23 November 2020

Weekly Market Review (23 Nov 2020) - What happened and What's Next?

Market update

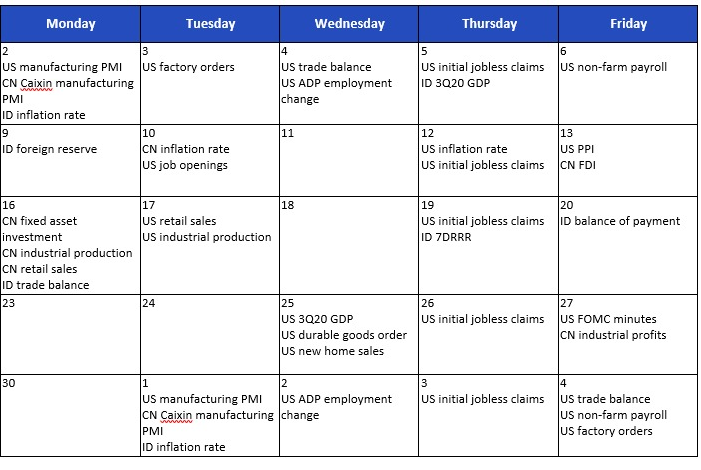

- Global equities ended mixed last Friday, US indexes booked slight losses whereas Asian and Europe were closed higher. Daily new covid-19 cases continued to surge across the US, reaching an average of more than 150k per day with rising hospitalization and fatality rate last week. In addition, cases have recently surged in Korea, Japan (recorded new high), Malaysia, Indonesia (back to more than 4,300) and Hong Kong. Meanwhile, there was more positive news on vaccine development. Pfizer reported its vaccine candidate to be 95?fective and has filed for emergency use authorization to FDA last Friday. Moderna announced its vaccine has efficacy rate of more than 94% and Astrazeneca trials showed robust immune response. On domestic equity, JCI index booked +2.0% WoW gain following other Asian indexes. The most outperformed sectors were infrastructure and property, up by +6.8% WoW and +4.5% WoW respectively. On the other hand, miscellaneous sector was the main drag, down -1.8% WoW. News flow to be watched this week: US 3Q20 GDP, US durable goods order, US new home sales, US initial jobless claims, US FOMC minutes and China industrial profits.

- Rupiah slightly weakened (-0.03% WoW) to IDR 14,165/USD, relatively worse compares to EM currencies. Meanwhile, DXY index also declined by -0.4% WoW to 92.4.

- Yield of mid to long end (10-30yr) government bonds declined by 5-16bps as market expected Bank Indonesia (BI) to cut interest rate. On Friday, BI held policy meeting and decided to cut rate by 25bps to 3.75%, in line with expectation. The decision was based on central bank’s expectation that Rupiah will continue to appreciate as it is still undervalued. 10yr bonds’ yield was at 6.21% by the end of the week. On Thursday, government also issued another 4-VR bonds of IDR 27bn under the burden-sharing scheme. This seventh time issuance brings total government bond for public goods financing amount to IDR 297.03tn.

- On Tuesday, demand for conventional auction was very strong with total incoming bids reached IDR 104.7tn (vs IDR 66.3tn in the previous auction). Demand for 5-15yr tenor increased significantly with onshore still dominated the auction. In addition, government issued IDR 24.6tn, higher than initial target of IDR 20tn.

- As of 19 Nov-20, foreign ownership was at IDR 964.73tn or 26.12% of total outstanding based on DMO data.

- Global pressure increased along with the disagreement between US treasury department and Federal Reserve over funding continuation for emergency programs. US Treasury was seeking to end the Fed facilities of corporate bonds buying program and lending program to SME businesses. As a result, UST 10yr yield slipped to 0.83% (-0.6% WoW) by the end of the week.

Global news

- US retail sales increased by 0.3% MoM in Oct-20, missed expectation of +0.5% MoM. Growth in the previous month was also revised down from +1.9% to +1.6% MoM.

- US’ industrial production was up by +1.1% in Oct-20, following -0.4% in the previous month. The number is better than consensus expectation of 1% but is still far from pre-covid-19 level at 5%.

- US initial jobless claims rose for the first time in 5 weeks, up by 31k to 742k. The number is worse than consensus expectation of 700k.

- China retail sales up by +4.3% YoY in Oct-20, slightly lower than expectation of +4.9% YoY but better than previous’ month number of +3.3% YoY.

- China’s industrial production rose by +6.9% YoY in Oct-20, in line with Sep-20 number. The number is slightly better than consensus’ estimation of +6.5% YoY.

Domestic News

- Jakarta Covid-19 daily new cases hit a new record high of 1,579 on 21 Nov-20. Jakarta Governor decided to extend the PSBB transition phase until 6th Dec-20.

- Bank Indonesia decided to cut policy rate by 25% to 3.75% last Friday.

- Indonesia books first current account surplus (USD 1bn) since 2011, as imports fell faster than exports due to weak domestic demand amid the coronavirus pandemic. The current account surplus was equal to 0.4% of GDP and a reversal from the USD 2.9bn deficit (1.2% of GDP) recorded in the April-to-June period. Meanwhile, trade surplus in 3Q20 reached USD 8bn.

- Government allocated IDR 45tn of state capital injection this year, higher than initially planned in state budget. So far, IDR 16.95tn of capital has been injected. The rest of the budget will be disbursed before year-end to several SOEs, including pharmaceutical holding, Bio Farma.

Calendar

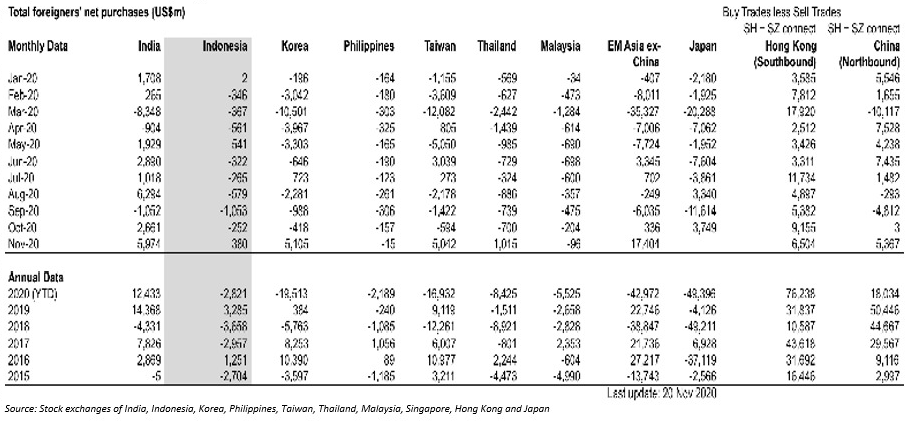

Foreign net purchases of Indonesia equities