19 (vs 2.3% in 9M19) due to softer non tax revenue growth. Meanwhile, tax revenue growth remained flat at 1.2% YoY owing to contraction in value added tax and trade duty.

- Government will implement the electricity tariff adjustment starting Jan-20. Furthermore, some of the households in 900VA class will no longer get a subsidy and prices will follow the new adjustment scheme. The government guides that any increases will not be major.

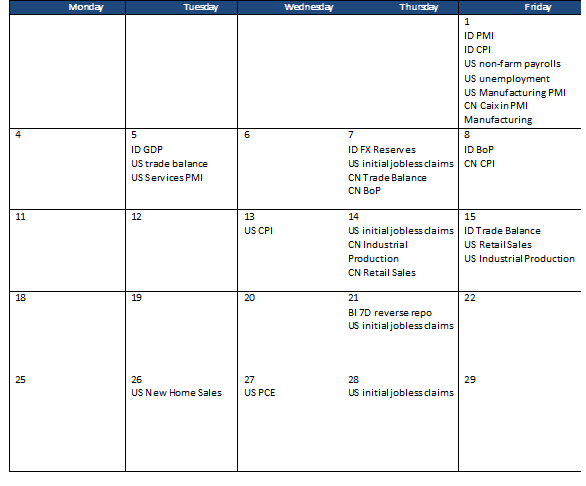

Calendar

November 2019

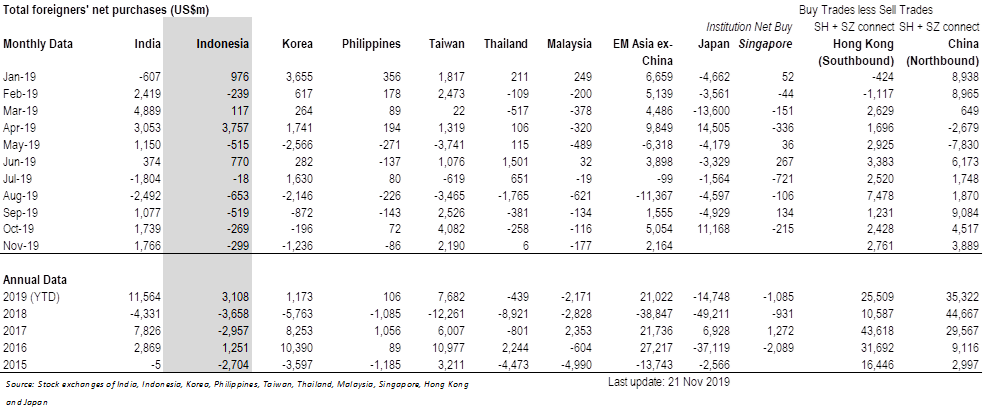

Foreign net purchases of Indonesia equities