27 April 2020

Weekly Market Review (27 April 2020) - What happened & What's next?

Market update

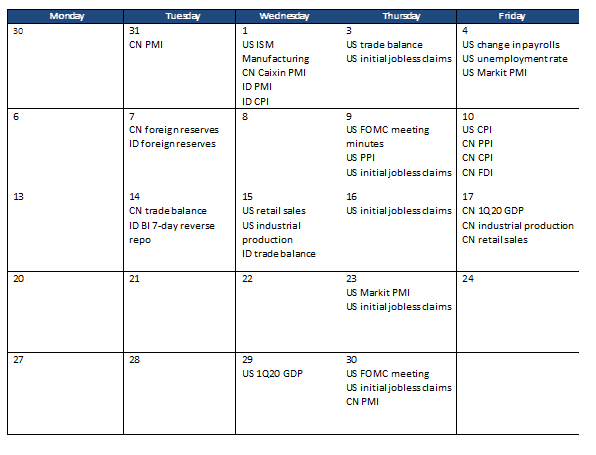

- Global indexes in negative territory through the week due to weak economic data result (Global flash PMIs, German IFO & ZEW, US jobless claims, etc) and high volatility in oil price. WTI oil price has collapsed with the futures contract May expiry falling below USD 0, although it rebound in the next day. However, oil oversupply risk still persists. Asian stocks were in red concerning economic downturn of the coronavirus shutdowns mounts even as some countries managed to slow the spread of the pandemic while progress of trials for potential covid-19 drug disappoints. On domestic side, JCI weakened -0.3% WoW as the continued foreign selling activities. Basic Industry was the most outperformed sectors, up by +6.1% WoW, as Petrochemical and Cement posted big gain. On the other hand, Property sector underperformed the rest with -10.6% WoW as correction on the back of profit-taking activities, while concern over the slow-down in construction activity. News flows within this week: US 1Q GDP, US FOMC meeting, US initial jobless claim, China PMI

- Rupiah strengthened by 0.4% WoW to IDR15,400, outperforming other currencies in EM. Meanwhile, DXY index also strengthened by +0.6% WoW to 100.4

- Better risk sentiment on Emerging Market made Indonesia bond market yield decreased by 4-28 bps. 20-years yield decreased the most.

- Foreign investor decreased by IDR 0.3 trn over the week.

- Concern on oil price and weekly jobless claim reached 4.4 million made 10 year US treasury yield decreased by 5 bps from 0.65% to 0.60%.

Global news

- US initial jobless claims added another 4.4 million (slightly lower than consensus 4.5 million), take pandemic toll to a record of 26 million over five weeks. The initial jobless claims total of 4.4m in the week ended April 18 was a decrease of 810,000 from the previous week.

- The potential of global oil market oversupply has triggered a hiccup on the future market and brought the WTI oil price even to the negative territory of –USD 38/barrel on 20-Apr-20, despite it bounced back to USD 10 on the next day. Furthermore, Brent oil price has also weakened to USD 20/ barrel in 22-Apr from USD 64 in YE 2019

- The new USD484bn US government pandemic relief package was passed by the House, Thursday April 23. This package to bolster small business and hospital ravaged

- The Federal Reserve's balance sheet increased to a record USD6.62trn this week to keep markets functioning amid an abrupt economic free fall due to the coronavirus pandemic. That is up from just USD4.29 trn in the first week of March.

- US Markit Manufacturing PMI slumps to 36.9, drops to 11-year low as business shuts down to combat the coronavirus epidemic

Domestic News

- President Jokowi has decided to ban all domestic passenger travel and prevent Ramadhan/ Lebaran exodus (mudik) from April 24,2020 to June 2020 to limit the spread of Covid-19 in Indonesia. The ban does not apply for cargo transportation or vehicle serving special purpose (such as ambulances and fire trucks)

- Jakarta Governor Anies Baswedan on Wednesday stated that the large-scale social restrictions (PSBB) will be extended until May 22 (initially to end in Thursday, April 23) as the COVID-19 outbreak has yet to subside.

- ADB agreed to provide a USD1.5bn (~IDR22.5trn at IDR15,500/USD) loan to Indonesia to help the government combating covid-19 and to improve healthcare and social-economic conditions in the country.

- The government realized Q1 2020 budget deficit of IDR76.4trn (0.45% of GDP), with the detail revenues of IDR376trn and government expenditure of IDR452.4trn. The budget deficit is lower than Q1 2019’s IDR102trn, due to higher revenues realization in Q1 2020 of 7.8%yoy.

- Indonesia Investment realization rose 10.2% yoy in Q1 2020 to USD14.3bn, led by domestic direct investment (+28.5% yoy) as foreign direct investment took a backseat (-5.4% yoy)

- The government and the House of Representatives have decided to delay deliberations over labor issues within the omnibus bill on job creation as they want to hear further feedbacks from the stakeholder, while at the same time avoid rallies by the labor union nearing the 1st of May – Labor Day (and the spread of Covid-19)

Calendar

April 2020

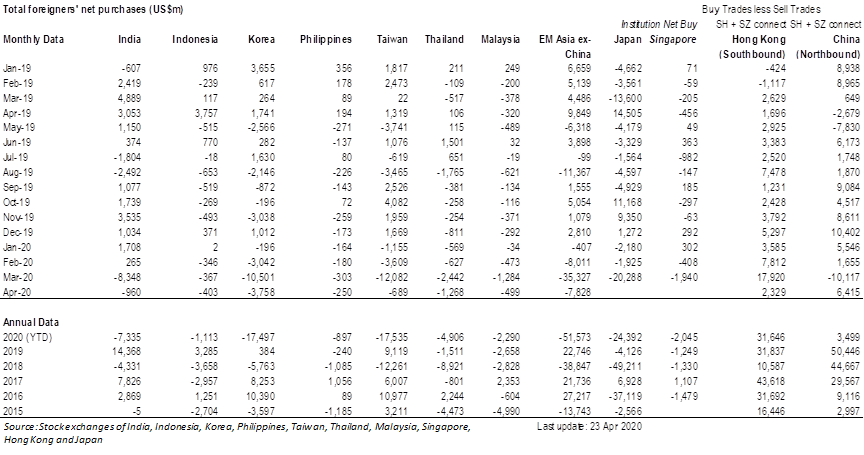

Foreign net purchases of Indonesia equities