04 May 2020

Weekly Market Review (04 May 2020) - What happened & What's next?

Market update

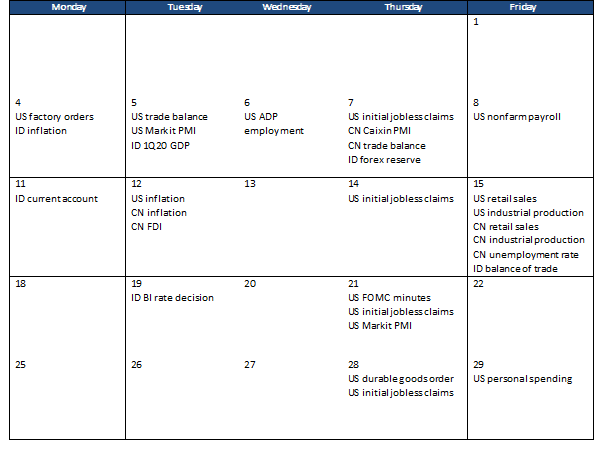

- Global indexes ended the week with a gain as Covid-19 news development and policy easing boosted investors’ confidence. Stock rose on Wednesday after Gilead showed that its drug remdesivir reduced the time it takes for patients to recover by 31%. In addition, the Fed held the rates at the effective lower bound, however maintained its flexible stance on treasury and MBS purchases; while it also expanded its various credit facilities. The BoJ has also expanded its monetary stimulus and pledged to buy an unlimited amount of bonds to keep borrowing costs low. Yet, gain was lessened on Thursday after a round of mixed corporate earnings and a report that US federal government was considering retailing against China for its handling of the coronavirus. Similarly, JCI index was also in the green territory, increased by +4.9% WoW. Infrastructure and basic industry sector were the best performers, up by +9.3 and +8.9% WoW respectively. On the other hand, property sector was the only one that booked loss (-0.7% WoW). News flows within this week: US trade balance, US Markit PMI, US ADP employment, US initial jobless claims, US nonfarm payroll, CN Caixin PMI, CN trade balance, ID forex reserve.

- Rupiah strengthened by 3.4% WoW to IDR14,882, the best performing currency in in EM. Meanwhile, DXY index weakened by -1.4% WoW to 99.

- Concern on additional supply issuance made Indonesia bond market yield increased by 2-5bps. 10 years yield increased the most.

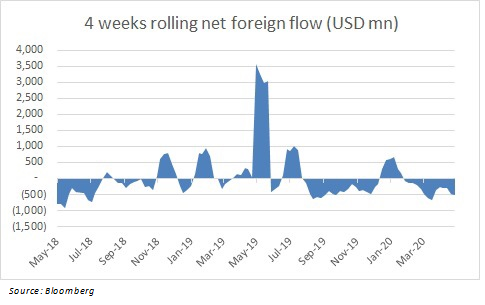

- Foreign investor ownership decreased by IDR 1.4tn over the week.

- US central bank left the interest rates unchanged at near zero. They stated that the ongoing pandemic will weigh heavily on the near term outlook and poses considerable risk for medium term. 10 year US treasury yield increased from 0.61 to 0.64%.

Global news

- US initial jobless claim climbed by 3.8mn by the end of last week. The weekly pace of layoffs has slowed since peaking at 6.9mn at the end of Mar-20.

- US GDP sinks -4.8% in 1Q20, marking the largest drop since 2008. The decline was bigger than consensus expectation of -3.5%.

- US personal income fell sharply -2% in Mar-20 while disposable income also declined by 2%. Consumer spending slumped 7.5% as households stayed at home.

- Eurozone reported a decline of -3.8% in its 1Q20 GDP as compared to 4Q19. Hence, on an annualized basis the economy fell -14.4%. In addition, France and Spain GDP plunged by -5.8% and -5.2% respectively, bigger than analyst’s expectation at -4.0%.

- China’s caixin PMI fell to 49.4 in Apr-20 (vs consensus’ expectation at 50.3) from 50.1 in the previous month. Factory activity unexpectedly shrank in April as coronavirus pandemic shattered global demand and causing a substantial drop in export orders and more layoffs.

Domestic News

- The government will offer IDR856.8tn (USD57.11bn) worth of government bonds from the second quarter through to the end of year to finance a widening budget deficit and to combat the pandemic.

- The Ministry of Finance has expanded tax incentives to 18 sectors. In details, MoF has budgeted tax incentives of IDR64.1tn to mitigate the impact of Covid-19. The 18 sectors will receive tax incentives in the form of Income Tax (PPH) Article 21 borne by the government (DTP), Income Tax Article 22 released for six months, PPh discount of as much as 30% and Additional Tax Refunds as Accelerated Value (VAT)

- Indonesia’s CPI grew by 2.67% YoY in Apr-20, lower than consensus number at 2.77%.