18 January 2021

Weekly Market Review (18 Jan 2021) - What happened and What's Next?

Market update

- Global equities mixed with AeJ equities index up by +0.5%WoW, while SPX and DJI down by -1.5%WoW and -0.9%WoW, respectively. Growth stocks led by tech sector gained in China and Taiwan, while in the contrary, US tech/growth stocks handed in its past gain. As Biden finally disclosed its Covid-19 relief package of USD1.9trn, (“American Rescue Plan”) on Friday, the focus then shifted on how fast Biden administration pass large fiscal stimulus, as well as risk of higher inflation in US including policy tightening (although The Fed released its dovish comment this past week reducing the risk on tapering for now). Meanwhile, Covid-19 active cases continue to surge across the world, imposing some lockdowns such as in Japan and China. Vaccine procurement has been continued by the government across countries. On the domestic side, JCI index recorded a gain of +1.8%WoW with foreign kept reporting net inflow at IDR49.8bn on Friday (IDR10.6trn YTD). Mining sector continued to be the main outperformer with up by +4.1%WoW, then followed by Financial sector up by +3.0%WoW. In contrast, Agriculture dragged the index, down by -4.7%WoW. Newsflows to be watched within this week: China GDP; US initial jobless claims and Markit PMI; Indonesia BI 7DRRR.

- Rupiah unchanged, between Jan 8 data and 15 Jan data, was USD/IDR 14,020, whereby EM currencies mixed. Meanwhile, DXY index also relatively flat by +0.7% WoW to 90.8.

- Indonesia government bonds trade lower as yield increased by 7bps along the curves. Yield on the long tenor bonds increased the most with 10yr and 20yr rose by 7bps and 14bps respectively over the week to 6.16% and 6.82%. Meanwhile, yield on the short tenor unchanged with 5yr reported at 5.18% (+1bps WoW) by the end of the week.

- Based on DMO data as of 14 Jan, foreign ownership reported at IDR976.51trn or 24.92% of total outstanding.

- The government received a total incoming bid of IDR24.3trn in the first sukuk auction this year, and finally issued IDR11.3trn (vs. IDR14trn initial target). The government then held additional sukuk auction or GSO on Wednesday and accepted IDR4.7trn. From both regular auction and GSO, the biggest incoming bid was still seen in the longest tenor, the PBS28 (25.8yr).

- The American Rescue Plan was the first of two major spending initiatives that Biden will seek in the first few months of his presidency. Yield on the 10y UST still trade above 1% and reported at 1.11% (-2bps WoW) by the end of the week as market expect the new fiscal stimulus will boost economic growth.

Global news

- Biden’s American Rescue Plan package will provide, such as, direct payment USD1,400 to most Americans (total USD2,000 if USD600 stimulus included), USD350bn for state and local gov aid, USD170bn for education, USD70bn in healthcare and vaccination program. The first bill might sustain the US families and firms until vaccine widely available. We might expect another bill in Feb to cover Biden’s longer-term goals.

- US CPI inflation in 2020 is recorded 1.4%YoY. US CPI inflated by 0.4%MoM in December (prior 0.2%MoM). US CPI inflation was mainly driven by gasoline prices which jumped by 8.4%YoY. US CPI core was 1.6%YoY (0.1%MoM).

- US weekly jobless claims for the week ended Jan 9 recorded +965K, worse than previous +784K and consensus of +789K. This figure was the highest since the week August 22, when ~1 million claims were added.

- China December Trade Balance recorded surplus of USD78.1bn (higher than consensus USD72bn and prior USD75.4bn), with exports up +18.1%YoY (vs consensus +15%YoY, prior +21.1%) while imports up +6.5%YoY (vs consensus +5.7%YoY, prior +4.5%YoY). Demand for medical supplies, electronic goods increased last year.

- China 4Q20 GDP was 6.5%YoY higher than consensus of 6.2%YoY and prior figure of 4.9%YoY. Meanwhile, YTD GDP was 2.3%YoY (consensus 2.1%YoY, prior 0.7%YoY).

Domestic News

- BPOM has officially authorized the emergency usage of Coronavac, COVID-19 vaccine from Sinovac. Based on the clinical trials in Bandung, Brazil and Turki, Coronavac has a 65.3%, 91%, 78?ficacy rate respectively (above WHO minimum efficacy rate of 50%).

- The Dec-20 Indonesia trade balance posted another surplus of USD2.1bn (lower than consensus USD2.96bn and prior USD2.5bn in Nov-20). Interestingly, export grew by 14.63% YoY, higher than consensus +6.2%YoY and prior +9.43%YoY. Import contraction only slightly -0.47%YoY (vs consensus of -12.96%YoY and prior -17.44%YoY)

- Indonesia's foreign exchange reserves at the end of December 2020 were recorded at USD135.9bn (higher than Nov-20 of USD133.6bn and Dec-19 of USD133.6).

- As stipulated in Circular Letter No. 2 Year 2021, the government has extended the entry ban of all foreigners until 25 January to prevent the spread of new Covid-19 variant.

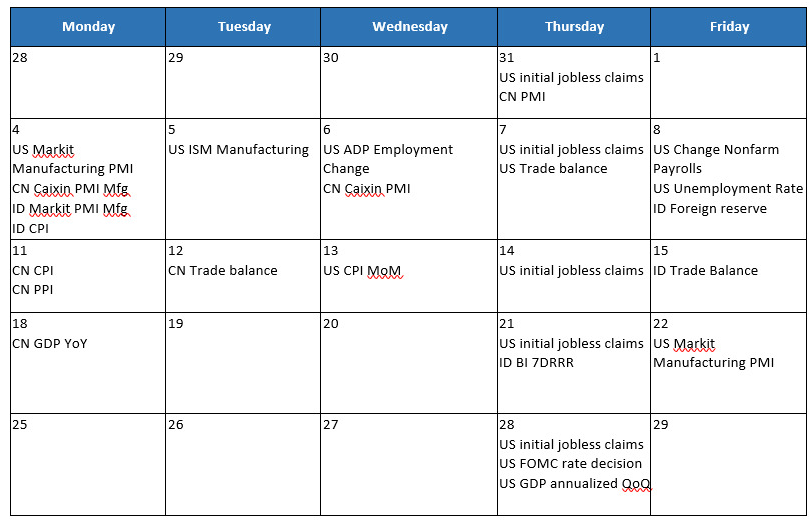

Calendar

January 2021

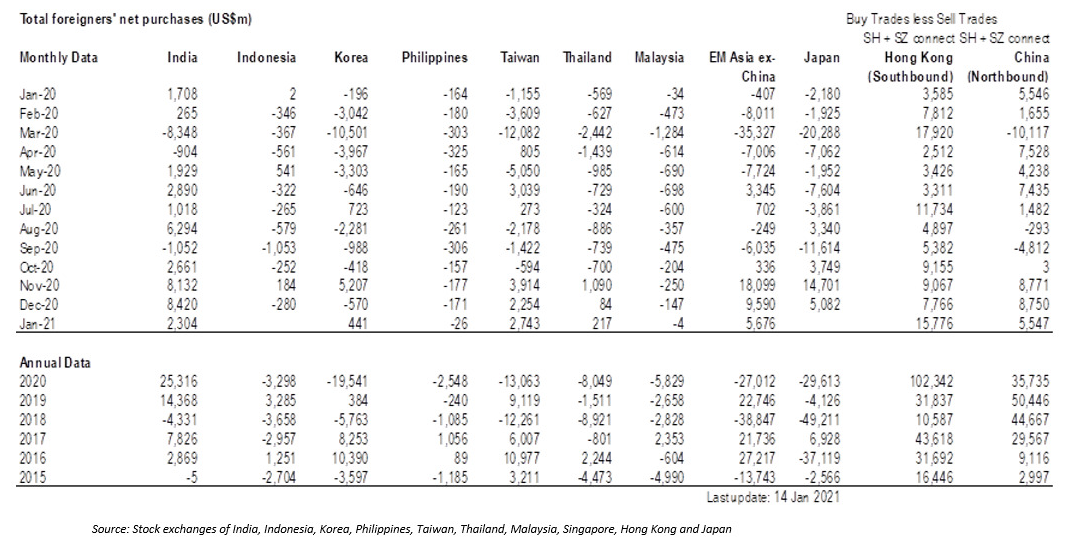

EM equities net foreign flow.