24 August 2020

Weekly Market Review (24 August 2020) - What happened and What's Next?

Market update

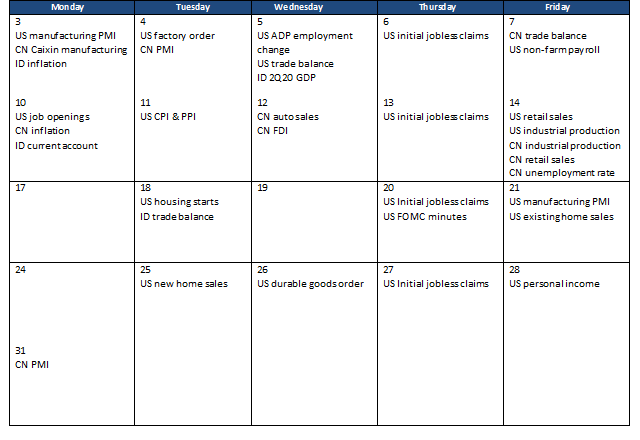

- Global indexes closed the week mixed with S&P 500 down slightly by -0.2% WoW, while MSCI Asia ex-Japan was up by +0.5% WoW. On US-China tensions, US further tightened restrictions on supplies to Huawei, which led to a broader risk-off sentiment for the tech sector. While US and China may possibly hold talks in the coming days, reports also suggested that the White House declined to acknowledge those plans on Thursday. Meanwhile reports also suggest that China has ramped up purchase of farm products in recent weeks ahead of these talks, which is a positive sign as the US has recently signaled that Phase-one deal is ‘fine’. FOMC minutes turned out to be less dovish than expected as it did not suggest the Committee is about to implement policy innovations notably regarding forward guidance and asset purchases. The negotiations over Phase 4 US fiscal stimulus remained at a standstill with Speaker Pelosi dismissing the scaled-back plan released by Senate Republican. On virus trends, while cases in the US are moderating, in some parts of Europe such as France, Italy, Spain and Germany, new cases have recently spiked up. In Asia, South Korea announced tougher social distancing guidelines to curb the spread of coronavirus nationwide as new cases spiked to 315 by Friday. South Korean now mandated the wearing of face masks in both indoor and outdoor public places for the first time. On the positive side, Pfizer announced this week that its COVID-19 vaccine is on track to be submitted for regulatory review as early as Oct-20. In addition, FDA authorized the use of blood plasma from recovered patients as treatment option. On the domestic side, JCI was up by +0.5% WoW on the short trading week, despite foreign net outflow of USD22mn. The outperformance was driven by Financial sector which booked a gain of +1.1% WoW. On the other hand, the major underperformance came from Miscellaneous sector, down by -0.9% WoW. News flows to be watched this week: US new home sales, initial jobless claims, durable goods orders, personal income.

- Rupiah strengthened by +0.1% WoW, in-line with EM currencies. DXY index declined by -0.2% WoW to 92.9.

- Indonesian government bonds continued to bull steepened with yield below 5 years declined by 12 bps, bringing spread between 5y and 10y tenor to 105bps. Yield on the shorter tenor continue to fall as banks liquidity remain ample. Bank Indonesia held its policy rates steady at 4% on Wednesday. Until mid-August, Bank Indonesia has purchased IDR125.1tn from primary market.

- Demand on Sukuk auction increased to IDR49.4tn (vs. IDR38.8tn on previous auction). Increasing demand was supported by higher demand on shorter tenors, 2.7yr and 4.2yr, at IDR15.8tn and IDR11.5tn respectively.

- Based on DMO data foreign ownership as of 18 Aug reported at IDR938.96 or 28.57% of total outstanding.

- Mixed sentiments coming from the global, as markets remained focus on US fiscal stimulus where there is no deal yet between Democrat and Republican. The higher tension between US and China also drive investors to be less aggressive to enter riskier assets. Those sentiments reflected on the declining on 10y UST to 0.64% (-7bps WoW).

Global news

- Global indexes closed the week mixed with S&P 500 down slightly by -0.2% WoW, while MSCI Asia ex-Japan was up by +0.5% WoW. On US-China tensions, US further tightened restrictions on supplies to Huawei, which led to a broader risk-off sentiment for the tech sector. While US and China may possibly hold talks in the coming days, reports also suggested that the White House declined to acknowledge those plans on Thursday. Meanwhile reports also suggest that China has ramped up purchase of farm products in recent weeks ahead of these talks, which is a positive sign as the US has recently signaled that Phase-one deal is ‘fine’. FOMC minutes turned out to be less dovish than expected as it did not suggest the Committee is about to implement policy innovations notably regarding forward guidance and asset purchases. The negotiations over Phase 4 US fiscal stimulus remained at a standstill with Speaker Pelosi dismissing the scaled-back plan released by Senate Republican. On virus trends, while cases in the US are moderating, in some parts of Europe such as France, Italy, Spain and Germany, new cases have recently spiked up. In Asia, South Korea announced tougher social distancing guidelines to curb the spread of coronavirus nationwide as new cases spiked to 315 by Friday. South Korean now mandated the wearing of face masks in both indoor and outdoor public places for the first time. On the positive side, Pfizer announced this week that its COVID-19 vaccine is on track to be submitted for regulatory review as early as Oct-20. In addition, FDA authorized the use of blood plasma from recovered patients as treatment option. On the domestic side, JCI was up by +0.5% WoW on the short trading week, despite foreign net outflow of USD22mn. The outperformance was driven by Financial sector which booked a gain of +1.1% WoW. On the other hand, the major underperformance came from Miscellaneous sector, down by -0.9% WoW. News flows to be watched this week: US new home sales, initial jobless claims, durable goods orders, personal income.

- Rupiah strengthened by +0.1% WoW, in-line with EM currencies. DXY index declined by -0.2% WoW to 92.9.

- Indonesian government bonds continued to bull steepened with yield below 5 years declined by 12 bps, bringing spread between 5y and 10y tenor to 105bps. Yield on the shorter tenor continue to fall as banks liquidity remain ample. Bank Indonesia held its policy rates steady at 4% on Wednesday. Until mid-August, Bank Indonesia has purchased IDR125.1tn from primary market.

- Demand on Sukuk auction increased to IDR49.4tn (vs. IDR38.8tn on previous auction). Increasing demand was supported by higher demand on shorter tenors, 2.7yr and 4.2yr, at IDR15.8tn and IDR11.5tn respectively.

- Based on DMO data foreign ownership as of 18 Aug reported at IDR938.96 or 28.57% of total outstanding.

- Mixed sentiments coming from the global, as markets remained focus on US fiscal stimulus where there is no deal yet between Democrat and Republican. The higher tension between US and China also drive investors to be less aggressive to enter riskier assets. Those sentiments reflected on the declining on 10y UST to 0.64% (-7bps WoW).

Domestic News

- BI maintained 7-day reverse repo rate at 4.0%.

- Bank Indonesia (BI) to cut down the minimum DP requirement for credit financing of environmental-friendly vehicles to 0% starting 1 Oct 2020. Currently, the minimum DP is at 5-10%.

- Indonesia recorded USD3.3bn trade surplus in July (vs. consensus expectation of USD 890mn), higher surplus than previous month of USD1.3bn.

- Indonesia 2Q20 Balance of Payment stood at USD2.9bn deficit, improved from previous deficit of USD3.9bn in 1Q20.

- Gov’t increases the income tax (PPh 25) instalment discount from 30% to 50%, as business production and sales are still low.

Calendar

August 2020

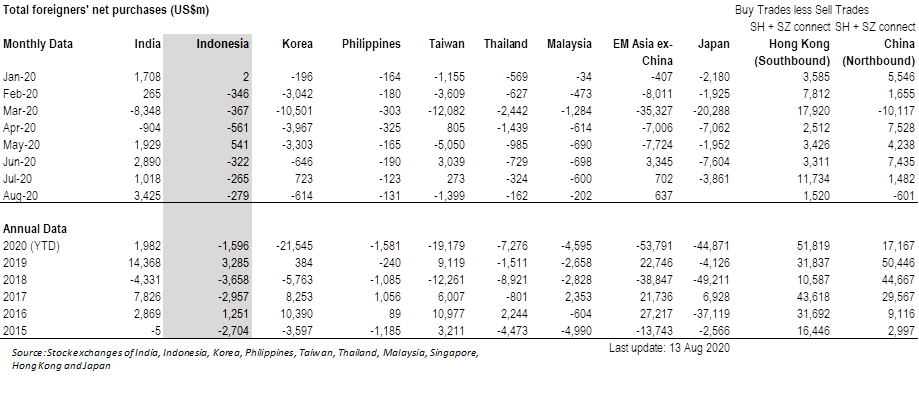

Foreign net purchases of Indonesia equities