15 June 2020

Weekly Market Review (15 June 2020) - What happened and What's Next?

Market update

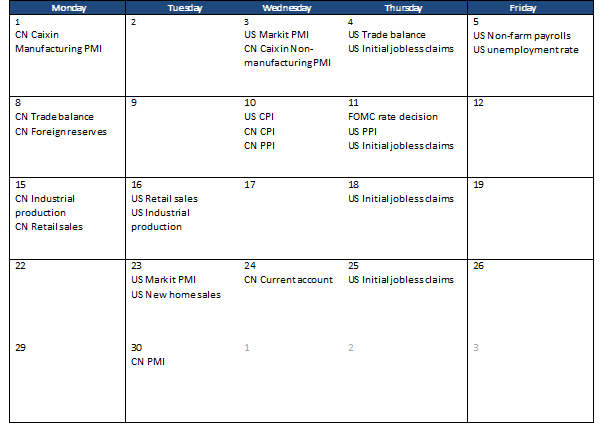

- Equites started the week on a strong footing following a strong payroll US data from the week before. However, gain was erased after the Fed meeting which indicated a grim outlook for economy recovery and increasing concern on potential second wave. As a result, global indexes ended lower with S&P and Dow Jones down by -4.8% and -5.6% WoW. On Wednesday afternoon, Jerome Powell stated that central bank forecasts a long recovery with unemployment likely to remain high for many years. The Fed then concluded its meeting by leaving the interest rate unchanged at near zero and indicating that they will stay there until 2022. Similarly, domestic also booked losses of -1.4% WoW last week. The main underperformers are infrastructure and basic industry sector, down -4.0% and -3.9% WoW respectively. While the most outperformed sector is agriculture, up by +0.8% WoW. News flows within this week: US retail sales, US industrial production, US initial jobless claim, China retails sales and China industrial production

- Rupiah weakened by -1.8% WoW to IDR 14,133, in line with emerging markets’ average. On the contrary, DXY strengthened +0.4% WoW to 97.3.

- Indonesian bond market was dominated by short term profit takers last week, following global risk off as rising number of Covid-19 infection sent EM asset classes down. Indonesian government bonds along the curve went up by 2bps with 5 year tenor went up the most by 9bps. Over the week, local banks and banking book kept buying in dips as foreign names were actively selling ahead of Tuesday auction to bet for higher yield.

- Foreign ownership declined by IDR 4.7tn to IDR 936.71tn last week.

- Dovish remark from the Fed and rising fears of second wave of Covid-19 drove investors to safe haven assets. The yield of 10 US treasury plunged by 20bps to 0.71%.

Global news

- US Labor Department report shows nearly 10 million people lost their jobs in Apr-20 after a record of 14.6 million were thrown out of work in Mar-20. Job openings also fell to 5 million in April from 6 million in the prior month.

- US consumer price fell for a third straight month in May-20 as demand remained subdued amid a recession caused by Covid-19 pandemic. CPI dipped 0.1% last month (vs consensus estimates at 0%) after plunging 0.8% in the prior month.

- US initial jobless claims slowed to 1.54mn last week from a revised 1.9 million in the previous month. The jobless claim number is slightly lower than consensus’ expectation of 1.6mn.

- China’s trade surplus rose to USD 62.9bn in May-20 from USD 45.3bn in Apr-20, reaching the highest level since Jan-16. Exports fell -3.3% YoY, better than consensus’ expectation of -6.5% YoY. Import contraction is deepened from -14.2% in the previous month to -16.7% YoY in May-20.

- China’s May-20 CPI is lower at 2.4% compares to 3.3% in Apr-20. The increase in CPI is lower than consensus’ expectation at 2.6% and is the slowest in 14 months.

Domestic News

- As of early June, Ministry of Finance has disbursed social safety net budget of IDR 56.7tn or equal to 31.7% of total budget.

- Special staff of the Ministry of Finance projects economy will contract 3-4% in 2Q20 given the wide scale social distancing (PSBB) measures implemented in Mar to Apr-20. In addition, government still believes the country can deliver positive economic growth for this year.

- Forex reserves increased by USD 2.7bn to USD 130.5bn in May-20. The current reserves level is equivalent to 8 months of imports and government’s external debt servicing.

Calender

June 2020

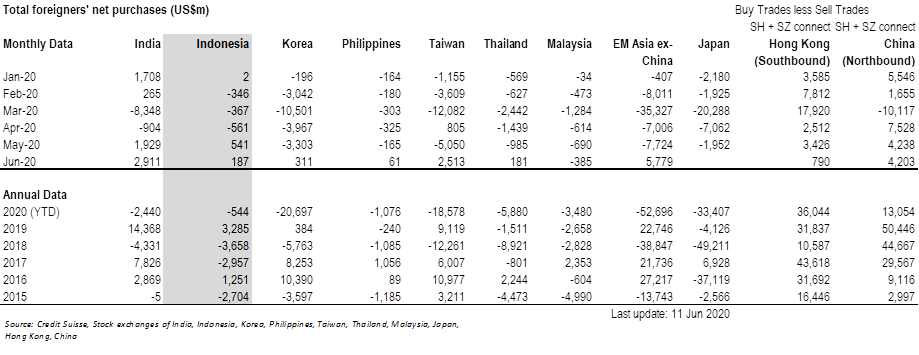

Foreign net purchases of Indonesia equities