16 November 2020

Weekly Market Review (16 Nov 2020) - What happened and What's Next?

Market update

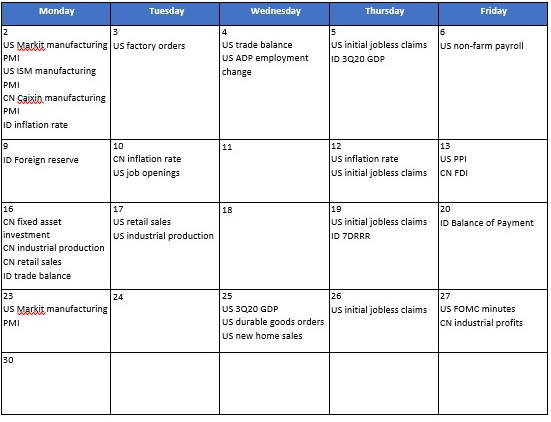

- Global equities continued to post another rally on the back of rising optimism towards the COVID-19 vaccine development by Pfizer and BioNTech, (S&P 500 gained 2.2%WoW, DJI 4.1%WoW, MSCI Asia ex-Japan +0.8% WoW). Asian equities might poise the week with a gain amidst positive sentiment on trade relationship in the region as Asia Pacific countries signed the world’s largest free trade deal (The RCEP, accounted ~30% of global GDP). In addition, president-elect Joe Biden have precluded the possibilities of US national lockdown despite the accelerating COVID-19 case. With the US presidential election now almost done, investors will return their focus to the global economic recovery, as the resurgent of COVID-19 worldwide that has surpassed the 50mn mark. On the domestic side, JCI also recorded another week higher, ended up by 2.4%WoW to IDR5,461. The largest flow was shown in Mon/Tues, with inflows YTD for JCI at +USD159mn/USD142mn as part of 7-day streak, the longest in 2020. The main outperformers were Financial and Agri sectors gaining, +4.4%WoW and 3.8%WoW, respectively. Meanwhile, Consumer sector was the most underperformer, down by -1.5%WoW. News flows to be watched this week: US retail sales, industrial production, initial jobless claims; China fixed asset investment, industrial production, retail sales; Indonesia trade balance, 7DRR, Balance of Payment.

- Rupiah ended the week stronger at USD/IDR 14,170 (by 0.3%WoW), following other EM countries’ strengthening. Meanwhile, DXY index also strengthen by 0.6% WoW to 92.8.

- Rupiah asset classes opened the week strong with most of the asset classes continued to rally post US election and news about progress on Covid-19 vaccine. Indonesian government bond yield along the curve declined by 1-8 bps (WoW), with 10yr yield reported at 6.26% by the end of the week. The government issued another four VR bond series through private placement with BI, with a total nominal value of IDR17.48trn. This issuance was the sixth issuance between government and BI under the burden-sharing scheme (SKB2) to finance public goods. Thus, the total issuance using the SKB2 scheme already reached IDR270.03trn.

- Incoming bids in Sukuk auction rebounded to IDR22.6trn compare to IDR20.9trn in the previous auction bids. The government finally issued IDR10trn, which was the same as their initial target issuance.

- Based on DMO data as of 11 Nov, foreign ownership reported at IDR964.93 trn or 26.31% of total outstanding.

- The promising development on the Covid-19 vaccine kept global market optimism, with several vaccine developers such as Pfizer, BioNTech and Moderna. The positive news on the vaccine was offset by the soaring number of US Covid-19 cases which already topped 10 million cases. The yield on 10-year Treasuries advanced one basis point to 0.89%

Global news

- US weekly Initial Jobless Claims continue to improve (in fourth consecutive weeks of decline) despite surging virus cases. It was added +709k vs consensus of +731k, prior +757k

- US Oct CPI inflation data reported flat, +0%MoM, and +1.2%YoY (vs consensus of +0.1%MoM and +1.3%YoY, prior +0.2MoM) and +1.4%YoY while CPI core flat +0%MoM and +1.6%YoY (vs cons +.2%MoM and +1.7%YoY, prior +.2%MoM and +1.7%YoY).

- US Oct Monthly Budget Statement was deficit USD-248.1bn vs consensus USD-275bn, prior USD-134.5b. The US fed budget deficit more than doubled in Oct from last year.

- China experienced deflation of -1.7% MoM in Oct, mainly due to the falling of pork prices (-2.8% YoY)

- China Oct Industrial Production up +6.9%YoY vs consensus +6.7%YoY, prior +6.9%YoY.

- China Oct Retail Sales up +4.3%YoY vs cons +5%YoY, prior +3.3%YoY

Domestic News

- Indonesia Oct Trade Balance was surplus of USD3.6bn (vs consensus USD+2.2bn vs prior USD +2.4bn), with imports contracted by -26.93% (lower than consensus -18.93%YoY vs prior -18.88%YoY) surpassed the exports contraction of -3.29%YoY (better than consensus expectation of -4.36%YoY, vs prior -0.51%YoY)

- Indonesia’s forex reserves have decreased for two consecutive months, previously declining by USD1.8bn in September. BI stated that October forex stood at USD133.7bn, (down by USD1.5bn MoM), due to foreign loan repayments, equivalent to financing 9.7 months of imports or 9.3 months of imports and foreign debt repayments.

- Indonesia’s retail sales improved in 3Q20, although still within a contractionary phase. Real Sales Index (IPR) in 3Q20 was recorded at -10.1% yoy, better than 2Q20 contraction at -18.2% yoy. The improvement was seen in the food, beverages and tobacco category.

- The Governor of BI stated quantitative easing (QE) injected into the banking system had reached IDR672.4tn (up to Nov 2020), where IDR420trn in period of Jan-Apr and another IDR252.5trn in May-Nov.

Calendar

November 2020

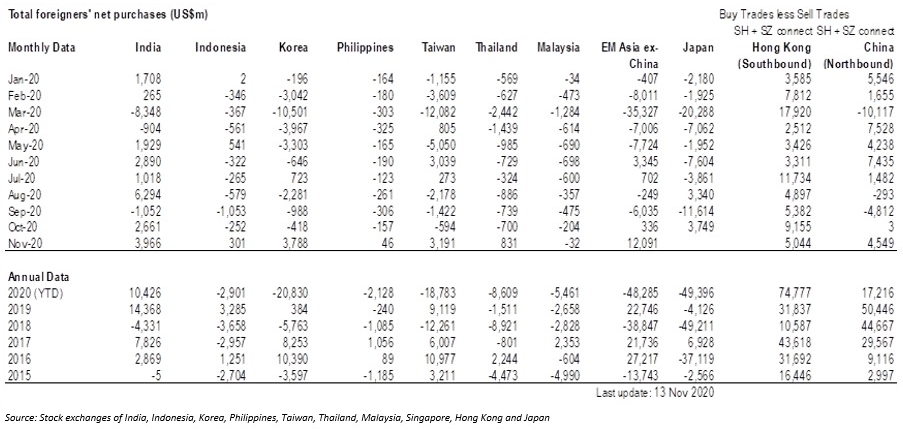

Foreign net purchases of Indonesia equities