06 January 2020

Weekly Market Review (6 Jan 2020) - What happened & What's next?

Market update

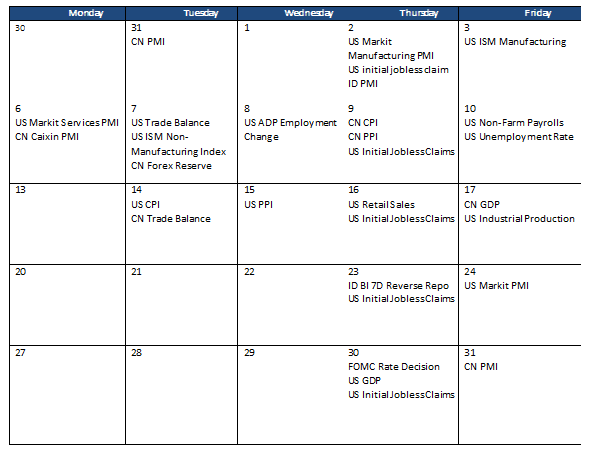

- Global markets closed with mixed result last week S&P 500 -0.2% WoW, Dow Jones Index (DJI) flat WoW while MSCI Asia ex-Japan +0.6% WoW. Earlier last week, President Trump announced the signing of trade deal on 15-Jan that provided optimistic momentum for the market. However, on Friday morning, the sentiment took a beating with the US announcement of the assassination of Iran’s top military general, which drove up crude prices. Iranian's Supreme Leader Khamenei vowed a 'harsh retaliation’. On domestic side, JCI was down to 6,323.5 (-0.1% WoW) by the end of the week buoyed by net foreign inflow with USD68mn. Property sector was the best performing sector, up +0.5%WoW. Meanwhile, Basic Industry was the biggest laggard, falling -1.1% WoW as rising oil price posed negative sentiment for the petrochemical companies. News flows to be watched within this week include US Trade balance, ADP employment change; China forex reserve, CPI, PPI.

- IDR strengthened to IDR13,930 (+0.2%WoW), in line with average emerging markets. On the other hand, DXY fell to 96.8 (-0.1%).

- Despite geopolitical risks on US-Iran conflict are rising after US confirmed that its airstrike killed Iran’s top military commander last week, Indo bond market yield still decreased by 2-8 bps. 10 years series yield decreased from 7.08% to 7%.

- Foreign investor decreased position by 0.6Tn. Trade volume was stable at 8.2Tn over the week.

- Increasing geopolitical risk between US-Iran and lower than expected US ISM manufacturing data that released 47.2 lower than previous month figure of 48.1 made 10 year US treasury yield decreased from 1.88% to 1.8% over the week.

Global news

- China’s Dec official manufacturing PMI beat expectations remaining unchanged at 50.2, Non-manufacturing PMI fell to 53.5 from 54.4 in Nov. Caixin manufacturing PMI also eased to 51.5 in Dec from 51.8 in Nov.

- US ISM manufacturing index missed expectations, declining 0.9pp to 47.2, the lowest level since June 2009, while Markit manufacturing PMI came out at 52.4, - 0.2pp below Nov level.

- PBOC unveiled its plan to replace the old benchmark lending rates with the LPR to lower financing costs, and also announced a 50bp RRR cut.

Domestic News

- Central Bank (BI) estimates that forex reserves can reach more than US$127bn in 2019 (November 2019 at US$126.6bn). Further, total capital inflow was Rp224.2tn last year.

- Non-subsidized fuel price was decreased, in Shell, Pertamina and Total. Price change ranges from -6.6% to 15.8%.

- News reported that total tax revenue (without excise and international tax) at Rp1,319tn or 83.7% of target as of December 2019, only increase by +0.5% YoY. With this the tax shortfall in 2019 was at Rp257.94tn.

- Indonesia’s Manufacture Purchasing Manager Index (PMI) was at the level of 49.5 as of December 2019, lower than the expansive level threshold of 50.

- Decade-low inflation of 2.72% YoY in 2019 was mainly contributed by administered prices, which only rose by 0.51% (vs 3.36% in 2018 when fuel and airfare climbed).

Calendar

January 2020

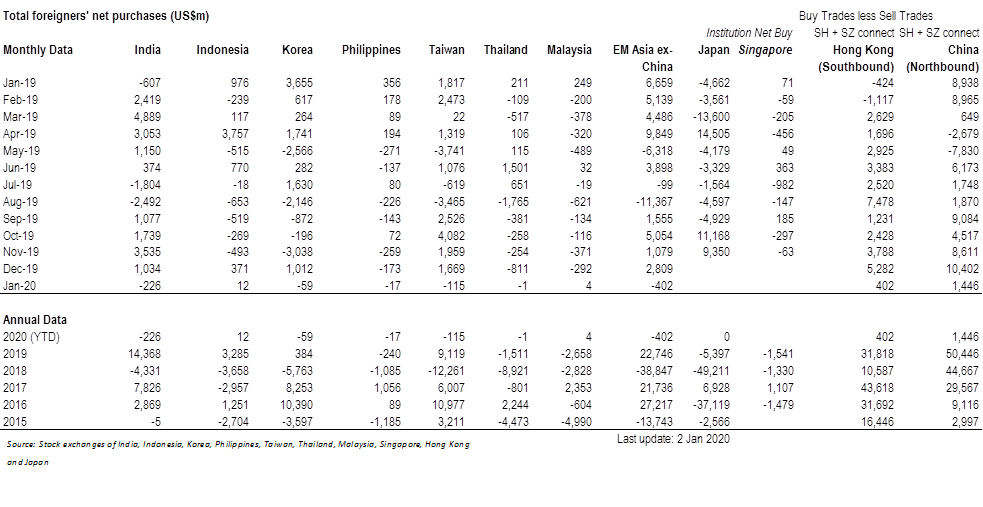

Foreign net purchases of Indonesia equities