02 April 2019

Weekly Market Review (01 April 2019) - What happened & What's next?

Market update

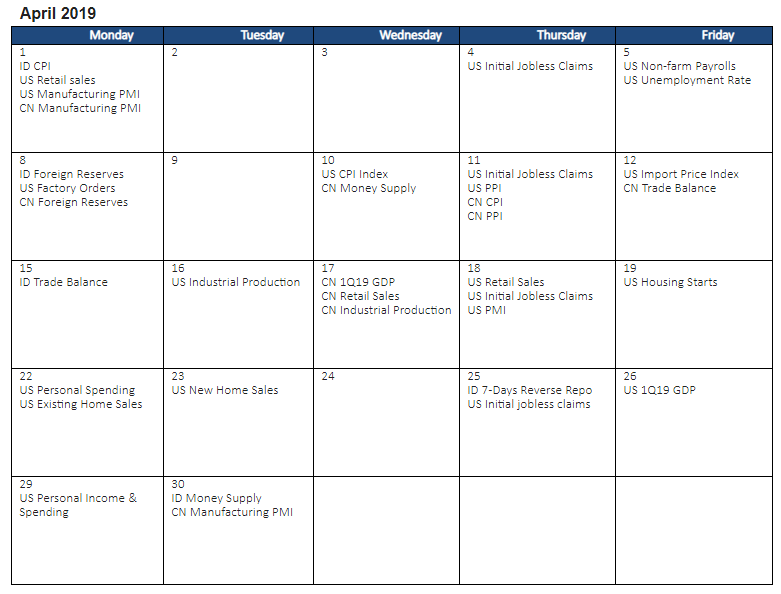

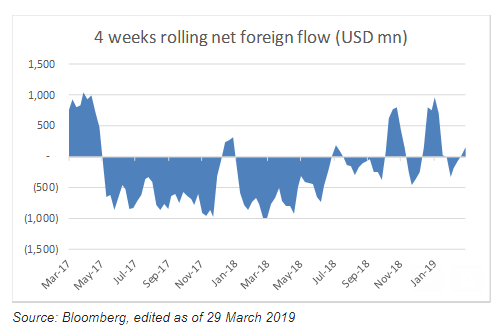

- Global index ended higher last week as signs of progress on US-China trade talks and better than expected earnings results outweighed fears over a slowing global economy. Dow Jones and S&P index each gained by +1.7% WoW and +1.2% WoW respectively. Treasury Secretary Steven Mnuchin said that discussions between US and Chinese officials had proven constructive with China’s Vice Premier Liu He is scheduled to make a visit to Washington this week. On the other hand, JCI Index booked a loss of -0.9% WoW despite net foreign inflow of USD 63.5mn. Most sectors moved into negative territory with basic industry as the main drag, down by -4.2% WoW. Whereas Financial (+0.5% WoW) and Infra (+0.4% WoW) were the only sectors that booked gains. Newsflows to be watched within this week include ID CPI, US retail sales, US manufacturing PMI, US initial jobless claims, US non-farm payrolls, US unemployment rate and CN manufacturing PMI.

- IDR weakened to IDR14,243 (-0.6%WoW), same as average emerging markets. On the other hand, DXY strengthened to 97.3 (+0.7% WoW).

- Negative sentiment came from concern on Turkish weaker currency ahead of local election. This made Indonesia bond market yield increased by 2-7 bps across the curve. 20 year series increased the most.

- Foreign investors increased position by IDR 4.9tn, mostly seen on 10 and 20 years series.

- Positive US-China trade talks progress made 10 year US Treasury yield decreased from 2.43% to 2.41%.

Global news

- US GDP grew a slower 2.2% in 4Q18, marked down from an initial 2.6% estimate. This was due to softer consumer spending as well as government spending.

- US trade deficit shrank 15% YoY to USD 51.1bn in Jan-19 due to cheaper oil price, surging soybean export and lower Chinese imports.

- US current account deficit increased to USD 134.4bn in 4Q18 from USD 126.6bn in the previous quarter. Hence, current account deficit was equal to 2.6% of GDP in 4Q18, the highest level since 2012.

- US jobless claims fall to 211,000, reaching lowest level of 2019.

- China’s official PMI rose to 50.5 in Mar-19 from 49.2 in the previous month. This suggests government stimulus measures may be starting to take hold.

Domestic News

- Government accelerates B30 policy due to anticipate CPO export decline to EU. Previously, government set 2020 for B30 policy but they have moved the timeline to end 2019 for testing phase.

- Ministry of Finance raised IDR 24.95tn with total bids reaching IDR 59.5tn from government debt securities auctions. The coupon rate for the securities auctioned ranging from 5.79%-8.42%.

- The Ministry of Finance will extend the imposition of anti-dumping import duties (BMAD) on iron and steel products (H and I beam profiles) from China. The 11.93% rate imposed will be applied for the next five years.