04 January 2021

Weekly Market Review (4 Jan 2021) - What happened and What's Next?

Market update

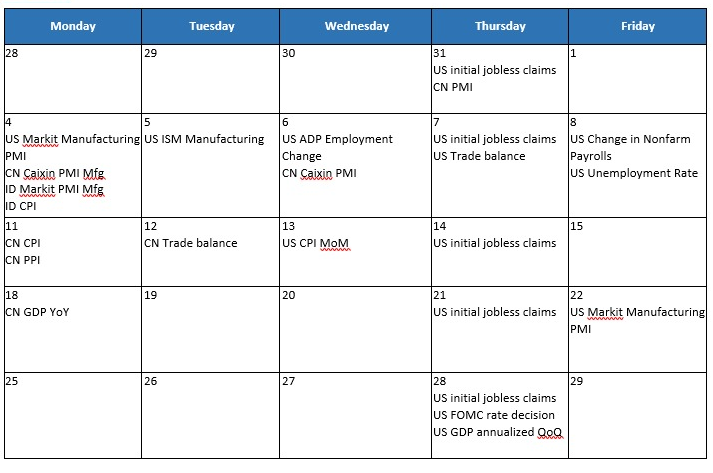

- Global equities booked gains last week ahead of the New Year's day holiday with S&P and Dow Jones each rose by +1.1% and +0.9% WoW respectively. The stock market rallied on Monday after Trump signed USD 900 bn stimulus bill. The aid includes USD 600 stimulus checks per person, an extra USD 300 in enhanced unemployment insurance for 11 weeks, continuation of key jobless programs and funding for food and rental assistance. In addition, initial jobless claims data was better than expected where weekly claims declined by 19k to 787k (vs consensus' expectation at 835k). On the other hand, JCI index was closed slightly negative -0.5% WoW as there was speculation on stricter restriction measures. The major drag down were basic industry and property sector, both declined by -1.9% WoW. On the other hand, agriculture was the most outperformed sector, up by +3.6% WoW. Newsflows to be watched within this week: US manufacturing PMI &ISM, US ADP employment change, US initial jobless claims, US trade balance, US non-farm payroll, US unemployment rate, CN Caixin PMI, ID manufacturing PMI and ID CPI,

- Rupiah strengthened to USD/IDR 14,050 (+1.1% WoW), one of the best performing EM currencies. Meanwhile, DXY index declined by -0.8% WoW to 89.7.

- Indonesia government bonds traded lower following a short trading week. Yield on 10y reported fell below 6% to 5.86% (-22bps WoW). Government announced the bond auction schedule for 2021, where there will be 24 auctions for both Conventional and Sukuk auction, the same as 2020.

- Based on DMO data as of 29 Dec, foreign ownership reported at IDR 972.99tn or 25.14% of total outstanding

- Risk appetite rose after Trump signed the additional coronavirus relief package. By the end of the week, 10y UST was reported flat at 0.93% (-1bps WoW).

Global news

- US home prices surged by 7% MoM and 8.4% YoY in Oct-20. The sharp increase was due to low mortgage rate as well as short supply of home for sales.

- US trade deficit widened by +5.5% MoM in Nov-20 to USD 84.8bn (vs consensus' expectation at USD 82.4bn).

Domestic News

- The Jakarta administration has set to continue transitional large-scale social distancing (PSBB) until 17 January 2021. Referring to data from the Jakarta Provincial Government Health Office as of 2 Jan, active cases in Jakarta reached 14,471 cases, an increase of 18% from the previous two weeks, namely 13,066 cases on 20 Dec.

- As of 23 Dec, national economic recovery program (PEN) budget realization stood at IDR 502.71tr or 72.3% of the total budget; IDR 659.2tr. According to Finance Minister, the remaining budget stands at IDR 192.59tr as business incentives in tax form leads with IDR 65.88tr, followed by SOEs and corporation support with IDR 52.57tr and health sector with IDR 45.1tr.

- As stipulated in Bank Indonesia (BI) regulation No. 22/21/PBI/2020, Bank Indonesia has decided to loosen the foreign exchange regulation on proceeds from export (DHE) and import payments (DPI) starting from 1 Jan 2021 amid COVID-19. 3 points regarding DHE difference value, DHE receipt crediting and imposition of administrative sanctions have been modified. In addition, imposition of administrative sanction in foreign exchange placement has been postponed to 1 Jan 2022.

Calendar

January 2021

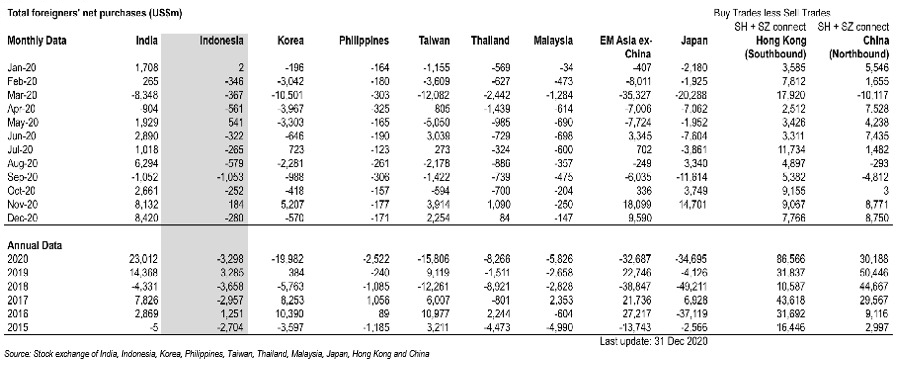

EM net foreign flow