22 June 2020

Weekly Market Review (22 June 2020) - What happened and What's Next?

Market update

- Equities posted gains with S&P 500 +1.9% and MSCI Asia ex Japan +1.7% WoW with defensive/growth sectors outperforming financials/cyclicals/value stocks. Stronger than expected economic data driven by re-opening momentum, and continued policy support from Central Banks and policy makers remain the dominant themes driving markets higher. Markets also got a boost from positive US-China Phase-1 trade deal headlines and talks of even more US stimulus potentially including infrastructure. In addition, Fed's announcement of purchasing a broad basket of corporate bonds from the secondary market through its emergency lending program added more optimism to the market. Other central banks such as BOE also announced an extra GBP100bn of QE, while the ECB published the allotments for its fourth TLTRO-III operation which showed that the take-up was the largest in the history of the ECB’s TLTROs, at EUR1.3trn. On the negative side, there are increasing signs of second waves of new infections as economies re-open, as is evident by new cases rising in a number of US states, Korea, China, Australia. On the domestic, JCI booked gain of +1.3% WoW despite USD46mn net outflow. The most outperformed sector goes to the Infrastructure sector +6.0% WoW, while the Mining sector underperformed the rest of the sectors with -0.3% WoW. News flows within this week: US Markit PMI, new home sales, initial jobless claims, and China current account.

- Rupiah strengthened by +0.2% WoW to 14,100, stronger than other emerging market currencies. On the contrary, DXY strengthened +0.3% WoW to 97.6.

- Indonesian government bonds along the curve declined by 8 bps over the week, with 1-5Y buckets decline the most by average 15bps following BI rate decision to trim its 7D-RRR by 25bps to 4.25%, which in line with market expectation. Demand for INDOGB still dominated by local player as liquidity in banking system has remained flushed. Last auction demand remained solid at IDR84.4tn with government issued only IDR20.5tn, which was lower from previous auction at IDR24.3tn, signaling that government still have high cash level.

- Indonesia received a strong demand for its newest dollar debt sale (sukuk based) on Tuesday. The government successfully issued USD2.5bn at three tranches 5Y,10Y and 30Y.

- Foreign ownership declined IDR1.25tn over the week to IDR933.97tn.

- Risk on coming from the Fed and Trump administrations as they prepared a USD 1tn infrastructure proposal for building roads and bridges while Fed planned to buy individual corporate bonds. The yield of 10-UST ended the week at 0.71%, unchanged compare to last week.

Global news

- US retail sales recorded strong +17.7% MoM in May, well above expectations vs. sharp declines of 14.7% and 8.2% in April and March.

- Industrial Production (IP) growth rose +1.4% MoM in May, consistent with the healthy rebound in corresponding aggregate hours worked.

- US initial jobless claims recorded 1.5mn last week (consensus’ expectation of 1.3mn), similar to the previous week.

- China industrial production rose to +4.4% YoY in May (consensus’ expectation of +5.0% YoY) vs. +3.9% YoY in April.

- China retail sales decline slowed to -13.5% in May (in-line with consensus) vs. -16.2% in April.

Domestic News

- Bank Indonesia (BI) cut BI-7 Day Reverse Repo Rate (BI-7DRRR) by 25bps to 4.25%, third time BI cut policy rate this year.

- Gov’t gives income tax (PPh) incentives for tax payers who help to fight Covid-19 pandemic as release in Presidential Decree (PP) No.29/2020. Additional reduction in net income 30% of the costs incurred for tax payers who produced medical equipment and disinfectant. Donations are a deduction from gross income. Donations in the form of money, goods, and services. Tariff for income tax final (PPh) article 21 of 0% for additional income for tax payers who are human resources in the health sector. Tariff for income tax final (PPh) article 21 of 0% for income tax payers from rental of land or buildings to handle Covid-19. Facility for listed company who do stock buyback based on OJK policy until 30 Sep2020.

- Gov’t increase allocation for Covid-19 stimulus to IDR695.2tn, with the main increase allocated for the injection to Perusahaan Pengelola Aset (PPA). Therefore, in total gov’t increased the stimulus by about Rp18tn from the previous allocation IDR677.2tn.

Domestic News

June 2020

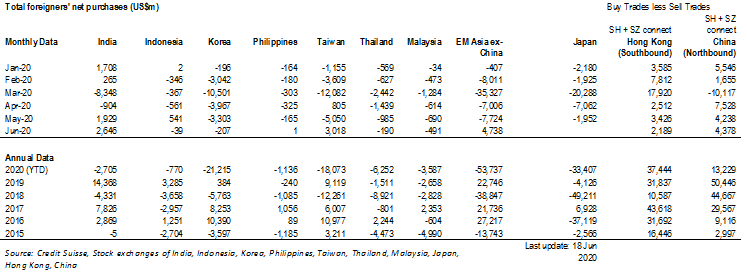

Foreign net purchases of Indonesia equities