20 April 2020

Weekly Market Review (20 April 2020) - What happened & What's next?

Market update

- Global indexes rallied last week as positive momentum continues with the continuing evidence that new coronavirus cases have peaked. S&P500 and MSCI Asia-exJ recorded +3.0% WoW and +2.8% WoW, respectively. Investor confidence improved as number of countries are embarking on “exit strategies” to gradually open their economies including the US (where the White House unveiled a phased approach to reopen the economy), or have announced plans to partially reopen their economies including Austria, Germany, Italy and Spain. While this is incrementally positive, there remains a risk of a second wave of infections if countries start to open too early without mass-scale testing measures in place. In addition, there were reports highlighting that covid-19 patients are responding to Gilead’s Remdesivir treatment, though it is still too soon to draw any conclusions. On domestic side, JCI weakened -0.3% WoW, underperformed the peers as number of case reached more than 6k cases. Foreign remained net seller USD36m last week. Infrastructure was the most outperformed sectors, up by +4.6% WoW. On the other hand, Miscellaneous sector underperformed the rest with -4.3% WoW as disappointing car sales figures were released. News flows within this week: US Markit PMI and initial jobless claims.

- Rupiah strengthened by +2.6% WoW to IDR15,465, outperforming other currencies in EM. On the other hand, DXY index strengthened by +0.3% WoW to 99.8.

- After BI lowered primary reserve requirement to 3% that result additional liquidity of IDR102trn, Indonesia bond market yield decreased by 4-28 bps. 5 years yield decreased the most.

- Foreign investor increased by IDR3.56trn over the week.

- The S&P Global Ratings agency revised Indonesia’s outlook on its long-term ratings to negative from stable and reaffirmed the sovereign rating at 'BBB' to reflect Indonesia's weakening external position, following considerable depreciation of the rupiah.

Global news

- US initial jobless claims added another 5.2m for the last week (consensus estimates 5.5mn) vs. 6.6mn in the previous week.

- US retail sales declined -8.7% MoM in March (consensus estimates -8.0% MoM) vs -0.5% MoM in Feb.

- US industrial production declined -5.4% MoM in March (consensus estimates of -4.0% MoM) vs. +0.6% MoM in Feb.

- China trade balance recorded +19.9bn in March, in-line with consensus expectation.

- China 1Q20 GDP recorded -6.8% YoY (consensus estimates of -6.0% YoY), the first decline in 28 years.

- China industrial production recorded -1.1% YoY in March (consensus estimates of -6.2% YoY).

Domestic News

- Standard & Poor’s (S&P) maintain Indonesia sovereign credit rating at BBB but revised down the outlook to negative (from stable). The revision to negative outlook represent S&P expectation that Indonesia will face higher external and fiscal risk due to the increase of gov’t debt (including foreign debt).

- Bank Indonesia requires banks to purchase government bonds after lowering RR ratio, which provides additional IDR102trn (USD6.5bn) worth of liquidity, in effort to reduce pressures to the bonds issuance. For context, BI recently kept the 7-day reverse repo rate unchanged but cut RR ratio by 200bps for conventional banks and 50bps for Sharia Banks, effective from 1 May 2020.

- Ministry of Finance (MoF) estimates that Indo economy will grow by about 4.5-4.6% YoY in 1Q20 but it will not reflect the growth in the coming quarters as Indo just reported their first Covid-19 case in early March.

- Gov’t to add 11 new sectors eligible to corporate tax incentives. They will receive tax free for PPh 22 (import) and relaxation for PPh 21 (personal income tax), PPh 25 at 30% off (corporate income tax) and faster VAT restitution.

- Indonesia Statistics Agency (BPS) announced trade surplus of USD743m in March with export fell 0.2% YoY while at the same time import declined -0.75% YoY.

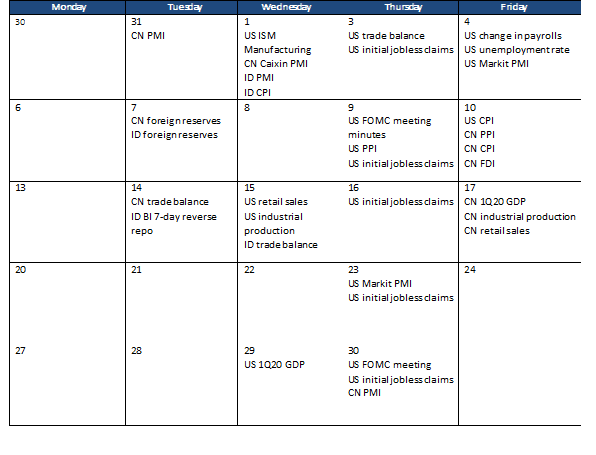

Calendar

April 2020

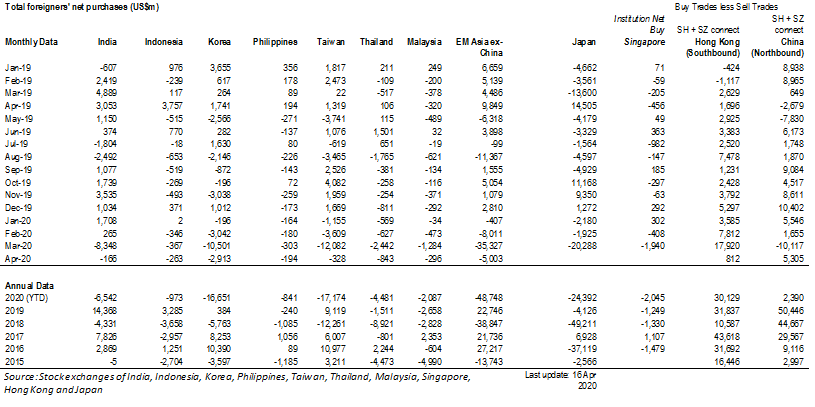

Foreign net purchases of Indonesia equities