15 February 2021

Weekly Market Review (15 Feb 2021) - What happened and What's Next?

Market update

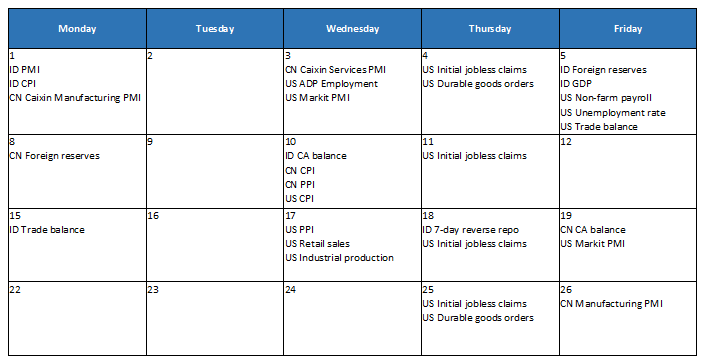

- Global equities continued to rally with S&P and Dow Jones each up by +1.2% WoW driven by optimism over stimulus and lower covid infection rates. Democrats pushed half of President Joe Biden's USD 1.9tn Covid-19 relief plan through a House Committee despite of strong opposition from Republicans. Included in the USD 940bn of federal spending was the USD 1,400 stimulus check and a sizeable increase in child tax credits. On a separate note, the pace of outbreak in US continued to ease as the country's week to week average fell to its lowest in almost four months. In addition, the weekly rate of vaccination continues to improve from 1.46mn/day to 1.68mn/day. So far, 53.8mn doses have been given to US citizens. Similarly, JCI index also booked a gain, up by +1.2% WoW. The most outperformed sectors were mining +3.1% and property +2.7% WoW. Mining sector was driven by nickel play ANTM (add to MSCI), INCO and HRUM (nickel mine M&A) and also on Tesla EV battery investments. Coal names also rallied as oil prices climbed up closer to USD 60/bb; and higher coal prices at USD 87.5/ton. Meanwhile, higher property and construction index was due to less restrictive social distancing measures and SWF supervisory body formation which will start in operation by the end of February or early April. On the other hand, the major drag was miscellaneous sector, down -2.8% WoW. News flows to be watched within this week: ID trade balance, ID 7-day reverse repo, US PPI, US retail sales, US industrial production, US initial jobless claims, US Markit PMI and CN CA balance.

- Rupiah strengthened by +0.4% WoW to USD/IDR 13,973, in line with EM' currencies average. On the other hand, DXY index weakened by -0.7% WoW to 90.4.

- Indonesian government bonds yield increased by 3 bps along the curve. Yield on the long end increased the most with both 10y and 20y each increased by 6bps. By the end of the week, yield on the 5yr and 10yr tenor was reported at 5.22% and 6.19%. Government increased PEN budget to IDR 627.96tn , up 55.4% from its initial plan of IDR 403.9tn. Meanwhile, BI in the parliament meeting on Tuesday reiterated there was room to lower interest rate further considering economic recovery was not as strong as expected.

- Incoming bids in Sukuk auction rebounded this week to IDR 26.1tn from previously at IDR 23.3tn. Biggest demand was seen in the 16yr tenor. As demand in the market was improved, no GSO or additional auction needed. In addition, government finally issued IDR 12tn as targeted.

- Based on DMO data, foreign ownership as of 10 Feb was reported at IDR 994.77 or 24.87% of total outstanding.

- US treasury yields rose sharply on Friday, amid worries that pent-up inflationary pressures would hurt the value of longer-dated debt. Fed Jerome Powel also painted a gloomy picture on US employment due to the Covid-19 pandemic. US Treasury yields was reported at 1.20% (+1bps WoW) by the end of the week

Global news

- US weekly initial jobless claims fell by 19k to 793k (higher than consensus at 760k ) from previous week at 812k.

- US jobs opening in Dec-20 was at 6.6mn, flat from previous month but slightly higher than consensus' at 6.5mn.

- US core CPI unchanged at 1.4% YoY in Jan-21, but increase +0.3% MoM (in line with forecast).

- China CPI declined by -0.3% YoY in Jan-21 (lower than consensus' expectation at -0.1% YoY) following an increase of +0.2% YoY in the previous month.

Domestic News

- Indonesia trade balance recorded a trade surplus of USD 1.96bn in Jan-21 (higher than expectation of USD 1.8bn) from previously USD2.1bn in Dec-20.

- Bank Government plans to enlarge the PEN stimulus again to IDR 628tn (3.8% of GDP) from previous update ate IDR 619.8tn and initial budget of IDR 356tn. SME & corporation support may receive allocation of IDR 157.6tn, followed by soical safety net of IDR 148.7tn and healthcare IDR 133.1tn. To fund the additional stimulus, government plans to reallocate the ministry/institution spending of around IDR 77tn and utilize last year's financing surplus. Thus, the government stated that fiscal deficit would remain to be at 5.7% of GDP.

- PPKM (social distancing measures) has been extended for another 2 weeks from 9-22 Feb-21. There is some relaxation on the new regulation where malls can open until 9pm (from previously 8pm). Meanwhile, both F&B dine in capacity and office is increased from 25% to 50%.

Calendar

February 2021

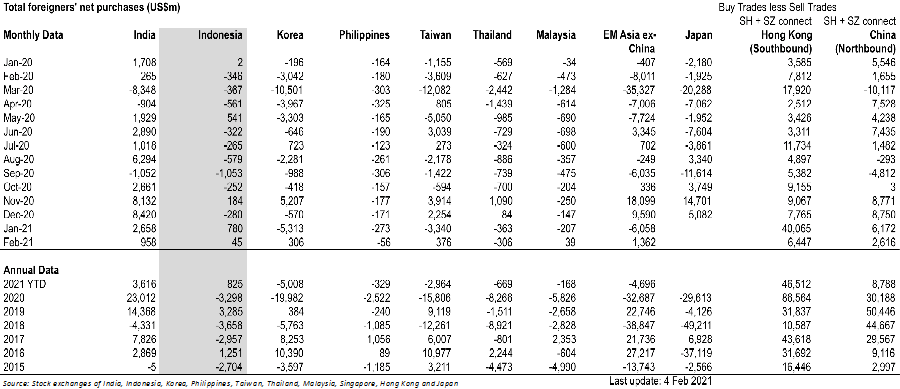

EM Equities net foreign flow