26 April 2021

Weekly Market Review (26 April 2021) - What happened and What's Next?

Market update

- Global indices delivered mixed results last week with S&P 500 down by -0.1% WoW while MSCI Asia ex-Japan gained +0.5% WoW, as yields continued to stabilize. Republicans proposed USD 568bn of infrastructure alternative this past week (to be funded by user fees and leftover funds from pandemic-related spending), but much lower than Biden’s own plan. There were also press reports suggesting that Biden will propose an increase in the capital gains tax rate from 20% to 39.6% for wealthy individuals, which weighed on the risk sentiment, but eventually faded. Economic data continued to remain quite strong in the US as April flash Markit Mfg. PMI (+0.7pp to 60.6) and services PMIs (+2.7pp to 63.1), initial jobless claims declined 39k to 547k for the week ending 17 April, and new home sales rebounded sharply. In Europe, the Euro area April flash PMIs surprised on the upside with the Mfg. PMIs rising further on rapidly growing global demand. Meanwhile, new cases remain elevated in the US around 60k per day. In Asia, COVID-19 cases continued to surge with India recording world’s highest one-day surge along with rising death rates and hospitalization, Korea and Thailand saw new highs in new cases (7DMA), while new cases are also rising in Malaysia. Japan declared a state of emergency in Tokyo and three other areas. On the positive side, CDC recommended the US to lift the pause on J&J vaccine, citing that benefits outweigh risks. On the domestic side, JCI declined -1.1% WoW with Basic Industry being the worst performer -3.1% WoW. On the other hand, Miscellaneous industry outperformed the most with +6.1% WoW. News flows to be watched within this week: US GDP, durable goods orders, FOMC meeting, initial jobless claims, and President Biden’s speech before Congress.

- Rupiah strengthened +0.3% WoW to USD/IDR 14,525, in-line with EM currencies. Meanwhile, DXY index continued to weaken to 90.8 (-0.8% WoW).

- Indonesian government bonds’ yield traded 5-13bps lower along the curve as inflows seen in mid to long tenor series. The 10y was reported at 6.42% (-5bps WoW) by th end of the week. BI decided to hold key rates on record low at 3.5% in its policy meeting and revised down its 2021 GDP growth forecast from 4.3-5.3% to 4.1-5.1%.

- Incoming bids in Tuesday’s sukuk auction rebounded and reached IDR 17.9tn compared to previous sukuk incoming bids of IDR 14.6tn. Increasing demand was still seen in the short end, 2yr and 4.5yr series, which reached IDR 5.8tn and IDR 2.8tn (vs. IDR 3.3tn and IDR 1.4tn in the previous auction). The government finally issued IDR 10tn through the regular auction and GSO.

- Based on DMO data foreign ownership as of 22 Apr 2021 reported at IDR 959.33 or 22.76%.

- US Treasury yields were little change for the week with investor focus on Biden’s capital gains tax proposal. Biden will seek an increase in tax on capital gains and people in the top marginal income tax bracket to fund infrastructures and other spending priorities. By the end of the week, 10yr UST was reported flat at 1.58% (-1bps WoW).

Global news

- US initial jobless claims for the week recorded 547k, better than consensus expectation of 610k and previous week of 576k.

- US new home sales in March recorded 1,021k, better than consensus expectation of 885k and previous month of 775k.

- The Biden administration said it will immediately make raw materials needed for India’s coronavirus vaccine production available as the country’s Covid-19 infections surge.

Domestic News

- Bank Indonesia kept 7-day reverse repo rate unchanged at 3.5%.

- According to Economic Affairs Coordinating Minister, gov’t will soon be providing incentives for malls and retail sector, similar to the ones provided for automotive and property sectors.

- According to Bio Farma’s secretary, the first dose of Gotong Royong’s vaccines is expected to arrive this week. However, if it is not possible, it could be delayed to May21. The vaccination program would use 15mn doses of Sinopharm and 3mn doses of Sputnik vaccine.

- Indonesia Stock Exchange (IDX) has decided to use free float in index weighting starting from Jun 2021. Subsequently, IDX hopes that the new free float index weighting would encourage companies to increase its free float shares portion.

- Covid-19 handling task force has issued a new regulation that lengthens the ‘Mudik’ restriction, from previously 6-17 May to 22 Apr-24 May. On the additional days before 6 May and after 17 May, mobility is only tightened and Mudik is only banned on 6-17 May. Covid-19 test result is now only valid for 1x24h, instead of 3x24h for all travelers, including the ones who use private transportations.

- As of 1 April 2021, the realization of tax incentives in economy recovery program has realization of IDR 14.02tn, which forms 23.98% of the budgeted IDR 58.5tn.

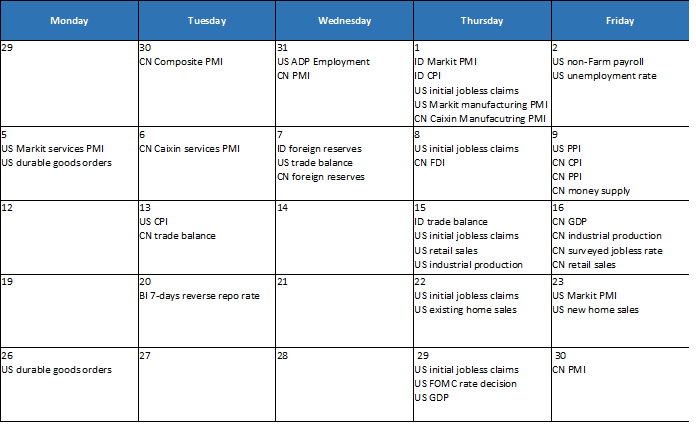

Calendar

April 2021

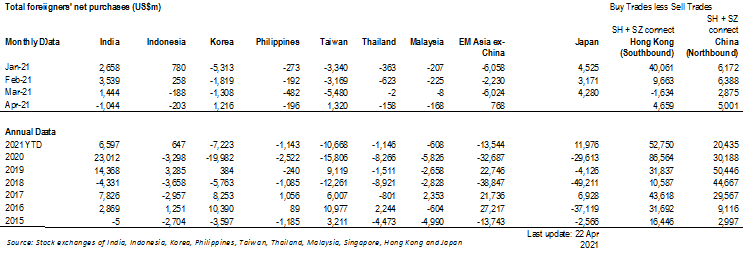

EM Equities net foreign flow