26 May 2020

Weekly Market Review (26 May 2020) - What happened and What's Next?

Market update

- Global indexes ended the week with gains as the market largely shrugged off rising US-China tension and remained optimistic on coronavirus and businesses reopening. US equities are increasingly pricing in a reopening of the economy. Trump stated that the country would not shut down again if there is second wave of coronavirus. In addition, promising early result from Moderna vaccine has also sparked investors’ optimism. On a separate note, the US congress was moving forward with a bill that could prevent Chinese companies from listing on US exchanges. The bill would require Chinese companies to establish they are not owned or controlled by a foreign government and to submit to audits by US Public Company Accounting Oversight Board, which Chinese firms have thus far refused to do. Similarly, domestic was also in positive territory ahead of long weekends with JCI index up by +0.9% WoW. The most outperformed sectors are miscellaneous industry and finance (increased by +5.3% and +3.5% WoW respectively). Whereas the most underperformed sector was consumer, down by -3.6% WoW. News flows within this week: US initial jobless claims, US durable goods order and US personal spending.

- Rupiah strengthened by 1.0%WoW to IDR14,710, in-line with other EM currencies.. On the contrary, DXY index weakened by -1.3% WoW to 99.1.

- Indonesia bond market advanced for the week despite of widening budget deficit from previously 5.07% to 6.27%. The government bond yield declined by 22bps along the curve with 7-Yr and 10-Yr experienced the most decline of 40bps and 28bps respectively. Rally in Indonesia bond market was also backed by thin supply in the market as next auction will be on 2nd June 2020.

- Foreign ownership posted a slight increase of 0.62tn over the week, showing limited market volume ahead of Hari Raya holiday despite of rally.

- Mixed catalyst from optimism on coronavirus news development and raising tension in US-China relationship has pushed the 10-Yr US Treasury higher to 0.66% or slightly increased by 2bps over the week.

Global news

- FOMC meeting minutes on Apr-20 that was recently released said that the Fed expects maintain the rate in the range of 0% - 0.25% until it is confident the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.

- US new jobless claims reached 3.3mn (seasonally adjusted) last week, beating consensus’ expectation of 2.35mn. However, weekly claims has decreased for the seventh straight week since its peak of 6.9mn in late Mar-20.

- According to latest US PMI data from IHS Markit, US private sector firms reported a slightly slower rate of contraction in activity in May-20. PMI manufacturing rose from 39.8 in May-20 from 36.1 in the previous month.

Domestic News

- Bank Indonesia (BI) decided to keep the 7 days reverse repo rate unchanged at 4.5%. In addition, BI is still confident inflation this year will be within the target of 2.0%-4.0% as inflation during lebaran festive season will be tame and manageable.

- Indonesia CAD improves to USD 3.9bn (1.4% of GDP) in 1Q20 from a deficit of USD 8.1bn (2.6% of GDP) in 4Q19. This is due mostly to improvement in the goods trade balance. Meanwhile, surplus in financial account reversed to -USD 2.9bn from +USD 12.6bn in the previous quarter mainly due to outflow in portfolio investment. On a positive note, FDI recorded a surplus of USD 3.5bn. Overall, BOP still recorded an outflow of USD 8.5bn in 1Q20.

- The MoF revealed that budget deficit could widen further to -6.27% of GDP this year (vs revised plan at -5.07% of GDP). The wider deficit is to accommodate the larger revenue shotfall and additional compensation for certain SOEs and stimulus.

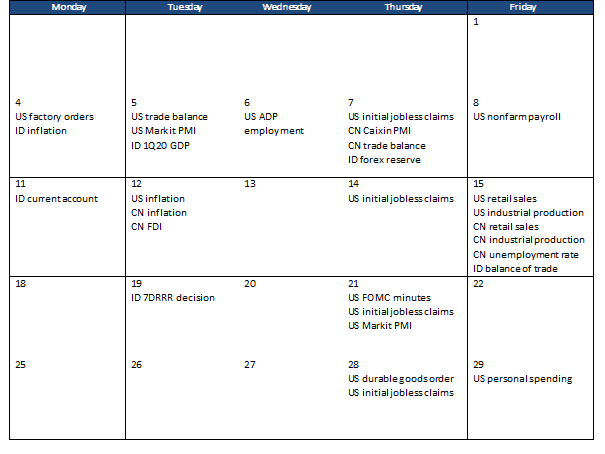

Calender

May 2020

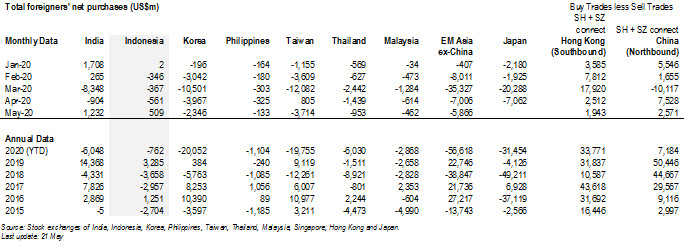

Foreign net purchases of Indonesia equities