26 February 2019

Weekly Market Review (25 February 2019) - What happened & What's next?

Market update

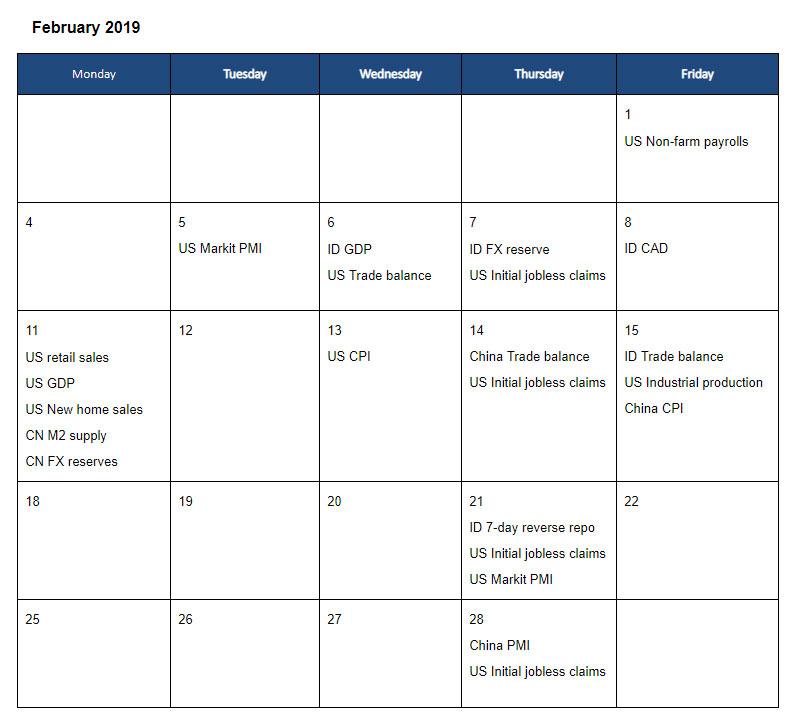

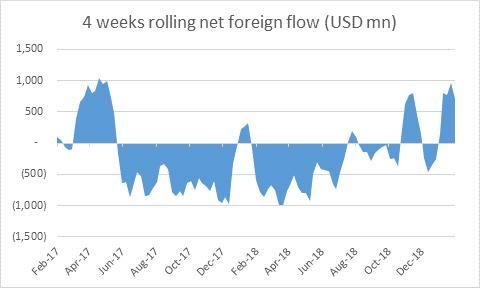

- Global indexes continued their positive momentum with Dow Jones and Nasdaq booked the ninth straight weekly gain. Growing hopes that US and China can strike a tariff pact has bolstered market optimism. Last Friday, Trump described negotiations with China as having a ‘very good chance’ of resulting in a deal, emphasizing that March 1 deadline for imposing new sanctions could be extended. On domestic side, JCI index recorded +1.8% WoW gain despite of net foreign outflow of –USD 5.6mn. All sectors moved higher but the most outperformed ones were Mining (+5.8% WoW) and Trading (+2.8% WoW). Mining sector performed well due to news of China’s northern port customs have banned Australian coal imports. On the other hand, Miscellanous industry booked the smallest gain of +0.7% WoW. Newsflows to be watched within this week include US initial jobless claim and China PMI.

- DXY index weakened by -0.4% WoW to 96.5 while Rupiah was appreciated by +0.7% WoW to IDR 14,058. Rupiah was one of the best performing currencies in emerging market.

- After the Fed reiterated the dovish policy stance, bond market yield decreased by 6-12 bps. 20 years series decreased the most.

- Foreign investors decreased position by IDR 4.5tn while domestic investors increased position on 1-5 years series.

- Dovish policy stance from the Fed and positive progress on US-China trade talk made 10 years US Treasury yield slightly decreased from 2.66% to 2.65%.

Global news

- US manufacturing PMI slumps to 53.7 in Feb-19 from 54.9 in Jan-19, reaching the lowest level in 17 months. This signifies a declining momentum in industrial sector.

- US weekly jobless claims only rose by 14,965 to 25,419 in the week ending 12 Jan-19, marking the lowest level since 1969.

- Sales of previously owned US homes fell to the weakest pace since Nov-15, indicating that the housing market remained in a slowdown despite a drop in mortgage rates.

Domestic News

- Central Bank (BI) retained the 7-days reverse repo rate at 6.0%, keeping it unchanged in the last three months. The move reflects the increasingly more dovish US Fed as well as keeping the positive domestic economic momentum uninterrupted.

- The government recorded non-tax state revenues of IDR 18.3tn in Jan-19 (-4.1% YoY). This decline reflects the lower oil price and strengthening of the rupiah.

- Fiscal deficit was higher at IDR 45.8tn in 1M19 compares to IDR 37.7tn in 1M18. This is as a result of stronger growth in total government spending (10% YoY vs 6% YoY increase in government revenue and grant). Government spending was higher due to elevated social spending (+183%)