27 January 2020

Weekly Market Review (27 Jan 2020) - What happened & What's next?

Market update

- Global indexes closed lower last week, triggered by fears China’s coronavirus will spread outside its border and impact the world economy. Fears over slower economic growth due to the outbreak has offset the better than expected US earnings reports. This week, investor will be focusing on the Fed meeting and 4Q19 GDP result. Similarly, JCI index also booked a loss, down by -0.8% WoW. The most underperformed sectors were agriculture and mining (nickel price was down -7% WoW), -4.4% WoW and -4.2% WoW respectively. On the other hand, basic industry was the best performing sector, up by +0.6% WoW. News flows within this week: US GDP 4Q19, US durable goods, US personal income, US spending, US initial jobless claims, FOMC meeting and Chinese PMI.

- IDR appreciated to IDR13,583 (+0.5%WoW), the best performer amongst emerging market, despite DXY index also strengthened by +0.3% WoW.

- Despite BI holds policy rate at 5%, strong fund flow from both domestic and foreign investor made Indonesia government bond yield continued to decreased by 14-23 bps along the curve.10 years yield decreased the most by 23 bps, from 6.81% to 6.58%.

- Foreign investor continue to increased position by IDR3.84trn over the week. Trade volume increased by 19.1Tn, from average IDR16.1trn YTD with FR 82 and FR 78 as the most actively traded in secondary market.

- Fitch rating agency affirmed Indonesia's rating at BBB with stable outlook on 24-January 2020. According to Fitch's report, the key rating drivers were favorable medium-term growth outlook and small government debt burden compared with 'BBB' category peers.

Global news

- US CPI rose by +0.2%MoM in Dec-19, below forecast of +0.3% MoM. However, annual CPI increase by +2.3%YoY in 2019, the fastest pace in eight years.

- US initial jobless claims declined by 10,000 to 204,000 last week, signifying strong US labor market. The largest declines in job openings were in retail trade and construction.

- The number of open jobs fell to 6.8 million in Dec’19 from 7.36 million in the prior month, reaching a 21 month low.

- US industrial production down to -0.3%MoM in Dec’19, relatively inline with Economists forecast of -0.2%MoM. It was driven by a -5.6%MoM decline among utilities, as demand for heating fell during an unseasonably warm December.

Domestic News

- In its last governor board meeting, BI left its 7DRRR unchanged at 5.0%. The central bank’s stance remains accommodative to support economic growth momentum while it will continue to monitor the global and domestic situation before deploying the proper accommodative policy mix if needed.

- The provincial government of DKI Jakarta recently issued a new incentive that waives the transfer of title tax (BBNKB) for both battery powered electric vehicles starting 2020, both 2W and 4W.

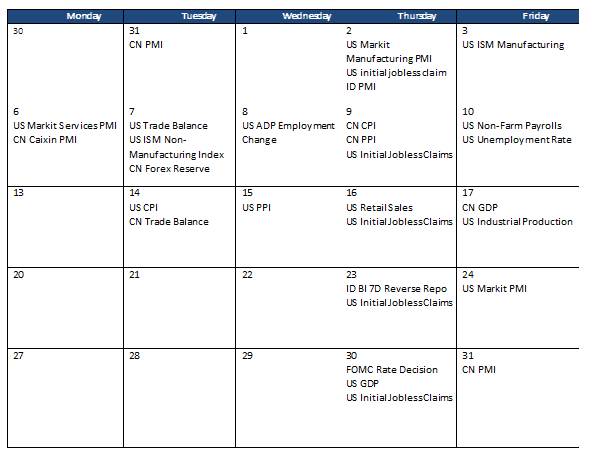

Calendar

January 2020

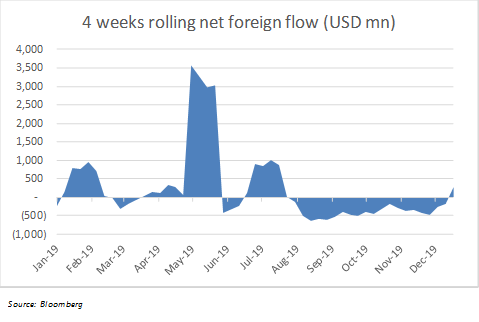

Foreign net purchases of Indonesia equities