30 December 2019

Weekly Market Review (30 Dec 2019) - What happened & What's next?

Market update

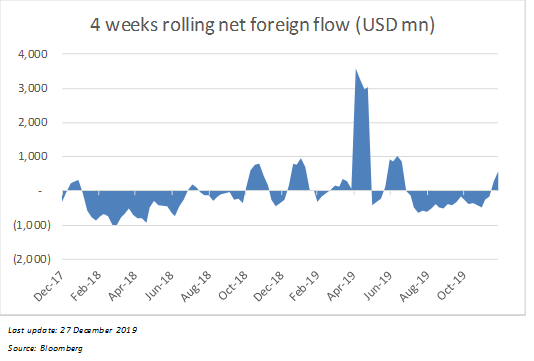

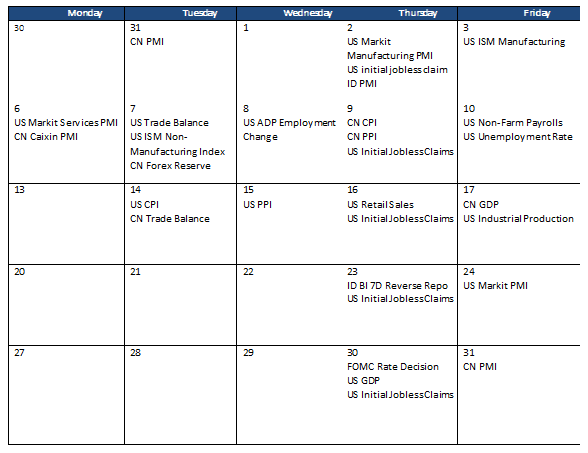

- Global markets closed higher last week with S&P 500 +0.6% WoW, Dow Jones Index (DJI) +0.7% WoW and MSCI Asia ex-Japan +0.9% WoW. Despite S&P500 and DJI touching another record highs, it was a quiet week as holiday mood extends through year-end festivities. On domestic side, JCI strengthened to 6,329.3 (+0.9%WoW) by the end of the week buoyed by net foreign inflow for the 4th consecutive week with USD98mn. Agriculture sector was the best performing sector, up +6.6%WoW as CPO price rose +4.8% WoW. Meanwhile, Basic Industry was the biggest laggard, falling -0.3% WoW. News flows to be watched within this week include China PMI, Indonesia PMI, US PMI and initial jobless claims.

- IDR strengthened to IDR13,952 (+0.2%WoW), in line with average emerging markets. On the other hand, DXY fell to 96.9 (-0.8%).

- Domestic investor appetite on short and mid tenor series made bond market yield continue to decrease by 5-14 bps over the week. 5 years series decreased the most.

- Foreign investor increased position by 0.5Tn. Trading volume decrease from 8.8Tn to 8.6Tn, with FR 77 (5 years benchmark) as the most active series in secondary market.

- 10 year US treasury yield decreased by 4 bps from 1.92% to 1.88% over the week. There was no US economic data released and trade volume was thin.

Global news

- US initial jobless claims came in at 222,000 in-line with consensus expectation of 220,000.

Domestic News

- The draft bills of omnibus law (tax and job creation ) is targeted to completed by end of 2019 and will be submit to House of Representative (DPR) by Jan2020.

- Central Bank (BI) estimates GDP growth of 5.1% in 2019.

- Gov’t to postpone the tariff adjustment for 900 VA customer that is considered capable (RTM – Rumah Tangga Mampu).

Calendar

January 2020

Foreign net purchases of Indonesia equities