07 December 2020

Weekly Market Review (7 Dec 2020) - What happened and What's Next?

Market update

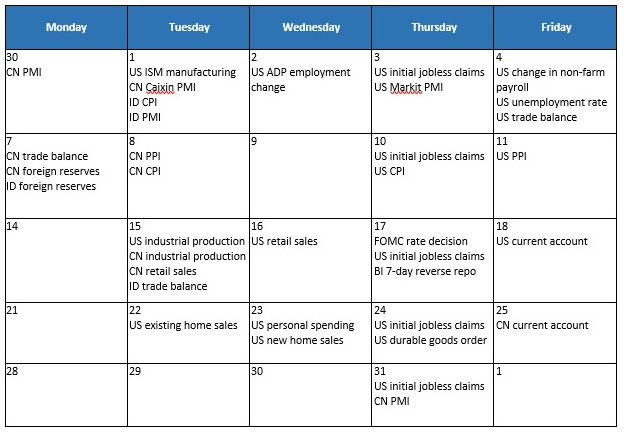

- Global equities continued its rally with S&P 500 +1.7% WoW, DJI +1.0%WoW, and MSCI Asia ex-Japan +0.2% WoW. Investors perceived positive on some early indications of vaccine deployment in the near time. Although, the pace of new job in US was slow (+245K in Nov vs +610K in Oct) prompted higher expectation for US fiscal stimulus in the next time. On the other hand, oil extended gains from a nine-month high after an OPEC+ deal. Asian stocks follow the positive momentum as USD weakness and strengthening capital inflows to the region. On the domestic, JCI index recorded a thin gain of +0.5% WoW with sectors are mixed. The most outperformed sectors were mining and agriculture, both were up respectively by +4.8% WoW and 4.7%WoW. In contrast, infrastructure sector was the main drag, down by -3.2% WoW. News flows to be watched this week: US Initial Jobless claims, CPI, PPI; China Trade Balance, Foreign reserve, PPI, CPI; Indonesia foreign reserves.

- Rupiah slightly weakened to USD/IDR 14,150 (+0.1%WoW), contrast than other EM countries’ strengthening. Meanwhile, DXY index continued its weakening by -1.2% WoW to 90.7 (lowest level since early 2018).

- Indonesia gov bonds’ price advanced tracking the strengthening of Rupiah. Yield declined by average 14bps along the curve and inflows were seen across the curve, especially non-benchmark series. By the end of the week, yield on 5yr and 10y tenor were reported at 5.04% and 6.19% respectively. Bank Indonesia’s governor pledged on Thursday to extend monetary stimulus into 2021 to support economy.

- Demand in the last conventional auction was reported at IDR94.3trn. The increased demand was seen in long tenor and government rejected all bids for the short tenor paper, the 3mo paper. At last, government issued IDR25.6trn which is higher than the initial target of IDR20trn but lower than max target issuance of IDR40trn. Government will hold the last sukuk bond auction on Tuesday (8/12).

- Based on DMO data as of 3 Dec, foreign ownership reported at IDR970.69trn or 25.85% of total outstanding.

- Riskier asset has raced to records peak, following the announcement of three viable vaccines that offset the surging Covid-19 cases around the world. Britain will begin inoculations next week, while the US Food and Drug Administration will hold advisory committee meeting next week, determining when treatments are approved for use in the country. Growing prospects for a US coronavirus relief package after a grim employment report also boost demand for riskier assets. Yield on 10y US Treasury rose to 0.97% (+13bps WoW)

Global news

- OPEC+ have agreed to increase oil production by 500K barrels per day starting in January. This will relax the production cut from current cut of 7.7mn barrels a day to 5.8mn barrels a day at the start 2021 through end April 2022.

- US Nov28 Jobless Claims added +712k, lower than consensus of +775k, prior +778k. It declined after moving higher in the prior two weeks.

- US Nov ADP Employment Change added +307k, lower than consensus of +440k, prior +404k.

- US Nov ISM Services Index was 55.9, slightly above consensus 55.8, prior 56.6.

- US Nov Unemployment rate fell to 6.7%, lower than consensus 6.8%, prior 6.9%.

- US Non-farm payroll employment was +245K, lower than consensus of +469K, prior +610K.

- US Oct Trade Balance was deficit of -USD63.1bn, vs consensus of USD-64.8bn. Export and import increased to respectively, USD182bn and USD245.1bn.

- China November Caixin PMI Manufacturing was 54.9, slightly higher consensus of 53.5, prior 53.6.

Domestic News

- Indonesia foreign reserves in Nov recorded steady at USD133.6bn (prior of USD133.7bn). This is equivalent to 9.5 months of imports financing and government external debt payment (above the international adequacy standard of ~3 months of imports).

- Government has received the first batch of Sinovac vaccines (1.2mn) on Sunday night (6 Dec) with another 1.8mn is expected to arrive in Jan-21. Meanwhile, 15mn/30mn doses of raw vaccines will arrive in Dec20/Jan21 which will be proceeded by Bio Farma.

- BPS announced monthly inflation Nov-20 up by 0.28% MoM and 1.59%YoY (vs 0.07% MoM and 1.44% YoY in Oct-20), contributed from seasonally higher food prices due to rainy season. Core inflation continued lowering to 1.67% YoY indicating domestic demand still weak.

- • BI released monthly money supply growth for Oct-20 was 12.5%yoy, slightly higher than previous month of 12.4% yoy.

- • IHS Market Indonesia PMI November stood at 50.6, higher than October figure of 47.8. This indicates an expansion in domestic manufacturing activities.

Calendar

December 2020

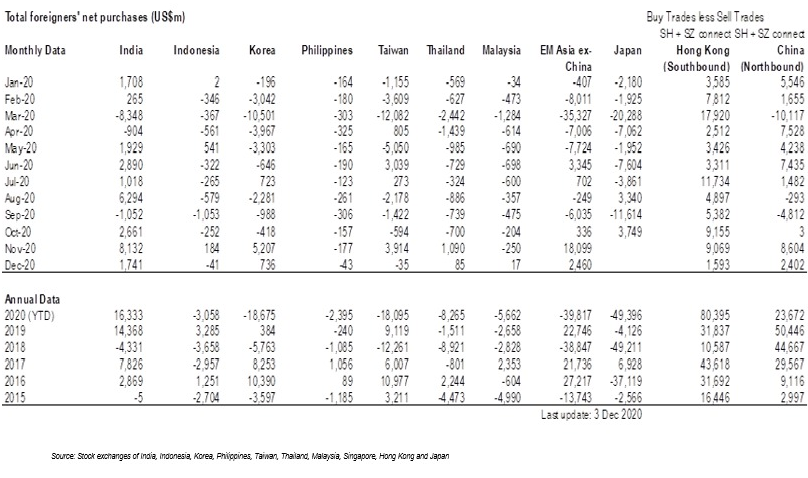

Foreign net purchases of Indonesia equities