28 September 2020

Weekly Market Review (28 Sep 2020) - What happened and What's Next?

Market update

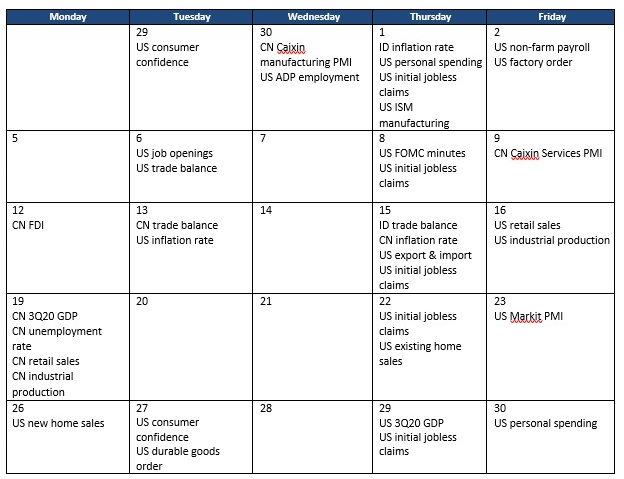

- Global equities were closed lower last week with S&P and Dow Jones down by -0.6% WoW and -1.7% WoW respectively. A number of negative developments has weighed the markets. Resurgence of Covid-19 infections has gripped Europe with a record number of daily cases seen in UK and France with positivity rate rising across all age groups. Cases were also rising in Spain, Germany and Switzerland, coinciding with the reopening of universities. In US, some states reported rising cases as well although testing has increased sharply over the last few weeks and virus infection rates remain overall stable as of now. In addition, the death of US Supreme Court Justice Ruth Bader Ginsburg reducing the prospect of fiscal stimulus to be passed on in the near-term. On domestic side, JCI also booked a loss of -2.2% WoW last Friday. All sectors were in the negative territory except for miscellaneous industry which managed to recorded +0.6% WoW gain. On the other hand, infrastructure was the biggest underperformer down by -4.1% WoW. Newsflows to be watched this week: ID inflation rate, CN Caixin manufacturing PMI, US consumer confidence, US ADP employment, US personal spending, US initial jobless claims, US ISM manufacturing, US non-farm payroll and US factory order.

- Rupiah depreciated by -0.9% WoW to USD/IDR 14,873, performed relatively better compared to other EM countries. On the contrary, DXY index strengthened by +1.8% WoW to 94.6.

- Indonesian government bonds rose along the curve by 1-5bps with 10y tenor increased by 2bps WoW, hence yield stood at 6.84% by the end of the week. Yield on the 5yr tenor increased the most by 13bps WoW. Government through private placement with Bank Indonesia has issued another 4-VR bond series with amount of IDR 84.4tn. This was the third bond issuance using the burden sharing scheme.

- Demand on conventional auction slowed to IDR 46.1tn vs previous auction at IDR 52.3tn. Lower incoming bid was due to lower onshore banks participants as banks placed their excess liquidity to central bank through open market operation (OMO). Finally, government issued IDR 22tn, slightly higher than initial target of IDR 20tn.

- Negative sentiments came from another infections wave in Europe, with UK imposed another restriction measures to curb the spread. In addition, escalating tension between US-China on trade and TikTok’s deal also worries investors. On US stimulus front, agreement still has not reached between the lawmakers. On the flip side, market digested positive news on the vaccine progress as another candidate, J&J entered the last phase of clinical trial. US 10y yield declined from previous week to 0.66% (-3bps WoW).

Global news

- US initial jobless claims rose to 870k (above expectation of 850k) from 866k in the previous week.

- US new home sales jumped by +4.8% MoM in Aug-20 vs consensus’ expectation of -1% MoM. Strong sales was driven by pent up demand and low mortgage rate.

- US Markit manufacturing PMI increased in Sep-20 to 53.5 from 53.1 in the previous month. The number is slightly higher than expectation of 53.2. On the other hand, service PMI edged lower to 54.6 from 55 in Aug-20 and missed forecast of 54.7.

Domestic News

- Jakarta Governor extended large scale social distancing (PSBB) status for another two weeks which will last until October 11.

- Badan Legislasi DPR stated that the discussion of Labor Law bill (RUU Cipta Kerja) under the omnibus law already reached 95%.

- As of Aug-20, the government has booked IDR 1034,1tn of revenue (60.8% realization), down -13.1% YoY.

- Chairman of OJK Board of Commissioners, Wimboh Santoso expressed that OJK is considering the Covid restructuring (as regulated in POJK no 11/2020 whereby Covid restructured loans are categorized as current) to be extended until 2022. As of 7 September 2020, banking industry has restructured IDR 878.5tn outstanding.

- PEN (Pemulihan Ekonomi Nasional) budget realization as of September 16 has reached IDR 254.4tn or 36.6% of the total budget.

Calendar

October 2020

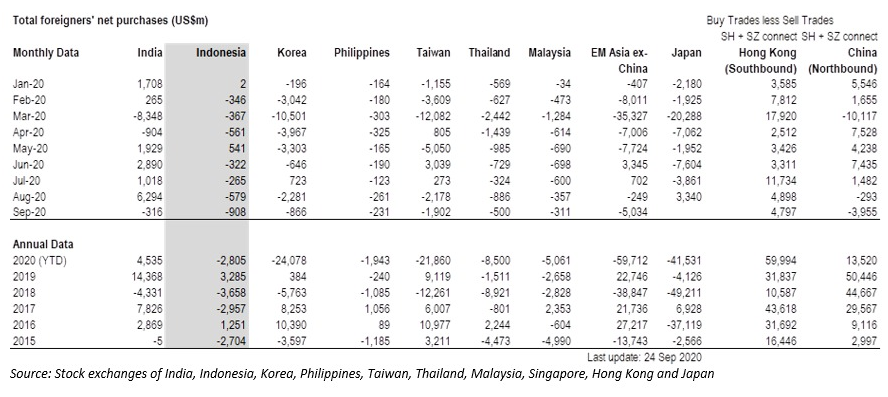

Foreign net purchases of Indonesia equities