03 August 2020

Weekly Market Review (3 August 2020) - What happened and What's Next?

Market update

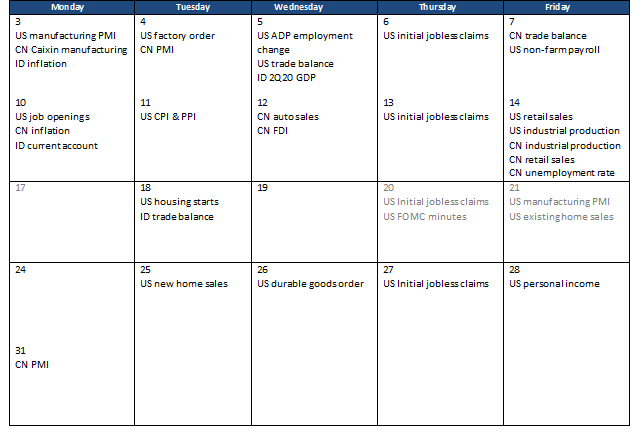

- Global equities were closed mixed last week on the back of mixed corporate earnings and economic data. US mega-cap tech stocks such as Apple, Amazon and Facebook booked better than expected profit. Whereas other sectors, especially energy stocks were hit by the poor results. On economic data, US consumer spending rose 5.6% in June while personal income declined by 1.1%. Unemployment benefit claims were ended up again in weekly data. In addition, Republican and Democrat lawmakers haven’t reached an agreement on the upcoming fiscal stimulus. The key debate that separate the two parties is the federal boost to unemployment assistance which was set at $600 per week in March. Democrats have called for keeping it at the current level but Republicans want to reduce it to $200 per week. JCI index ended the shorter trading week (ahead of Idul Adha holiday) with a gain, up by +1.3% WoW . The most outperformed sectors were financial and consumer, up by +2.7% WoW and +1.9% WoW respectively. On the other hand, basic industry sector was the main drag, down by -3.4% WoW. News flows to be watched this week: US factory order, US ADP employment change, US trade balance, US initial jobless claims, US non-farm payroll, CN PMI, CN trade balance and ID 2Q20 GDP.

- Rupiah appreciated by +0.1% WoW to USD/IDR 14,610, slightly worse than EM currencies. DXY index continues to weaken by -1.5% WoW to 93.0.

- Indonesian government bonds yield slightly declined over the week. Along the curve yield declined by 9 bps. The 10 y benchmark stood at 6.78 or declined by 7 bps WoW. Indonesian government bonds turn biddish after the Fed announcement to hold its interest rate at near zero. Yet, news on higher budget deficit for 2021 at 5.2% level began to worry market participants.

- Based on DMO data, foreign ownership increased by IDR 0.16tn to IDR 942.06tn last week.

- Demand rebounded on conventional auction, incoming bids reported at IDR 72.8tn (vs 61.2tn on previous auction). Government issued IDR 22tn or IDR 2tn higher than its initial target.

- Global optimism increased after the Fed kept its benchmark rate unchanged and showed their commitment to maintain bond purchase. Meanwhile, safe haven assets rose as dollar tumbled on plunging US 2Q20 GDP number. Gold surged to its highest level, touching $2,000 per ounce while yield on US 10 y slipped to 0.55% (-4bps WoW).

Global news

- US consumer index fell to 92.6 in June (vs consensus expectation at 96.0) from a revised 98.3 In the previous month.

- US initial jobless rose for second week in a row, up by 12,000 to 1.43mn. However, the total claim is still lower than consensus’ expectation of 1.5mn.

- US 2Q20 GDP plunged by -32.9% amid virus induced shutdown. The number is slightly lower than expectation of -34.7%.

- China NBS manufacturing PMI unexpectedly rose to 51.1 in July (vs consensus’ number at 50.7) from 50.9 in the previous month.

Domestic News

- As of end of July, Finance Ministry reported the realization of its Family Hope Program (PKH) and food aid (kartu sembako) has reached 43.8% from a total budget of IDR 37.4tn.

- Jakarta Governor, Anies Baswedan decided to extend transitional PSBB phase I for the third time last Thursday. This will be effective until 13th of August 2020.

- The government is preparing a budget of IDR 3tn for electricity incentives to lighten the electricity burden of industry, businesses, and social customers.

Calendar

August 2020

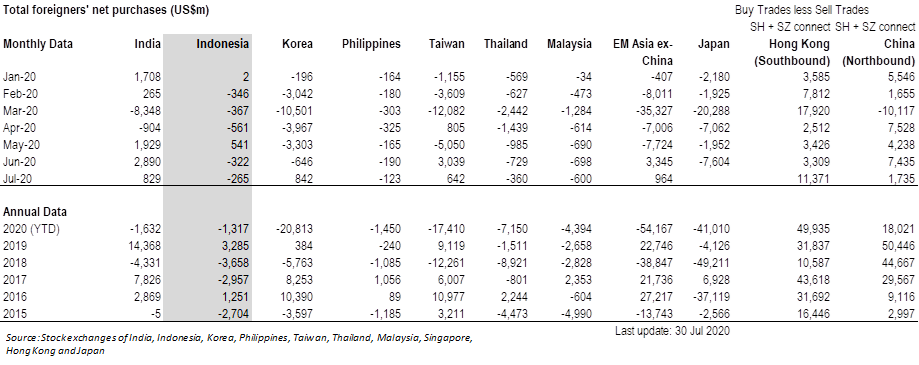

Foreign net purchases of Indonesia equities