01 February 2021

Weekly Market Review (1 Feb 2021) - What happened and What's Next?

Market update

- Global equities pulled back as volatility rose sharply amid a battle between retail traders and brokers/short sellers in the US. Risk-off was the order of the week as MSCI Asia ex-Japan declined by -4.9% WoW whilst S&P 500 gave up -3.3% WoW. Earnings still beating expectations, but market reaction generally muted. With 37% of S&P 500 companies having reported actual results, 82% of the companies have announced positive EPS surprises. In aggregate, S&P 500 companies have reported earnings around +14?ove estimates vs the five-year average of +6%. In Asia, earnings are still coming ahead of expectations so far, as indicated by consensus revisions since the beginning of the year, which stands at +0.4% for FY2020. On the monetary policies, during the Jan 2021 FOMC meet, the Fed kept its asset purchases and rates guidance unchanged, and suggested a better outlook on vaccine rollout and the potential for additional fiscal support. Meanwhile in China, the tight interbank liquidity conditions prevailed (taking the 7-day repo rate to above 3.0%). On the virus front, the pace of new cases and hospitalizations continued to decline in US (though the number of new deaths remains elevated) while the daily pace of US vaccinations ramped up. Johnson & Johnson announced that its single-dose vaccine which should boost vaccine rollout progress (even though efficacy rates are lower than other vaccines). At the same time, the vaccine developed by Novavax reported around 89?fectiveness in UK trials. On the domestic side, JCI index closed negative as well -7.1% WoW. Mining was the main underperformer down by -9.3% WoW, while Trading sector was the main outperformer down by -2.0% WoW. Newsflows to be watched within this week: Indonesia PMI, CPI, foreign reserves, GDP; US ADP employment, PMI, initial jobless claims, durable goods orders, unemployment rate, trade balance, non-farm payroll; China PMI.

- Rupiah was flat last week at USD/IDR 14,030, in-line with EM currencies. Meanwhile, DXY index strengthened by +0.4% WoW to 90.6.

- Indonesia government bonds trade higher as yield decreased by 7bps along the curves following the non-eventful FOMC as The Fed damps taper talk. Yield on the mid to long tenor increased the by 6-10bps over the week. By the end of the week, 10y benchmark was reported at 6.19% (-7 WoW).

- Based on DMO data as of 28 Jan, foreign ownership reported at IDR 985.38tn or 24.81% of total outstanding.

- Total incoming bids on Tuesday’s Sukuk auction was reported at IDR 23.3tn (vs. IDR 24.3tn on previous auction). The government finally issued IDR 9tn which was lower than its initial target of IDR 14tn and lower than previous auction issuance of IDR 11.3tn. Following the lower issuance, the government again conduct GSO on Wednesday.

- The Federal Reserve kept its benchmark interest rate unchanged at 0% - 0.25% at its FOMC last week. The Fed also maintained its asset purchasing program, and said that the central bank was not close to tapering its monthly asset purchases. Yield on 10y UST steadied at 1.11% by the end of the week (-1bps WoW).

Global news

- China manufacturing PMI in Jan reported 51.3, lower than consensus expectation of 51.6 and previous month of 51.9.

- China non-manufacturing PMI in Jan reported 52.4, lower than consensus expectation of 55.0 and previous month of 55.7.

- US initial jobless claims recorded 847k, better than consensus expectation of 875k and previous week of 900k.

- US continuing claims recorded 4,771k, better than consensus expectation of 5,088k.

- US 4Q GDP reported 4.0% QoQ growth, lower than consensus expectation of 4.2%.

- US new home sales in Dec recorded 842k, lower than consensus expectation of 870k.

Domestic News

- Currently 38 government regulation draft (RPP) and 4 presidential regulation draft (RPerpres) for omnibus law have been submitted to the president for approval.

- The Sovereign Wealth Fund (SWF) could obtain foreign investment/capital of USD 200bn in the long term. In the short term, the SWF is targeted to obtain around USD 20bn investment, depending on the asset type and portfolio desired by the investors.

- Financial Services Authority OJK have noted contraction for earnings of the banking industry by 33.08%YoY due to the pandemic. In addition, net interest margin (NIM) of banks for Dec 2020 is at 4.32%, higher than Nov 2020 which is at 4.29%.

- The gov’t is allocating IDR 76.7tn of urgent budget allocation for the COVID19 handling. This allocation is not included in the National Economic Recovery Fund of IDR 533.1tn.

- Investment coordinating board (BKPM) recorded investment of IDR 826.3tn in 2020, which is 101.1% of full year target. Target for 2021 reached IDR 858.5tn (+3.9% YoY).

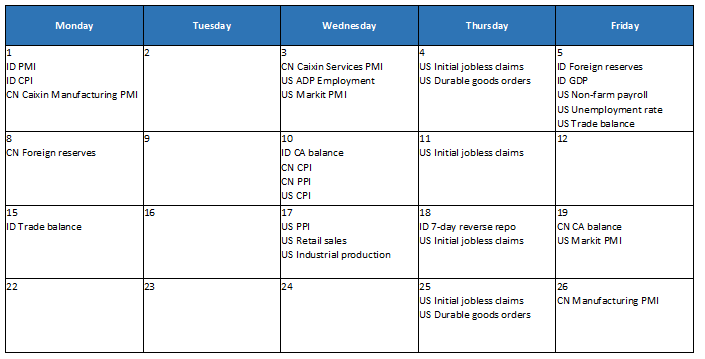

Calender

February 2021

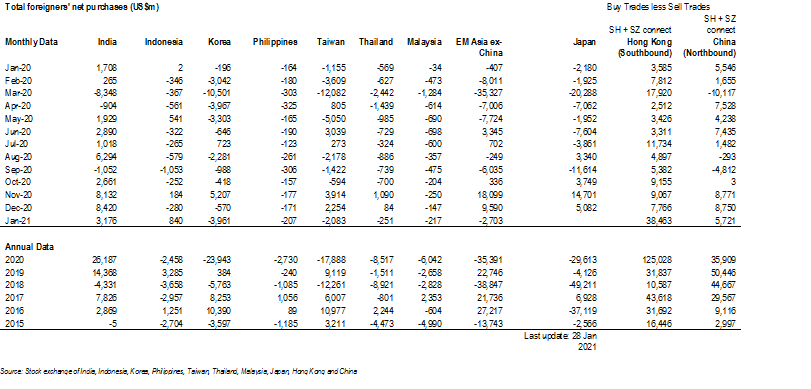

EM net foreign flow