02 March 2020

Weekly Market Review (02 March 2020) - What happened & What's next?

Market update

- Global indexes closed lower last Friday amid intensifying fears over the potential degree of damage the spread of COVID-19 will inflict on global economy and supply chains. Dow Jones and S&P 500 lost 12.4% WoW and 11.5% WoW respectively. Stocks pared back session losses after Federal Reserve Chairman Jerome Powell, in a brief statement on Friday afternoon, said the central bank was closely monitoring the coronavirus epidemic emanating from China and its potential to slow economic growth, sparking some optimism that the Fed will cut rates to help bolster the economy. Still, the major benchmarks remained under pressure on fallout concerns of the epidemic. Domestic also continued its weekly loss, JCI plunged by -7.3% WoW. All sectors were in the red but the most underperformed one was basic industry sector (-11.8% WoW). On the other hand, sector with least loss was trading sector(-3.8% WoW). News flows within this week: US GDP and US Initial Jobless Claim; Indonesia CPI.

- Rupiah depreciated by -4.0% WoW to IDR 14,318 in-line with EM average. DXY index also down by -1.1% WoW to 98.1.

- Foreign sell off due to fears of coronavirus pandemic made IDR bond market yield increased by 22-48 bps along the curve. 5 years series increased the most.

- Foreign investor decreased position by IDR19.36trn mostly on mid tenor series. BI still supported bond market, as they reported net buy of IDR7.7trn over the week and conduct reverse auction.

- 10 years yield decreased by 33 bps from 1.46% to 1.13%.Concerns about the global economic impact of the coronavirus have dented investor sentiment last week. The outbreak sent investors switch from equities to Treasury, which have traditionally been a safer alternative to stocks.

Global news

- China’s national bureau of statistic reported PMI fell to 35.7 in Feb’20. The number is lower than during financial crisis in 2008 of 38.8.

- US initial jobless claims rose by 8,000 to a one-month high of 219,000 last week. However, initial jobless claims still aren’t far off from a 50 year low.

- US economy expanded at 2.1% pace at the end of 2019. Consumer spending, the main engine of the economy was revised down to 1.7%. Trade deficit was also sharply lower with export rose a revised 2% (from 1.44%). The decline in imports was little changed at 8.7%.

Domestic News

- Government haS decided to implement white list scheme as a preventive method starting 18 Apr 2020 in order to control International Mobile Equipment Identity (IMEI) for blocking black market phones. Current active devices will remain connected to cellular mobile network and individual registration is not required.

- Government introduced USD750m stimulus package as a counter measure for Covid-19 outbreak. The stimulus is as followed: 1) subsidy increase for basic needs for 15m poor households to boost consumption, 2) subsidy to airlines and travel agents for 30% discounts on air fares for 3 months, 3) tax exemption for restaurants and hotels in touristic destinations, etc.

- Indonesia’s government is working on plans to make natural gas prices cheaper for its manufacturing industry, capping prices at around USD6 per million British thermal units (mmbtu). Government cited that the price to be set for conversion program (from fuel to gas) has yet to be finalized.

- Two Indonesians have tested positive for Covid-19, the first two confirmed cases of the disease in the country. The two people had been in contact with a Japanese citizen who tested positive in Malaysia after visiting Indonesia in early Feb’20.

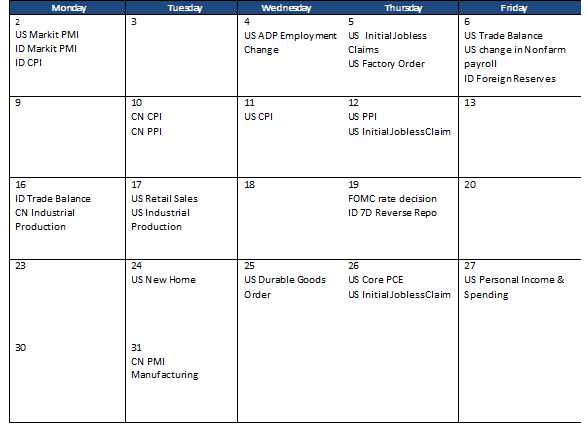

Calendar

March 2020

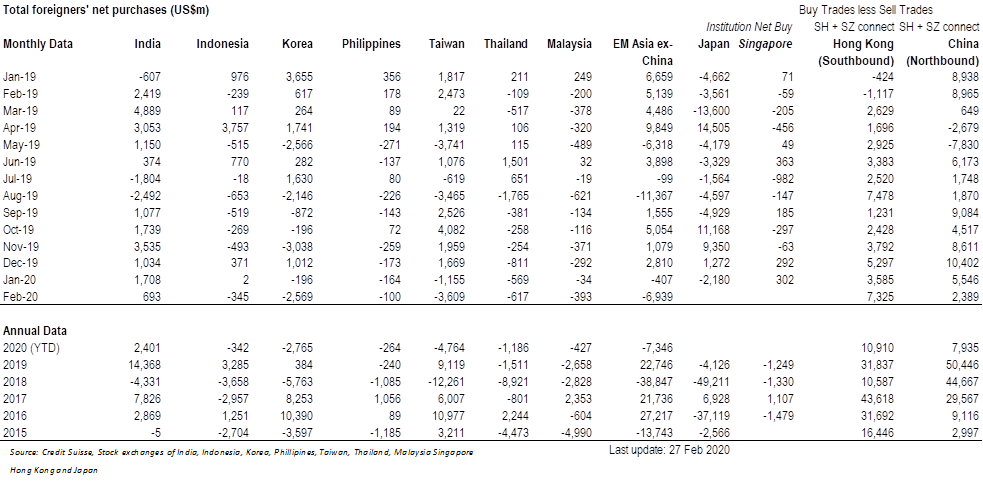

Foreign net purchases of Indonesia equities