05 April 2021

Weekly Market Review (5 April 2021) - What happened and What's Next?

Market update

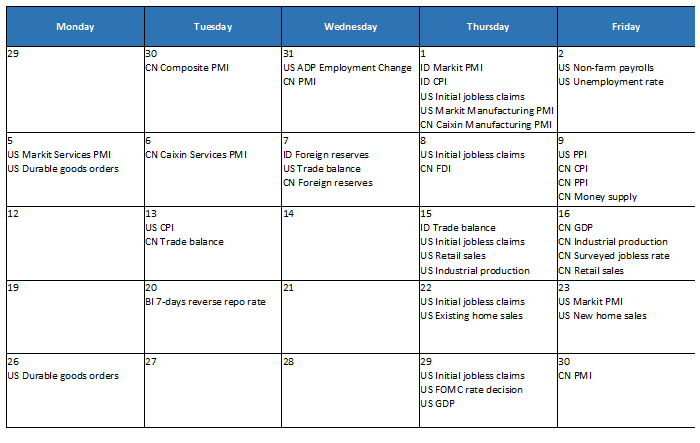

- Global equities ended the week higher with S&P 500 up by +2.8% WoW and MSCI Asia ex-Japan +3.4%, recovering from the losses in previous week. Economic data remain strong with US ISM manufacturing surged to 64.7 in March, far above expectations of 61.5. A variety of developments including moderation of selling pressure from liquidation of a large fund, plans to make secondary listings easier in HK, TSMC planning to spend USD100bn on capex in the next three years, resolution of the Suez Canal blockage, and strong guidance from memory bellwether Micron contributed to the positivity in the market. President Biden unveiled more than USD 2tn infrastructure and economic recovery which aims to revitalize US transportation infrastructure, water systems, broadband and manufacturing. Biden plans to fund the spending by raising the corporate tax rate to 28% and by other measures designed to stop offshoring of profits. On the virus front, new cases continued to rise in most of Europe except for UK, and India continues to see increasing daily new cases of more than 100k (highest since pandemic). On vaccines, UK has partially vaccinated 46% of the total population and nearly 60% of the adult population, while the daily new cases continue to decline. In the US, infections increased by 5% and hospital admissions by 2%, however, this will likely start to decline in the coming weeks as full efficacy of the vaccination ramp up is achieved. US had only partially vaccinated 16% of its population and had fully immunised 8% of its population, compared to 32% partial vaccinations and 18% immunisations currently. On the domestic side, JCI ended the week -3.0% WoW lower to 6,011.5. Trading sector was the outperformer but still down by -0.5% WoW. On the other hand, Property sector was the worst performer down by -5.0% WoW. News flows to be watched within this week: US Markit services PMI, PPI, durable goods order, trade balance, initial jobless claims; China Caixin services PMI, foreign reserves, FDI, CPI, PPI, money supply; Indonesia foreign reserves.

- Rupiah weakened by 0.7% WoW to USD/IDR 14,525, underperforming other EM currencies. DXY index strengthened by +0.2% WoW to 92.9.

- Indonesian government bonds yield along the curve increased by average 3bps this week, with 10y was reported at 6.67% by the end of the week. The government has already issued Rp 281tn of bonds for Q1 through regular auction (including Sukuk) or lower than its Rp 342tn quarterly target. This is in line with the relatively high excess financing in January and their plan to use excess financing from 2020 to reduce supply risk that have been triggered foreign outflow.

- Incoming bid on Tuesday bond auction continued to lower to IDR 34tn compare to IDR 40tn on previous conventional auction. All series’ incoming bids were lower except for the longer tenor of 19yr and 30.4yr, whose bids increased by IDR 2.7tn and IDR 0.4tn, respectively. The biggest drop was seen in 10yr, which fell by IDR 5.4tn compared to the previous auction. At last, Government only issued IDR 4.75tn (vs. IDR 30tn initial target) and marked as the lowest issuance this year. The government then held GSO on Wednesday and absorb IDR 15tn. Adding to the previous regular auction, the government has issued IDR 19.8tn.

- Based on DMO data foreign ownership as of 31 Mar 2021 reported at IDR 951.41tn or 22.89%.

- 10y UST went slightly higher to 1.72%(+5bps) by the end of the week following Biden’s plan and a better-than-expected March jobs report.

Global news

- The container ship that has been block the Suez Canal for 6 days was freed, paving the way to open critical waterway.

- US initial jobless claims recorded 719k for the week, worse than consensus expectation of 675k and previous week of 684k.

- US ISM manufacturing in March recorded 64.7, above consensus expectation of 61.5 and previous month of 60.8.

- US change in non-farm payrolls in March recorded 916k, above consensus expectation of 660k and previous month of 468k.

- US unemployment rate in March recorded 6.0%, in-line with consensus expectation of 6.0%.

- China manufacturing PMI in March recorded 51.9, above consensus expectation of 51.2 and previous month of 50.6.

- China Caixin manufacturing PMI recorded 50.6, below consensus expectation of 51.4 and previous month of 50.9.

Domestic News

- Indonesia Markit manufacturing PMI in March recorded 53.2, higher than previous month of 50.9.

- Indonesia CPI in March recorded 1.37%, in-line with consensus expectation 1.40%.

- Indonesia core CPI in March recorded 1.21%, lower than consensus expectation of 1.44%.

- The Directorate General of Taxes recorded that the number of annual income tax returns reported as of Wednesday (31/3) night has reached 11,119,044 taxpayers, higher than 2020’s figure of 8,911,067.

- Industrial Ministry stated that the local content requirement of 4W below 1,500cc to receive temporary luxury tax (PPnBM) relaxation will be cut from 70% to 60%.

- Financial Services Authority (OJK) stated that total restructuring of banking industry declined by IDR 2.1tn MoM to IDR 823.7tn as of Feb2021 (15% of total loan).

Calendar

April 2021

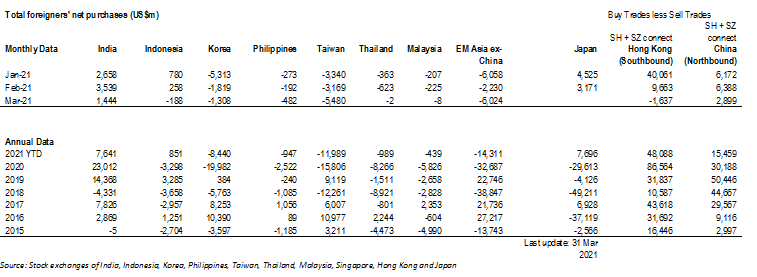

EM Equities net foreign flow