12 April 2021

Weekly Market Review (12 April 2021) - What happened and What's Next?

Market update

- Global equities mixed with US equities recorded a gain (DJIA 2.0%WoW; S&P 2.7%WoW) but Asian equities lagged (-0.6%WoW). The rise of US Tech and Growth stocks was on the back UST 10-year stabilization, supported by downplay inflation concern move by the Fed and rising doubt in eventual timing and size of the new fiscal package. US Infrastructure stimulus of USD2.2tn might find a challenging path since some senators showed some concerns. US bond yield might be tested again in the upcoming progress of US Fiscal package and near-term US inflation data. Asian equities moved sideways along the rising concern in inflationary pressure in the wake of Headline US PPI report (rose by +0.5%MoM). The new cases and hospitalizations continue to increase in European, particularly in Germany whereby Chancellor Merkel in favour to a short nation lockdown. On the domestic side, JCI rebound from the last week loss, recorded gain of +1.0% WoW. Trading sector continued to be the outperformer, up by +2.8% WoW, followed by Financial sector up by +1.4%WoW. On the other hand, Miscellaneous sector was the underperformer, down by -0.8% WoW. News flows to be watched within this week: US CPI, Initial jobless claims, Retail sales, Industrial Production; China Trade Balance, GDP, Industrial Production, surveyed jobless rate, Retail Sales; Indonesia Trade Balance.

- Rupiah weakened by 0.3% WoW to USD/IDR 14,565 with other EM currencies mixed. Meanwhile, DXY index also weakened by 0.9% WoW to 92.2.

- Indonesian government bonds traded higher with yield along the curve declined by 6-20bps on the back of buying flow and lower US rates. By the end of the week, 10y yield was reported at 6.43%.

- Incoming bids in Tuesday’s Sukuk Auction reached IDR14.6tn, which is lower than previous incoming bids of IDR17.2tn. All series’ incoming bids were lower than previous auction, with the medium tenor dropped the most and 6-months SPNS demand rose the most. At last, the government finally issued IDR7.3tn, slightly higher than the previous but still lower than the initial target. Thus, on Wednesday government held additional sukuk and accepted IDR 2.7tn.

- Based on DMO data foreign bond ownership as of 8 Apr 2021 reported at IDR955.76tn or 22.87%.

- Global investors’ worries on the US inflationary pressure eased after the Federal Reserve Chairman, Jerome Powell, said that the US central bank has the tools to curb any inflation pressures, which are expected to be temporary as the economy reopens. Powell also signalled that the economic rebound from the pandemic still has room to go as the current recovery has not been well-rounded. By the end of the week, the 10y yield was reported at 1.67% (-5bps WoW).

Global news

- US Mar PPI up +1%MoM and +4.2%YoY (higher than consensus expectation +0.5%MoM and +3.8%YoY, prior +0.5%MoM and +2.8%YoY), while PPI ex Food and Energy up +0.7%MoM and +3.1%YoY (also higher than consensus expectation of +0.2%MoM and +2.7%YoY, prior +0.2%MoM and +2.5%YoY)

- US Feb Trade Deficit was USD -71.1bn deeper than consensus expectation of USD -70.5bn and prior USD -67.8bn. Feb US trade deficit widened to record amid larger drop in exports than fall in imports. Services surplus shrinks to lowest since Jan 2012.

- US initial jobless claims recorded added +744k, higher than consensus expectation of +680k and prior +728k.

- US Markit Services PMI was 60.4 slightly higher than consensus expectation 60.2 and prior 60.

- US Durable Goods Orders down -1.2%MoM, lower than consensus expectation of -1.1%MoM, prior -1.1%MoM.

- China Mar Caixin PMI Services was 54.3 higher than consensus expectation 52.1 and prior 51.5.

- China Mar CPI up by +0.4%YoY higher than consensus expectation +0.3%YoY and prior -0.2%YoY. The major factor was gasoline which rose +11.5%YoY. Food prices fell by -0.7%YoY and may remain sluggish given a high earlier-base and a continued decline in pork prices.

- China Mar PPI up +4.4%YoY also higher than consensus expectation +3.6%YoY, prior +1.7%YoY. The increase in prices of commodities such as oil and copper were major supports for the PPI.

Domestic News

- According to Bank Indonesia (BI), foreign reserves were declined to USD137.1bn in Mar21 (vs USD138.8bn in Feb21), attributed by foreign debt payment. The current reserves level is equivalent to 9.7 months of imports and government’s external debt servicing.

- The Consumer Confidence Index (IKK) in March 2021 stood at 93.4 or increased from 85.8 in the previous month, according to a consumer survey by BI.

- The government is reviewing the plan to adjust electricity prices, with tariff increases by IDR18,000/month for 900 VA households, and IDR10,800/month tariff increases for 1,300 VA households. For industries such as cement and the food industry, the monthly electricity tariff will increase by IDR2.9bn/month.

- The Ministry of Finance has issued a policy in the form of a working capital loan guarantee stimulus for corporations (loan IDR5-300bn will be borne 100% by the government while loan IDR300bn – IDR1tn will be through two schemes: (a) For the period 1 April - 31 July 21, 80% is guaranteed by the government and 20% by the debtor; (b) For the period 1 Aug – 17 Dec 21, the government bears 70% of the guarantee, while 30% is paid by the business.

- Minister of Transportation has issued Permenhub No.13/2021, referring to a circular letter No.13/2021 regarding the 'mudik' ban during Ramadan and Eid. The government has banned all means of transportation (air, sea, land, and train), both private and public, between 6 and 17 May.

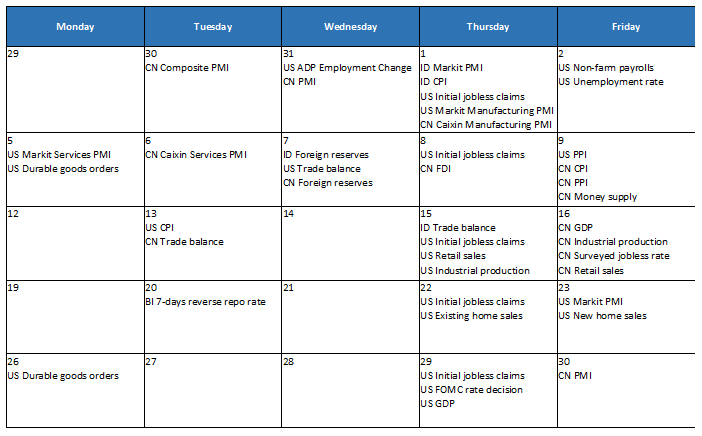

Calendar

April 2021

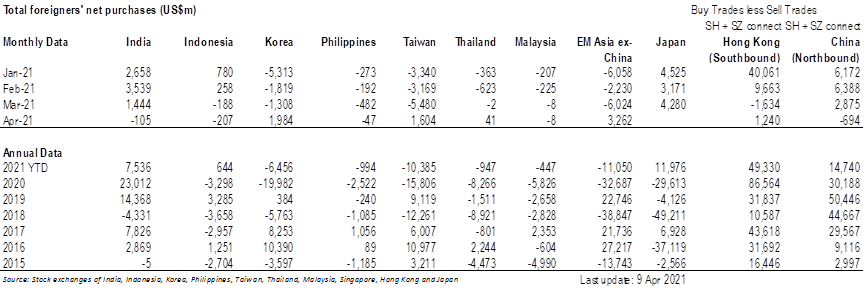

EM Equities net foreign flow