29 June 2020

Weekly Market Review (29 June 2020) - What happened and What's Next?

Market update

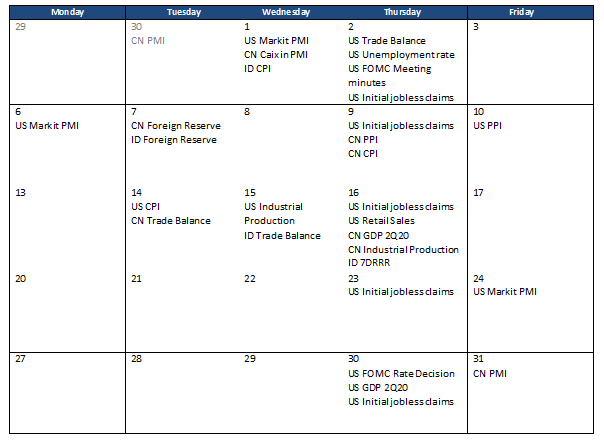

- Equity recorded mixed result during the past week, with SPX -2.9%WoW, DJI -3.3%WoW, while MSCI Asia ex Japan +0.3%WoW. Investors are facing a continuation risk-off sentiment as COVID-19 cases surpassed 10mn globally and resurgence cases in US, particularly in Arizona, South Carolina, Florida, and Texas. There are increasing signs that cities/states are re-imposing restrictions as new COVID-19 cases continue to surge sharply in the US. The Fed also presented its stress test suggested increasing concern over financial stability outlook and imposed stock buyback restrictions/dividend caps (that might be extended beyond Q3). On the domestic side, JCI down by -0.8% WoW to 4904. The most outperformed sector goes to the Financial sector +0.6% WoW. The positive sentiment came from some regulations issued by Ministry of Finance to place excess state cash to commercial banks and insure new SME loan (both with certain criteria). On the contrary, the Mining sector underperformed the rest of the sectors, same as prior week, with -2.7% WoW. News flows within this week: US Trade balance, Unemployment rate, FOMC Meeting minutes, Initial Jobless Claim, Markit PMI, China PMI, Indonesia CPI

- Rupiah depreciated by 0.9% WoW to 14,220, weakest among the region. Meanwhile, DXY also weakened by 0.2% WoW to 97.4.

- Indonesian government bonds along the curve declined by 5 bps over the week, with 1-5Y buckets decline the most by average 8bps. Inflows from offshore was driven by the announcement made by MOF that the government will place up to IDR30trn to the SOE banks for lending to support recovery in real sector and economy. Meanwhile, outflows were seen in 10Y with yield rose by 4bps WoW and closed at 7.19% on the last trading day.

- Foreign ownership in bond increased by IDR2.73trn over the week to IDR937.63trn.

- Recent news on IMF slashed global GDP to -4.9% and fresh outbreaks in Beijing, US and some parts of Europe and India, dented investors optimism on economic recovery, sending the UST 10y closing the week down to 0.64%. However, global sentiments on risk assets might improve after Federal Deposit Insurance Commission announced that they will loosen some parts of the Volker Rule, which allows banks invest in venture capital funds and to relax some limitation in derivatives trading, potentially freeing up more capital for the industry.

Global news

- IMF renewed its global economy projection into a deeper contraction of -4.9%YoY from its prior estimation in April -3%YoY. For 2021, IMF projected global growth of +5.4%YoY (vs prior est. +5.8%YoY) but if the case of second wave it would see only +0%YoY in 2021. This reflects a scarring from larger than anticipated supply shock and demand loss from social distancing.

- US June Markit manufacturing PMI recovered to 49.6 from 39.8 in May-20. This figure slightly below the consensus of 50. While US June Markit services PMI was 46.7, recovered from 37.5 and slightly below the expectation of 37.5

- US May new home sales in May rebounded strongly, up by 16.6%MoM, jumped from prior result of +0.6%MoM. The figure was higher than expected of +2.7%MoM

- US June-20 initial jobless claims added 1,480k vs consensus 1,320k, prior 1,540k. It is indicating labor market improvement shows further signs of slowing. Almost 20m Americans remain on stage jobless benefits

- China ran a current-account deficit of USD33.7bn in the first quarter, compared with a surplus of USD40.5bn in the fourth quarter.

Domestic News

- IMF cuts Indonesia’s economic growth projection from +0.5% to -0.3% in 2020, following its revision to global economic growth. In 2021, IMF projected that Indonesia could rebound to 6.1% in 2021. However, IMF projected Indonesia’s growth still the best among ASEAN-5

- President Joko Widodo has signed Presidential Regulation (Perpres) 72/2020 on 24 June, which is a revision of Perpres 54/2020 and contains changes in posture and details of the 2020 State Budget. The government expects budget deficit to reach 6.34% of GDP (IDR1,039.2trn) this year to cover the IDR695.2trn fiscal stimulus package due to COVID-19 pandemic.

- Ministry of Finance issued PMK 70/2020 regulating 2020 which allows the government to place the state’s excess funds in commercial banks to accelerate the national economic recovery program (PEN). Eligible banks as follow: a minimal healthy of 3 (the lower, the better); Majority owned by Indonesians or Indonesian entities; Fund to support the acceleration of PEN

- End of last week, PMK 71/2020 has been issued discussing credit guarantee given to bank (with health index of 1 or 2) by two state insurance companies: Jamkrindo and Askrindo. Object of guarantee: micro and SME working capital loans (

- The government has issued President Regulation (PP) No. 30/2020 about corporate income tax cut from 25% to 22% in 2020 and 2021, and then to 20% in 2022. For the listed companies has at least 40% of its shares traded in the capital market with certain criteria will also benefit additional 3% tax cut.

- Asian Infrastructure Investment Bank (AIIB), a China backed multilateral development bank, approved USD1bn loan for Indonesia to response Covid-19 pandemic. First trance USD750mn and co-financed with ADB will support Indonesia’s economic recovery program while the rest co-funded with World Bank to strengthen the public healthcare

Calender

July 2020

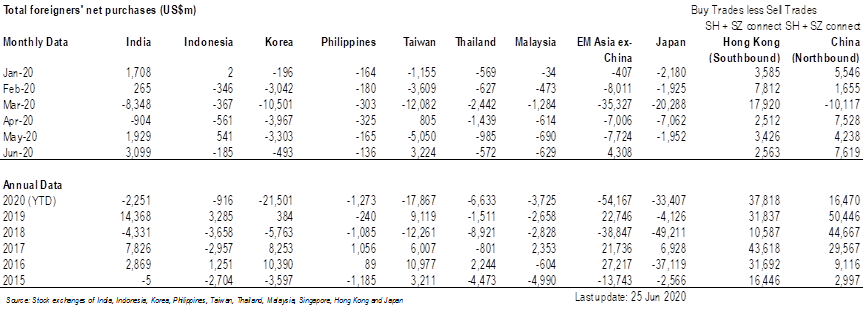

Foreign net purchases of Indonesia equities