09 April 2019

Weekly Market Review (08 April 2019) - What happened & What's next?

Market update

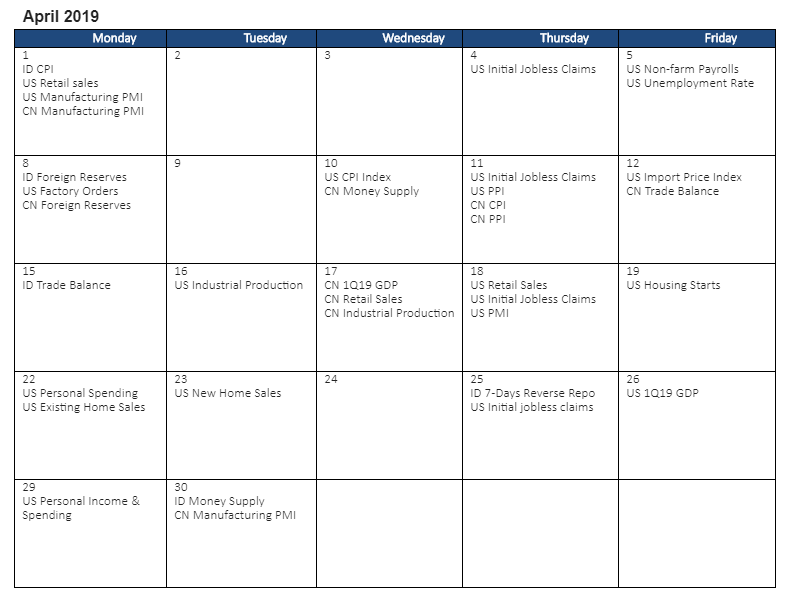

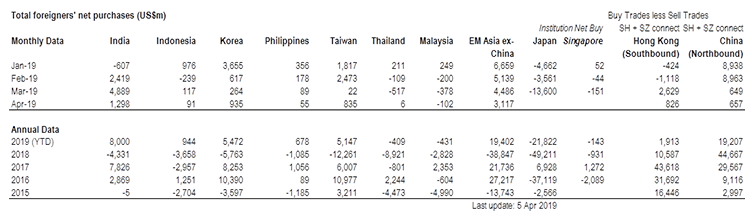

- Global index closed higher last week due to better than expected China’s March PMI (50.5 vs consensus of 49.6) signs of progress on US-China trade talks. President Donald Trump’s top economic adviser says the U.S. and China are “closer and closer” to a trade deal, and that top-tier officials would be talking again this week via "a lot of teleconferencing." On Friday, US non-farm payrolls came in at 196K (beating consensus expectations of 177K) also contributed to the +1.9% and +2.1% WoW gain for DJI and S&P 500, respectively. On the domestic side, JCI Index underperformed the region with a gain of only +0.1% WoW despite net foreign inflow of USD 31mn. Agriculture (+3.8% WoW) and Property (+3.5% WoW) outperformed other sectors due to rise in CPO price (+6.4% WoW) and strong presales data. Mining was the worst performing sector (-2.3% WoW) as coal price plunged -15% WoW. Newsflows to be watched within this week include US industrial production, CN 1Q19 GCP, CN retail sales, CN industrial production, US retail sales, US PMI, US initial jobless claims.

- IDR strengthened to IDR14,133 (+0.8% WoW), outperforming other emerging markets’ currencies. On the other hand, DXY was flat at 97.4 (+0.1% WoW).

- Benign Indonesia inflation data at +0.11% MoM made bond market yield decreased by 1-6 bps. 10 years series decreased the most.

- Foreign investor decreased position by IDR 3.4 Trillion, mostly seen on 5 years series.

- After strong jobs data released, 10 year US Treasury yield increased from 2.41% to 2.5%. US Nonfarm payrolls expanded by 196.000 and unemployment rate stay at 3.8%.

Global news

- In the UK, after the second round of indicative votes on various options failed yet again, PM Theresa May formally requested for an extension for Brexit up to 30-June, with an option to leave earlier if the Parliament would be able to ratify a deal. The EU summit would take place on 10-April to decide whether they agree on an extension and the likely period and options for the extension.

- US-China trade talks continued to be on track; while US treasury yields slipped after Trump pressured the Fed again to sustain growth and restore quantitative easing rather than tightening.

- Brent oil price was back above the US$70/bbl territory for the first time since Nov18 as concern towards supply outages from Libya escalated after the battle between Khalifa Haftar’s army and the Government move closer to its capital city of Tripoli.

Domestic News

- Senior Deputy Governor at BI Mirza Adityaswara, said that Indonesia’s 1Q19 CAD will improve mainly driven by more controlled conditions during the period. BI will continue to monitor CAD for the overall year and aims to set it at 2.5% of GDP.

- Government releases PMK No. 32/2019 in 29 March 2019 which states that there are 10 services sectors that are now eligible for 0% value added tax: construction consultant, technology and information, research and development, freight rental services for international flights and services, trade interconnection servies, satellites, communications and data connectivity, and other sectors (business, law consultants, etc).

- Indonesia’s PMI rose to 51.2 in Mar’19, from 50.1 in previous month.

- Govt prepares price formula regulation for B100. Based on Energy Ministry’s calculation, B100 economical price will be about Rp14,000 per litre (US$1), which is about the same as Pertamina Dex. Hence, the govt is looking for ways to reduce the cost of production.