08 June 2020

Weekly Market Review (8 June 2020) - What happened and What's Next?

Market update

- Global indexes rally across the board again, with SPX +4.9%WoW, DJI +6.8%WoW, and MXASJ +7.4%WoW. The market rally is now broadening to include some of the laggards, such as financials and deep cyclicals that are more geared to the economic recovery. Further, US Jobs Report that managed to smashed expectation with rising payrolls as oppose to declining payrolls, which consensus expected. The quick rebound in May is signaling that the economy is recovering faster than anticipated from COVID-19 slowdown – prompting another optimistic rally in equities. Buoyed by USD233m foreign inflow, JCI continued in the green zone as it closed up to IDR4,948 level (+4.1%WoW), underperforming MSCI Asia ex-Japan (+7.4%WoW). All domestic sectors recorded positive performances, where the most outperformed sector was financial sector (+7.2%WoW). The least performed sector was consumer sector (+0.6%WoW). News flows within this week: US CPI, PPI, Initial jobless claims, FOMC rate decision, China Trade Balance, Foreign reserves, CPI, PPI.

- Rupiah strengthened by 5.0% WoW to IDR13,878, became the strongest currency in the region. On the contrary, DXY index weakened by -1.4% WoW to 96.9.

- Indonesian Bond market pressured eased in early this month with 10-Y government bond extend its downside trend to 6.96%, the lowest since market sell off in April. Over the week, yield declined 9bps across tenor with the most declined in 10-Y (-19bps WoW). Despite the declining yield, concern on supply risk still remains as Indonesia budget deficit swell to 6.34% from previously 6.27%.

- Foreign ownership increased by IDR7trn to IDR938.85trn over the week.

- Risk sentiment has largely remained intact as the better than expected US Labor data and reopening of several global economies has supported economic recovery hopes and helped investors look beyond US-China tensions. 10-UST rose to 0.91% from 0.65% over the week.

Global news

- US May-20 nonfarm payroll increase by 2.5million was unexpected jump vs consensus expectation of -7.5million (prior it was drop by 20.6million)

- US May unemployment rate declined to 13.3%, confounding forecaster. The unemployment rate consensus was at 19%, where previous figure at 14.7%

- US Apr trade deficit came in at -USD49.4bn vs consensus -USD49.2bn, prior -USD42.3bn. The value of US exports and imports fell to USD352bn, the lowest since May 2010. Imports from China rebounded in Apr’20 to USD 35.2bn from USD24.2bn in Mar’20. US deficit with China up from -USD9bn to -USD26bn in Apr’20

- OPEC+ meeting has agreed to extend the production cut for another month and adopted stricter approach to ensuring members do not pump more than they pledged.

- US initial jobless claims last week added 1,877k vs consensus 1,833k. This is lower than prior number of 2,126k

- US May Markit services PMI was 37.5 vs consensus 37.3, prior 36.9

- China May trade balance came in at USD +62.93bn vs consensus USD+41.40bn, prior USD +45.33bn with exports -3.3%YoY vs consensus -6.5%YoY, prior +3.5%YoY while imports -16.7%YoY vs cons -7.9%YoY, prior -14.2%YoY .

Domestic News

- The government has updated (again) the fiscal deficit outlook, in which it is now expected to widen further to -6.34% of GDP compared to the earlier outlook at -6.27% (on 18-May) and Perpres 54/2020 Budget (APBN 2020) of -5.07% of GDP (on 3-Apr). Overall, the Ministry of Finance plans to incorporate the new fiscal figures in the official budget revision that will be announced likely in the next 1-2 weeks.

- Pres Jokowi signs regulation on Tapera public housing saving program (PP25/2020). Membership is mandatory with a contribution at 3% of one's salary (2.5% employee, 0.5% from employer). The funds will be used to finance the social housing program for its members. Employees can only receive back their savings (with interest) at the age of 58.

- Jakarta Governor Anies Baswedan decided to extend the large-scale social restrictions (PSBB) implementation starting today (Jun 5th, 2020), citing June 2020 as the transition period, evaluated weekly basis. During the transition, various social and economic activities are allowed with strict health protocol. Shopping malls are slated to open on Jun 15th, 2020

- The Indonesian Statistics Agency (BPS) stated that inflation during the Lebaran season in May reached only 0.07%MoM, 2.19%YoY, due to prolonged weak demand coupled with price stabilization efforts done by the government .

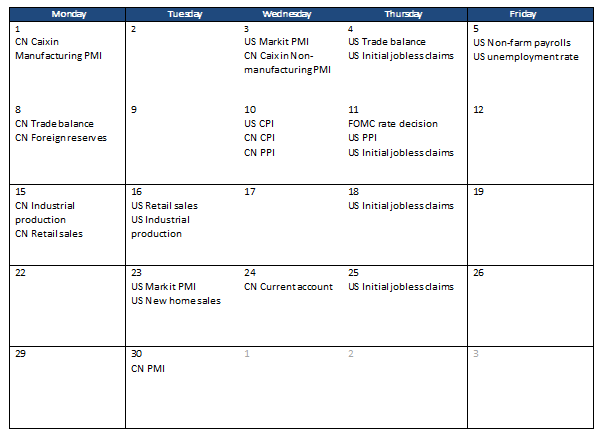

Calender

June 2020

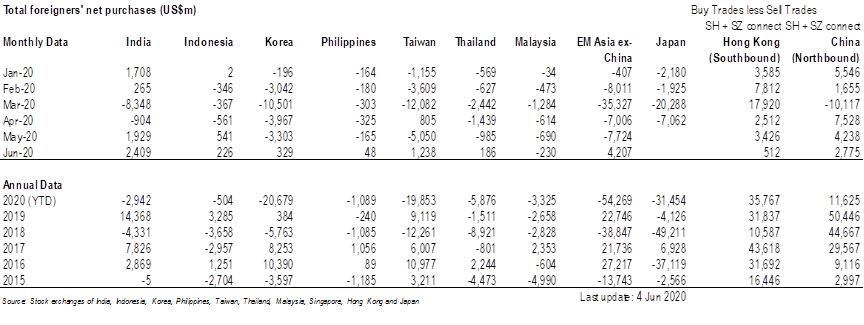

Foreign net purchases of Indonesia equities