03 February 2020

Weekly Market Review (3 Feb 2020) - What happened & What's next?

Market update

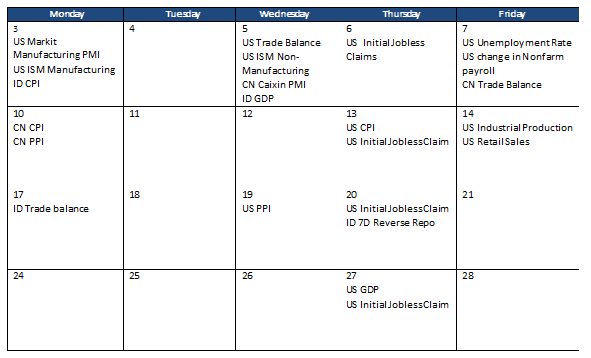

- Global indexes continue to collapse following the surging negative sentiment of Coronavirus (nCoV) and WHO declaration of global emergency. Cautious on the virus impact to China’s Q1 GDP number that might drop significantly and subsequently global slowdown. Oil and commodities price dropped by rising the concern on the sinking of global economic demand. On the domestic side, JCI tumbled to 5,940 (-4.9% WoW). All sectoral index was sluggish with the biggest laggards were basic industry and miscellaneous industry (respectively down by -8.7% WoW and -7.8% WoW). News flows within this week: US PMI, US Trade Balance, Initial Jobless claim, Unemployment rate, China Trade Balance, Indonesia CPI and GDP.

- Most EM Asia Fx unit weakened including IDR that depreciated to IDR13,655 (-0.55% WoW). A risk sentiment took a hit on the deepening fears of rapidly-spreading nCoV that could hurt global economy.

- Risk off sentiment due to coronavirus made IDR bond yield increased by 6-8 bps along the curve. 10-year yield increased the most.

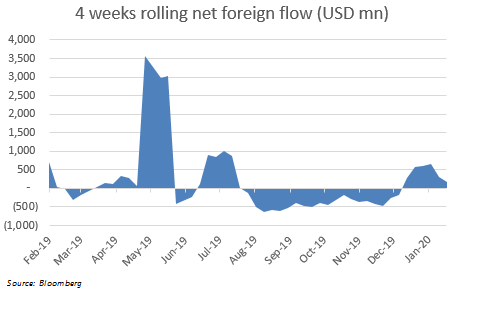

- EM Asia ex China equities observed large outflow of USD 4.0bn over the last week.

- Foreign investor decreased bond position by Rp7.6 Tn over the week. BI conducted reverse repo auction & intervene in FX to limit the selling pressure from both domestic and foreign investors.

- Japan Credit Rating raised Indonesia sovereign to BBB+ from BBB with a stable outlook. Continuing transformation, omnibus law, budget reform are main factors behind the upgrade. The rating also reflects Indonesia solid domestic consumption that support economic growth, restrained budget deficit and public debt.

Global news

- As the latest report (Feb 3 2020, 9AM), nCoV confirmed cases were 17,383 and death toll rises to 362 cases. Although WHO has so far not stated travel ban necessary, some countries such as US, Australia, UK, Indonesia already restrict and/or ban flight to and from mainland China.

- The UK has officially left the European Union in 31 Jan 2020 after 47 years of membership. This is to finalize the Brexit referendum process that has been announced since June 2016.

- The Fed holds interest rate steady between 1.5% – 1.75%. Based on its post-meeting statement, the committee appears to commit to nudge up inflation.

- US initial jobless claim down by 7k to 216k (vs 215k expectation) for the week ended 31 Jan.

- US year-over-year GDP growth was reported slowed to 2.3% in 2019 from 2.5% in 2018. This well below Trump’s promise of 3% growth.

- China January manufacturing PMI was 50, previously 50.2. China factories were flattening even before the virus worsened due to slowing economy and trade war

Domestic News

- President Jokowi has signed Presidential Letter (Surpres) on the draft of Omnibus Law on Taxation. The draft will be delivered to Parliament this week, subject to parliament’s assembly schedule. Meanwhile, Omnibus Law on Employment Creation is still delayed due to some points are still on discussion.

- BPS plans to adjust CPI base year from 2012 to 2018 starting in Jan-20’s inflation figure. The rebase will also introduce new classifications for the new consumption basket, which consists of 11 groups and 43 subgroups (vs. 7 groups and 35 subgroups in 2012 base year).

- Indonesia January CPI increased by +0.39% MoM and +2.68YoY. This figure was below than consensus +0.46% MoM and +2.84YoY. Meanwhile, core CPI up to +2.88% YoY where previously 3.02% YoY

Calendar

February 2020

Foreign net purchases of Indonesia equities