27 July 2020

Weekly Market Review (27 July 2020) - What happened and What's Next?

Market update

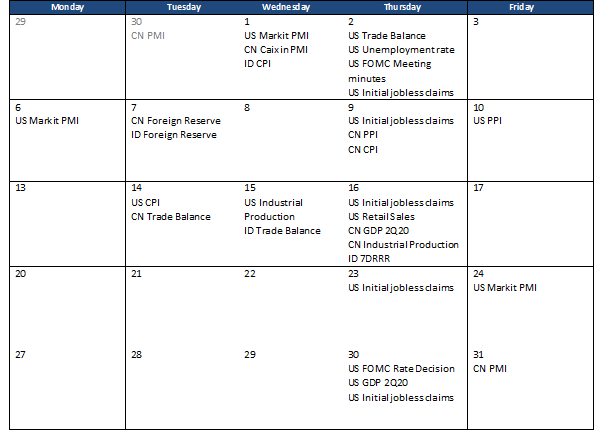

- Global equities were broadly flat this past week after having started the week on a strong footing driven by positive vaccine headlines and agreement on EU’s recovery fund, but gave up gains later on weaker-than-expected economic data and further ratcheting up in US-China tensions. SPX was down -0.3% WoW, while MSCI Asia ex Japan was flat. EU reached an agreement on the EUR750bn Recovery Fund, 70% of which will be distributed in 2021-22. Euro area Flash PMIs for July reported their first month of economic expansion since the virus hit with manufacturing PMI rose to 51.1 vs. 47.4 in June while Services PMI rose to 55.1 from 48.3 in June. In the US too, July Markit manufacturing and service PMIs both increased from June levels, but missed expectations. Adding to the optimism, early-stage trial data on AstraZeneca’s COVID-19 vaccine showed an immune response, boosting hopes of availability of an effective vaccine. However, on the negative side, the Republican-dominated Senate failed to release the Phase-4 stimulus proposal, increasing the risk of a lapse in USD600/week enhanced unemployment benefits for more than a few days. US initial jobless claims (SA) unexpectedly rose to 1.4mn during the week ending 18 July (vs Cons. 1.3mn), suggesting that the pace of filing activity has plateaued over the past two weeks after steadily declining through mid-June. Furthermore, US-China relations continued to deteriorate, as the US ordered China to close its consulate in Houston, to which China retaliated in kind on Friday by announcing the closure of the US consulate in Chengdu. On the domestic side, JCI closed flat by +0.1% WoW despite sizable net outflow amounting to USD51mn. The most outperformed sectors were Mining and Agriculture, up by +2.9% WoW and +2.8% WoW respectively, on the back of improving commodity prices. On the other hand, the most laggard is the Miscellaneous sector, down -2.1% WoW. News flows within this week: US FOMC meeting, US GDP 2Q20, US Initial jobless claims, and China PMI.

- Rupiah appreciated by +0.6% WoW to USD/IDR 14,610, in-line with EM currencies. DXY index weakened by -1.6% WoW to 94.4.

- Indonesian government bonds yield declined significantly, breaking its 7% level with average 20bps along the curve. The 10y benchmark itself declined by 20bps WoW. Bond price rose, tracking the Rupiah that strengthen back to 14,650 levels on midweek compare to Monday where USD/IDR spot trading at 14,850 levels.

- Based on DMO data, from 17-21 Jul foreign ownership has increased by IDR0.69tn to IDR939.42tn.

- This week Sukuk auction remained solid with demand reported at IDR40.2tn (vs. 41.6tn on previous auction) and government upsized the issuance by IDR3tn from their initial target to IDR11tn.

- Agreements on EU nation on a rescue package for the bloc’s coronavirus cases and the encouraging results from several vaccine trials supported the EM asset classes in the early week, but tone changed on the final trading day as US-China tension worsen. Chinese foreign ministry said it ordered the US to close its consulate in the southwestern city of Chengdu as a response to a sudden closure of Chinese consulate in Houston. 10y UST closing the week lower at 0.59% (-5bps WoW).

Global news

- US July Markit Manufacturing PMI increased to 51.3 (vs. consensus expectation of 52.0) from the previous month of 49.8.

- US July Markit Services PMI increased to 49.6 (vs. consensus expectation of 51.0) from the previous month of 47.9.

- US initial jobless claims increased to 1.4mn (vs. consensus expectation of 1.3mn) from the previous week of 1.3mn.

- US existing home sales in June increased to 4.72mn (vs. consensus expectation of 4.75mn) from the previous month of 3.91mn.

- China industrial profits grew by +11.5% in June, up from +6% in the previous month.

Domestic News

- Indonesia recorded USD1.3bn trade surplus (vs. consensus estimate of USD1.2bn) in June, led by export increase of +2.3% YoY while imports decreased by -6.4% YoY.

- BI decided to cut 7-days reverse repo rate by 25bps to 4.0% (in-line with consensus expectation).

- The Deposit Insurance Corporation (LPS) issued LPS regulation (PLPS) No.3/2020 which become the implementing regulations of PP 33/2020 (with regards to LPS authority in handling financial system stability problems) As mentioned in PP33/2020, LPS can directly inject funds to the bank under special surveillance (BDPK) which could potentially become default bank.

- President Jokowi predicts Indonesian economy to fall by -4.3-5% in the 2Q20 and the economic condition for FY20 will rely on the 3Q20’s economic condition.

- Financial Service Authority (OJK) estimates banks’ loan growth at the range of 3-4% for 2020, from the initial target of 10-12% in early 2020.

- Government promised that property sector regulations will be more business friendly after the omnibus law UU Ciptaker is implemented around Sept2020.

- Investment Coordinating Board (BKPM) recorded investment realisation dropped by 4.3% YoY to Rp191.9tn in 2Q20, due to the corona virus pandemic.

Calender

July 2020

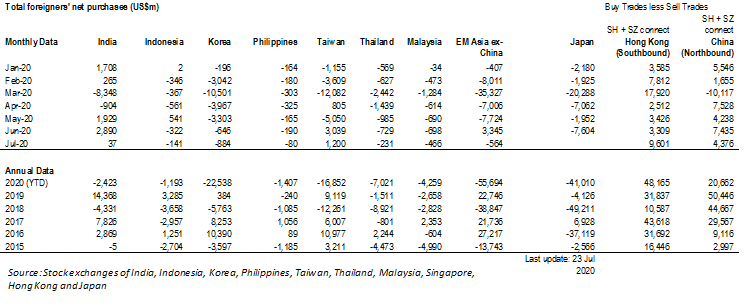

Foreign net purchases of Indonesia equities