28 December 2020

Weekly Market Review (28 Dec 2020) - What happened and What's Next?

Market update

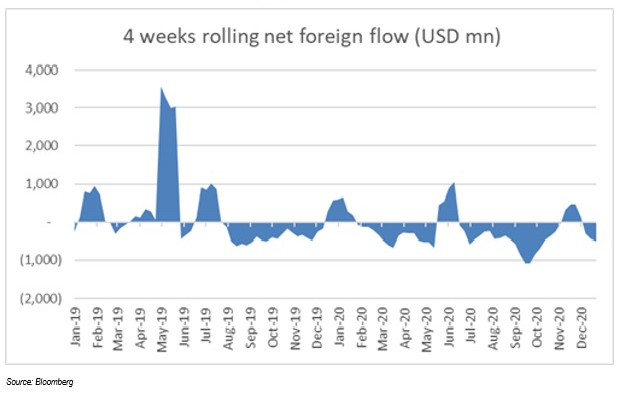

- Global equities pulled back the rally (S&P -0.3%WoW, DJI -0.1%WoW, MSCI Asia ex Japan -0.3%WoW) along increasing risk sentiment from the new variant of Covid-19 in the UK, which indeed too early to tell but remain providing uncertainties. Scientists are still trying to figure out how transmissible the new Covid-19 strain spreading across the UK, which now indicated in some Asian countries. This might cover the recent good news of US stimulus package of USD900bn that has been approved by the congress. On the domestic side, JCI fell by -1.6%WoW, with foreign reporting net outflow of IDR390.7bn (net outflow of IDR3.9trn MTD or -IDR47.7trn YTD). The expectation on a surge covid-19 cases after Christmas and New Year holidays may cloud the market, despite reshuffle announcement gave fresh hope. The most outperform and the sole gainer sector was agriculture, up by +0.4%WoW, on the back of the underlying strength of CPO price that closed at MYR3,856/mt (+26.99%YoY). In contrast, Miscellaneous and Infrastructure dragged down index the most, lower by -2.5%WoW and -2.1%WoW, respectively. News flows to be watched this week: US Initial jobless claim and China PMI.

- Rupiah weakened to USD/IDR 14,200 (0.6% WoW). Meanwhile, DXY index relatively flat by 0.2% WoW to 90.2.

- Indonesia government bonds trade weaker following long Christmas Holiday. Yield on 10y reported at 6.08% (+11bps WoW). Government announced new benchmark series for 2021, which are FR86 (5yr), FR87 (10yr), FR88 (15yr) and FR83 (20YR). The only new series is FR88, with other being reopening series.

- Based on DMO data as of 21 Dec, foreign ownership reported at IDR977.41trn or 25.31% of total outstanding.

- US Treasuries were flat after Congress passed a USD900bn Covid-19 relief package. The package includes a boost for jobless benefits, more small business loans, and another USD600bn direct payment and fund to streamline critical distribution of Covid-19 vaccines. The 10y UST was little changed to 0.94% (-1bps) WoW by the end of the week. News on the long-awaited US stimulus bill was offset by the unease over new Covid-19 strain that more transmissible in UK.

Global news

- US Initial Jobless Claims in the week ending 19-Dec decelerated to 803k, this far lower than consensus expectation of +880k and prior figure of +885k

- US 3Q GDP Annualized up by +33.4%QoQ, this was higher than consensus with up by +33.1%QoQ and prior quarter +33.1%QoQ

- US 3Q GDP Price Index up +3.5%QoQ, lower than consensus +3.6% QoQ and prior quarter +3.6% QoQ

- US November Existing Home Sales down by -2.5%MoM, worse than consensus expectation -2.2%MoM and prior month +4.4%MoM

Domestic News

- President Jokowi announced six new ministers during the end year cabinet reshuffling. Those are Tri Rismaharini (Ministry of Social), Sandiaga Uno (Ministry of Tourism and Creative Economy), Sakti Wahyu Trenggono (Ministry of Marine Affairs and Fisheries), Budi Gunadi Sadikin (Ministry of health), Yaqut Cholil Qoumas (Ministry of Religion), Muhammad Lutfi (Ministry of Trade)

- The government is currently preparing derived regulation of Omnibus Bill, comprises of PP (Gov regulation) and Perpres (Presidential regulation). As stated in Omnibus Bill, the derived regulation needs to be issued 3 months after the bill’s enactment at the latest (Feb-21).

- According to Finance Minister, state revenue 11M20 was booked at IDR1,423trn (-15.1% yoy), 83.7% from the target (PP 72/20). State expenditure reached IDR2,307trn (+12.7%yoy), 90.8% from target. Hence, budget deficit remains on track at -5.6% of GDP (IDR883.7trn)

- The government, represented by coordinating minister for economic affairs, stated that they allocated IDR169.7trn on 2021 state budget for the nation’s health sector, including IDR63-73trn for national vaccination program.

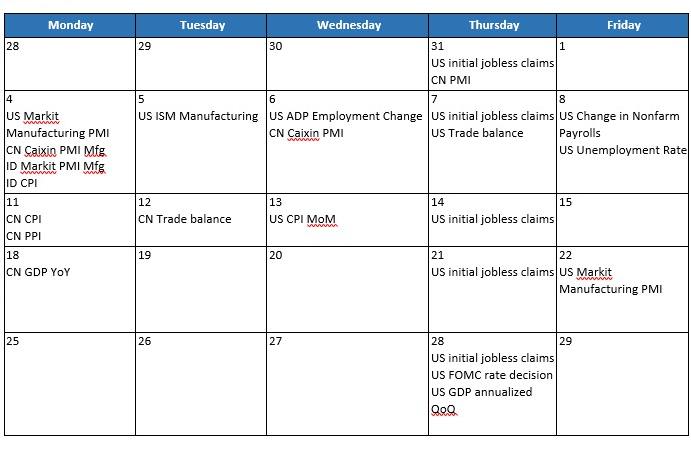

Calendar

January 2021

Indonesia equities: 4 weeks rolling net foreign flow (USDmn)