21 September 2020

Weekly Market Review (21 Sep 2020) - What happened and What's Next?

Market update

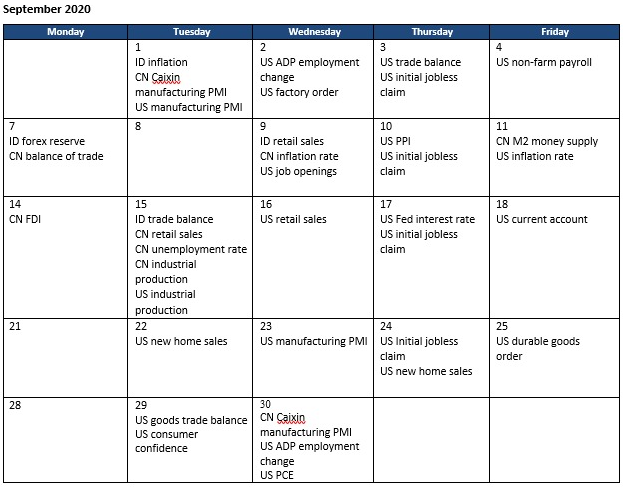

- Global equities closed with mixed performance last week with S&P 500 down -0.6% WoW while MSCI Asia ex-Japan gained +1.7% WoW. During the September FOMC meeting Fed forecasts were substantially upgraded, but the median “dots” continue to imply policy rates remaining at 0-25bp through 2023. Forward guidance on rate rises was adjusted to explicitly incorporate the new long-run goal of achieving an inflation overshoot. Fed officials made a remarkable 2.8pp upward revision to 2020 real GDP growth from -6.5% to -3.7%. Inflation forecasts were revised up in 2020, consistent with recently stronger-than-expected price rises. On a separate note, US-China tension remains high with the renowned President Trump’s proposal to ban WeChat and TikTok, although the ban is currently being on hold. On the other hand, macro data continues to be robust, with August activity data from China showing a recovery in consumption as retail sales +2.3% MoM. US retail sales for August was also in the positive territory +0.6% MoM, although below consensus expectation, still suggesting momentum in the global economy is re-accelerating. On domestic side, JCI booked a gain of +0.8% WoW, reversing some of the losses after Jakarta Governor announced strict large scale social distancing (PSBB) that turned out to have lesser activity limitations than the first PSBB in April. The outperformance was led by Property sector +12.7% WoW while the underperformance was on the Financial sector -1.4% WoW. News flows to be watched this week: US PMI, new home sales, initial jobless claims, durable goods order.

- Rupiah strengthened by +1.0% WoW to USD/IDR 14,735, one of the best performing currencies in EM. On the contrary, DXY index weakened by -0.4% WoW to 92.9.

- Indonesian government bonds declined along the curve by average 5bps, with the 10y tenor decline by 8bps WoW and finally stood at 6.84% by the end of the week. Yield on the 1yr tenor declined the most by 13bps WoW as domestic liquidity remained ample. The likelihood of increase in bond yield may be curbed by the ample liquidity and BI’s presence to maintain market stability. Bond market also trade firmer after the President Jokowi said that BI will stay independent. On monetary policy, BI held the policy rate steady at 4% as market expected, with deposit and lending facility rates were also stable at 3.25% and 4.75% respectively.

- Demand on Sukuk auction lowered to IDR 20.8tn vs the IDR 38.3tn on the previous bid. Government has successfully issued IDR 9.5tn, which is higher than its indicative target of IDR 8tn.

- The Federal Reserve kept its benchmark interest rate unchanged at 0%-0.25% on its FOMC meeting. The Fed signaled that the current level of benchmark rate may be maintained until 2023 and said it would allow periods of higher inflation as it strengthened its commitment to reach full employment. The dovishness sent the US 10y yield rose by 3 bps to 0.70%.

Global news

- US retail sales in August rose by +0.6% MoM, lower than consensus estimate of +1.0% MoM and previous month of +1.2% MoM.

- US industrial production in August rose by 0.4% MoM, lower than consensus estimate of +1.0% MoM and previous month of +3.0% MoM.

- Fed kept its policy rate at 0-25bps in September FOMC meeting.

- US initial jobless claims stood at 860k, in-line with consensus estimate of 850k, better than previous week of 884k.

- China industrial production in August rose by 5.6% YoY, better than consensus estimate of +5.1% YoY and previous month of +4.8% YoY.

- China retail sales in August rose by +0.5% YoY, better than consensus estimate of 0% YoY and previous month of -1.1% YoY.

Domestic News

- Indonesia trade balance in August recorded USD 2.3bn surplus, better than consensus estimate of USD 2.2bn, lower than previous month of USD 3.2bn. The surplus is driven by export of -8.4% YoY and import of -24.3% YoY.

- BI kept 7-day reverse repo rate unchanged at 4.0%.

- President Jokowi highlighted that BI will remain independent.

- Gov’t highlighted that about the tax revenue shortfall for this year due to weakening economic activity. Tax revenue realization fell by -14.67% YoY to Rp601.91tn as of July and this is higher than -10% of gov’t earlier projection.

- The Organization for Economic Cooperation and Development (OECD) predicts that Indonesia's economic growth will be contracted by -3.3% this year due to the large impact of the Covid-19 pandemic.

Calendar

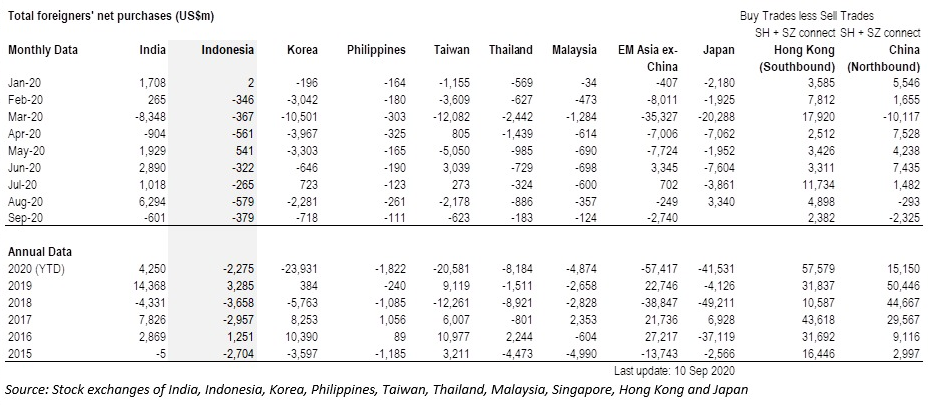

Foreign net purchases of Indonesia equities