23 March 2020

Weekly Market Review (23 March 2020) - What happened & What's next?

Market update

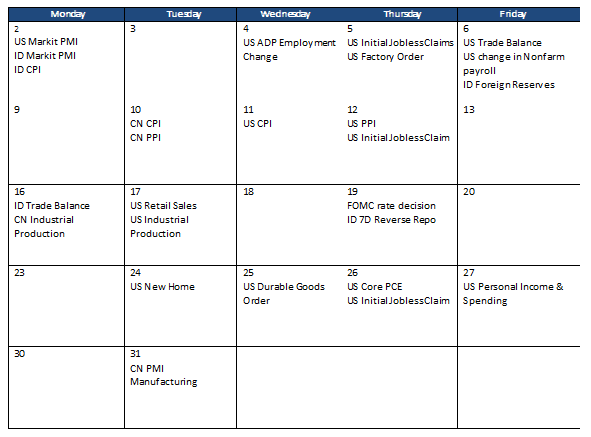

- Global indexes finished another bruising week with sharp losses as panic over the coronavirus outbreak persists amid the acceleration of global death toll. Investors have not yet been comforted by the government’s response to limit the economic impact of the pandemic whose severity and duration is still unclear. Globally, more than 338k cases have been confirmed with total death of approximately 14k. Even though new cases in China has been stabilizing at low level, new infection rate outside China (especially in Italy and US) continues to spike. Domestic also booked significant loss, JCI plunged by -14.5% WoW. All sectors were in the negative territory with Miscellaneous Industry and Financial as the most underperformed ones (-19.4% WoW and -18.6% WoW respectively). Trading sector booked the least loss, down by -6.2% WoW. News flows within this week: US durable goods order, US core PCE, US initial jobless claim, US personal income and spending.

- Rupiah depreciated by -8.0%WoW to IDR15,960, one of the most underperformed currencies in EM. On the contrary, DXY index strengthened by 4.0%WoW to 102.8

- Growing concern on the impact of coronavirus outbreak to global economy caused market yield to increase by 54-75 bps across the curve. 10 years series experienced the highest increase.

- Foreign investor decreased position by IDR 30tn, mostly on 10-15 years maturity bucket.

- ECB and the Fed announced further monetary stimulus to counter the outbreak. The Fed cut its benchmark interest rate by 100 bps to 0-0.25%. In addition, the also implemented a bond buying program (QE) of at least USD 700bn. Following this, ECB announced a new Pandemic Emergency Purchase Program amounting to EUR 750bn.

Global news

- US retail sales drop by -0.5% MoM in Feb-20 following a gain of +0.6% MoM in the previous month. The number is below consensus’ expectation of +0.1% MoM, indicating sign of early damage from the outbreak.

- The number of job openings in US surged by 400k to 7mn in Jan-20, before the coronavirus storm. Job openings rose mostly in finance, insurance and construction sectors.

- US jobless claims surged by 70k to 281k last week as coronavirus triggers layoffs. This is one of the highest weekly jobless claims, thus bringing total jobless claims to the highest level since Sep-17.

- The Philadelphia Fed manufacturing index in Mar-20 plunged to -12.7 after registering 36.7 in the previous month. This is the lowest reading since Jun-12.

- Amid a widespread shutdown of manufacturing operation, China’s industrial production decl

Domestic News

- Bank Indonesia cut its 7 days-RRR rate by 25 bps to 4.5% during the last governor board meeting. Besides that, central bank also lowered 2020 GDP growth estimate to 4.2-4.6% from previously 5.0-5.4%.

- Trade balance recorded a significant surplus of USD 2.3bn, the highest level since Oct-11. The number is above expectation since consensus estimated a deficit.

- Government has introduced the second economic stimulus which amount reached IDR 23tn. The stimulus provides 6 months tax waiver for sectors that are significantly impacted by the coronavirus outbreak. Currently, government is under discussion with Parliament to increase budget deficit ceiling to > 3% of GDP temporarily.

Calendar

March 2020

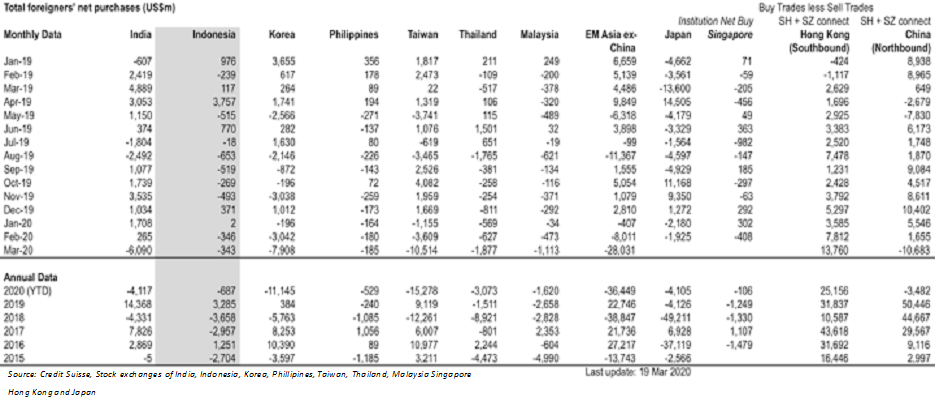

Foreign net purchases of Indonesia equities