09 March 2020

Weekly Market Review (09 March 2020) - What happened & What's next?

Market update

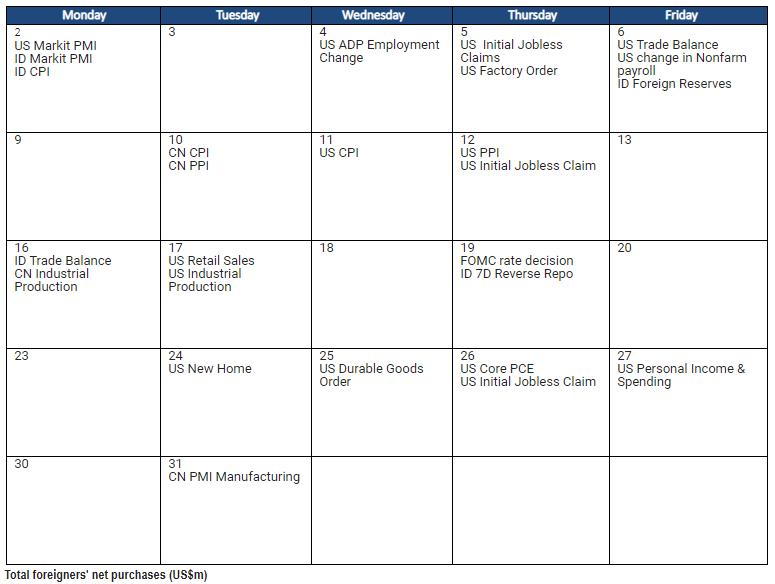

- Global indexes closed slightly higher after posting heavy losses the week before in a wild, volatile week in which VIX shot up to its highest levels since 2011, as global leaders trying to stimulate the economy amid rising COVID-19 cases globally (despite muted increase in China). Dow Jones and S&P 500 gained 1.8% WoW and 0.6% WoW, respectively, partly supported by the regaining momentum of Democrat candidate Joe Biden after Super Tuesday results. During the week, Fed also surprised the market with 50bps Fed rate cut during an unscheduled meeting, although it still failed to calm the market. On Friday, oil price tumbled -9% as Russia declined to cut production resulting in no agreement with OPEC. This is worsened as Saudi Arabia declared price war in order to force oil production cut on other countries. Domestic also rebounded slightly with JCI gaining +0.8% WoW. Infrastructure sector was the best performer +4.0% WoW led by strong rebound in TLKM. On the other hand, Property and Financial underperformed others as both suffered -1.2% WoW. News flows within this week: China CPI, PPI; US CPI, PPI, initial jobless claims.

- Rupiah appreciated by +0.5% WoW to IDR 14,243 in-line with EM average. DXY index also down by -2.2% WoW to 96.0.

- Relaxation on FX reserve requirement FX and rupiah create additional liquidity for USD and IDR. This made IDR bond market yield decreased by 20-25 bps along the curve. 20 years series decreased the most.

- Foreign investor decreased position by IDR16.7tn mostly on benchmark series. BI still support bond market by triple intervention to guard the market.

- Concern on the global economic impact and oil price war made 10 years UST yield continue to decreased by 39bps from 1.13% to 0.74%.

Global news

- Saudi Arabia declared all out price war as Russia refused to participate with an associated cut. Saudi decided over the weekend: 1) setting record discounts on crude sales in April; and 2) deciding to raise output from 9.7 MMBbld to well over >10 MMBbld, with threats to potentially increase towards capacity of 12 MMBbld.

- The Federal Reserve cut rates in surprise by half a percentage point to combat coronavirus slowdown. The move was the first such cut since December 2008, during the financial crisis. The Fed’s benchmark funds rate will now be targeted in a range between 1%-1.25%.

- US market manufacturing PMI came in at 50.7 vs consensus expectation of 50.8.

- US ADP employment change reported 183,000 additions vs consensus expectations of 170,000.

- US trade balance recorded -USD45.3bn vs consensus expectation of –USD46.1bn.

- US non-farm payroll came in at 273,000 vs consensus expectation of 175,000.

- US recorded unemployment rate of 3.5% vs consensus expectation of 3.6%.

- China forex reserve stood at USD3.1tn in Feb 2020.

Domestic News

- Central Bank (BI) forecast economic growth will slow to 3-year low of 4.9% in 1Q20, from 4.97% in the 4Q19. In addition, gov’t prepares a second fiscal stimulus package to support the economy.

- Central Bank (BI) revised down banks loan growth target to 9-11% in 2020 (from 10-12%). This is in line with the lower economic growth target of 5-5.4% from previously 5.1-5.5%.

- BI recorded foreign reserves of US$130.4bn as of February 2020, down by US$1.3bn from US$131.7bn in January 2020. The decline is due to debt payment.

- Government is considering more tax incentives this year. The government is currently considering extending the fiscal stimulus to mitigate the downside risk of the coronavirus outbreak via a reduction in corporate income tax (PPh 25), import tax (PPh 22), and acceleration in VAT restitution.

- The Ministry of Social Affairs stated the government will improve quality spending in the Family Hope Program (PKH) and by increasing non-cash assistance to reduce poverty rate. Furthermore, the government will also provide higher non-cash food assistance to the beneficiaries of IDR150,000 per month for each beneficiary, up from IDR110,000 in 2019.

- BI decided to cut conventional banks’ primary reserve requirement (GWM) by 50bps to 5% (effective 1April and will be implemented for 9 months). This new regulation will be implemented for banks with clients engaged in export and import activities.

- Foreign exchange reserve requirement also cut from 8% to 4% (effective 16March). Lowering this forex reserve requirement will boost banks’ liquidity by US$3.2bn.

Calendar

March 2020

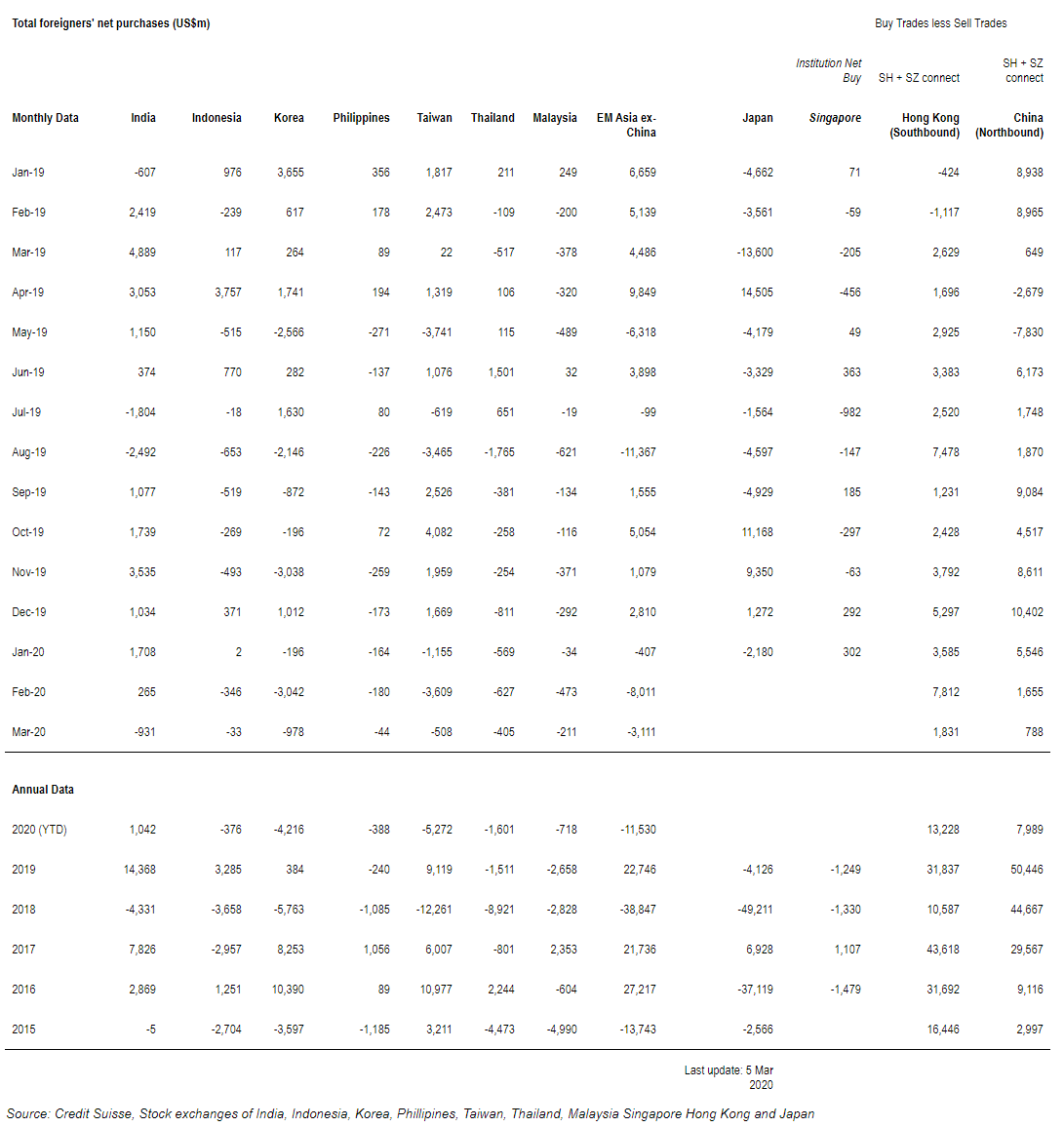

Foreign net purchases of Indonesia equities